In Summary

- A large portion of the workforce in Africa, estimated at 85.8%, is employed in the informal sector.

- Africa’s FDI inflows reached a record $94 billion in 2024, a surge of 84%–with experts projecting a double-figure increase by the end of 2025.

- In 2024, Foreign Direct Investment (FDI) flows into Africa surged to a record $94 billion, representing an 84% increase, driven by a megaproject in Egypt’s Ras El-Hekma peninsula, according to UN Trade and Development (UNCTAD).

Deep Dive!!

Africa’s business landscape in 2025 presents a tapestry of opportunities and challenges, shaped by its diverse economies, rich natural resources, and burgeoning digital transformation. For global investors aiming to tap into this dynamic environment, understanding the continent’s multifaceted sectors is crucial.

For local and international investors, navigating Africa’s complex business environment requires a nuanced understanding of its diverse sectors, evolving policies, and socio-economic dynamics. By focusing on digital transformation, renewable energy, agriculture, infrastructure, healthcare, and emerging markets, investors can identify and capitalize on growth opportunities.

However, staying informed about policy shifts, trade dynamics, workforce trends, and sustainability considerations is essential for making informed investment decisions in this multifaceted continent. In this article, we have highlighted insights for global investors to navigate Africa’s complex business environment.

Here are the Top 10 Insights for Global Investors to Navigate Africa’s Complex Business Environment in 2025

- Embrace the Digital Transformation

Africa’s digital landscape is experiencing rapid growth, with mobile data usage increasing by approximately 40% annually. The World Bank’s International Finance Corporation (IFC) has invested $100 million in Raxio Group to enhance digital infrastructure across the continent, including data centers in Ethiopia, Angola, Ivory Coast, Mozambique, the Democratic Republic of Congo, and Uganda. This investment underscores the continent’s commitment to bolstering its digital economy, presenting opportunities in fintech, e-commerce, and software development. - Invest in Renewable Energy

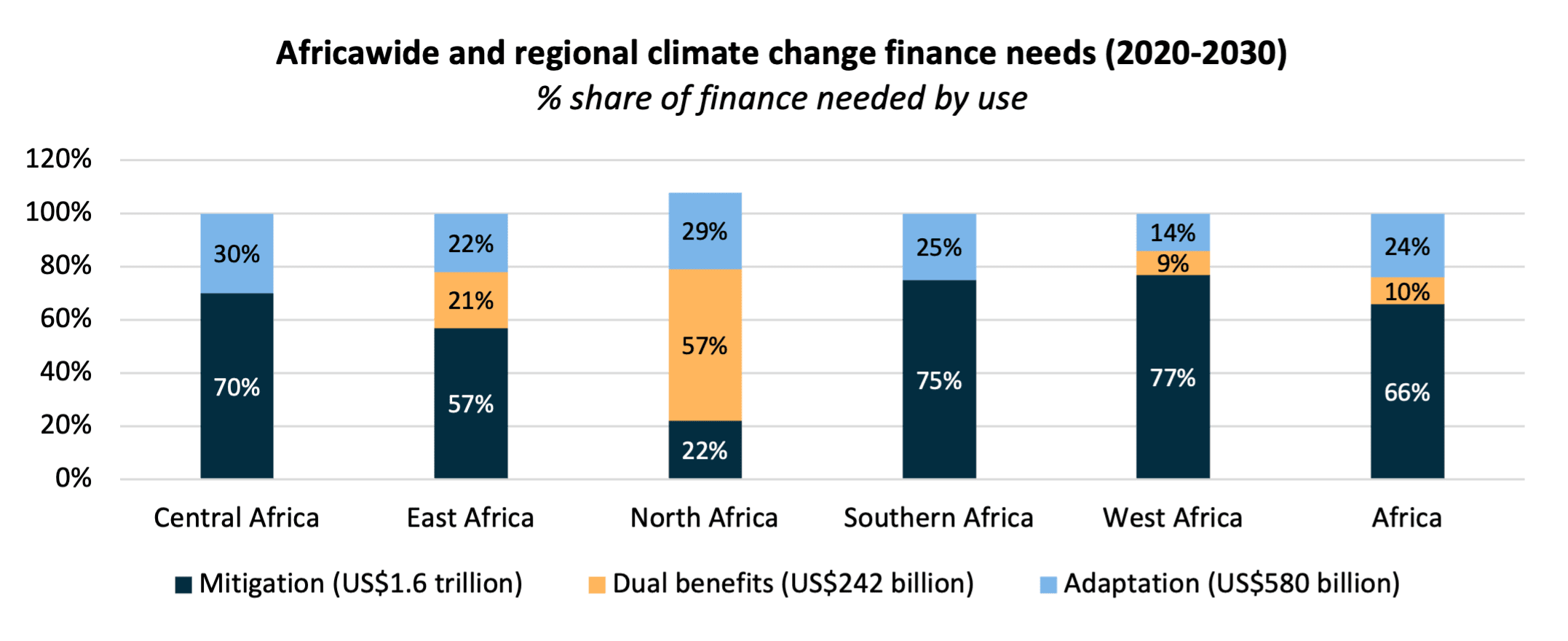

Africa’s abundant natural resources position it as a leader in renewable energy. Countries like Kenya are expanding their geothermal capacity, while others are harnessing solar and wind energy. China has allocated $51 billion for 30 clean energy projects across Africa, with funds flowing in 2025. Investors can capitalize on off-grid solutions and large-scale renewable projects to meet the continent’s energy demands. - Capitalize on Agricultural Growth

Agriculture remains a cornerstone of African economies, offering vast investment potential. Increased investments in agricultural technologies, value-added food processing, and infrastructure are driving growth. For instance, South Africa’s expansion of citrus cultivation and Botswana’s wheat production are notable developments. Investors can explore opportunities in agribusiness, food processing, and export-oriented agriculture. - Engage in Infrastructure Development

Rapid urbanization necessitates significant infrastructure investments. Projects like Kenya and Ethiopia’s $14 billion rail link, South Africa’s Gautrain light rail expansion, and Morocco’s light rail system extension to Marrakech are underway. Additionally, the African Development Bank’s $320 million investment in 50 sanitation projects aims to benefit 15 million urban residents across 52 countries. These developments offer lucrative opportunities in construction, transportation, and urban planning. - Tap into the Healthcare Sector

The burgeoning middle class and heightened health awareness are driving growth in Africa’s healthcare sector. Investments in private hospitals, telemedicine, and healthcare technologies are on the rise. For example, African Medical Investments plans to expand its private hospitals in East Africa and Nigeria. Nairobi’s tech hub is also investing in AI and telemedicine to enhance patient care. Opportunities abound in healthcare infrastructure, services, and technology. - Explore Emerging Market Economies

Countries like Egypt, Nigeria, South Africa, Algeria, and Ethiopia are leading investment destinations. Egypt’s focus on renewable energy and large-scale infrastructure, Nigeria’s fintech boom, South Africa’s industrial diversification, Algeria’s agricultural and manufacturing investments, and Ethiopia’s infrastructure development present diverse opportunities. Investors should assess each country’s unique value propositions and growth trajectories. - Navigate Trade Policy Shifts

Recent U.S. policy changes, including the imposition of steep tariffs on several African nations, signal a shift in trade dynamics. Countries like Lesotho, Madagascar, Mauritius, Botswana, and South Africa now face tariffs ranging from 30% to 50%. Investors must stay informed about such policy changes and adapt strategies accordingly. - Address Workforce Dynamics Amid Automation

A report from the inaugural Global AI Summit for Africa highlights that women in Africa’s outsourcing sector are more vulnerable to job displacement due to automation. Tasks performed by women are 10% more susceptible to automation, potentially deepening gender inequalities. Investors should consider the social implications of automation and invest in workforce upskilling and inclusive technologies. - Leverage Trade Agreements and Regional Integration

The African Continental Free Trade Area (AfCFTA) aims to create a single market for goods and services, enhancing intra-Africa trade. Investors should explore opportunities arising from reduced trade barriers and improved regulatory frameworks. Staying abreast of regional integration initiatives can unlock new markets and investment avenues. - Embrace Sustainable and Inclusive Practices

There’s a growing emphasis on sustainable and inclusive business practices. Investments that prioritize environmental stewardship, social responsibility, and governance (ESG) criteria are gaining favor. Aligning investment strategies with these principles can lead to long-term value creation and positive societal impact.

https://www.africanexponent.com/top-10-insights-for-global-investors-to-navigate-africas-complex-business-environment-in-2025/