In Summary

- Africa is the second-largest gold-producing region in the world, after China, with gold export from Africa projected to exceed $45 billion by the end of 2025, driven by rising production and favorable market conditions.

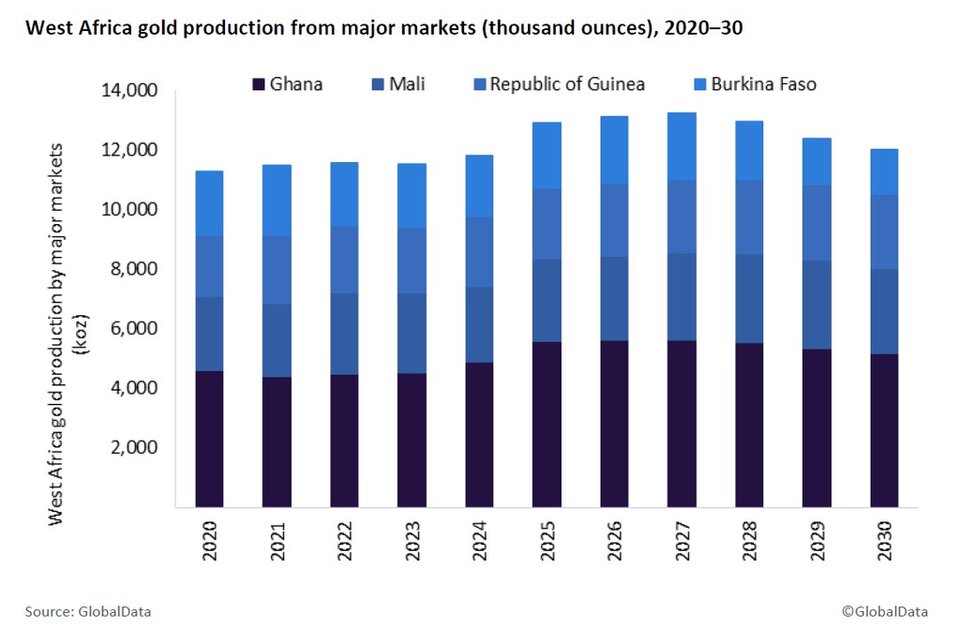

- West Africa is a key gold mining hub, with Ghana, Mali, Burkina Faso, and Ivory Coast leading production. However, many of these countries experience declines due to political instability and illegal mining.

- West Africa is expected to account for a significant portion of global gold output, with production projected to grow by over 10% by 2025.

- Ghana is the leader in African mining, with Cardinal Resources’ Namdini mine expected to produce 358,000 ounces per year, and Newmont’s Ahafo South Mine targeting an expected annual output of 325,000 ounces yearly from 2025.

Deep Dive!!

Gold mining has long been a vital economic engine across Africa. Even before independence, it has shaped the continent’s industrial landscape and has continued to drive substantial revenue generation for governments, companies, and local communities alike.

As global demand for gold continues to rise, fueled by investment demand, technology, and increasing demand for gold jewelry; Africa’s rich mineral reserves remain at the forefront of this booming sector. In 2025, the continent’s gold mining industry is experiencing dynamic shifts, with some countries solidifying their leadership through increased production and strategic reforms, while others navigate challenges such as geopolitical risks, infrastructural deficits, and artisanal mining complexities.

While the exact total value of Africa’s gold industry in 2025 isn’t available, it’s estimated to be worth tens of billions of dollars. The continent is the second-largest gold-producing region in the world, after China, with gold export from Africa projected to exceed $45 billion by the end of 2025, driven by rising production and favorable market conditions..

In this article, we take a deep dive into the top 10 gold mining countries in Africa for 2025, ranked by estimated production volume and economic impact. We go a step further to explore the driving forces behind each country’s output, including major mining operations, artisanal contributions, policy reforms, and foreign investment trends. Beyond production figures, we highlight how gold mining influences broader economic indicators, such as GDP contribution, export earnings, employment, and rural development, offering a comprehensive perspective on why gold remains a cornerstone of African economies.

10. Guinea

Occupying the tenth position on your ranking, Guinea may not be the gold hubs in Africa, but it’s quickly becoming one to watch out for. In 2024, the country produced about 63 tonnes of gold, most of it from the Siguiri mine run by AngloGold Ashanti. Smaller but significant contributions come from artisanal miners in areas like Dinguiraye, Kouroussa, and Mandiana. With untapped reserves capable of yielding over 700,000 ounces of gold each year, Guinea’s gold sector is brimming with opportunity.

Gold mining plays a huge role in Guinea’s economy, contributing 20% of GDP and more than 90% of export earnings as of 2022. Revenue from the sector, whether from large companies or small-scale miners are used to fund the construction of roads, schools, and hospitals, while also creating thousands of jobs. Beyond direct employment in mining, the industry supports countless others in transportation, trade, and local services. For many communities in Guinea, gold is more than a resource, it’s a lifeline.

Despite its promise, Guinea’s gold sector faces real challenges. Much of its output still comes from artisanal miners, with 58 tonnes exported in 2023 from small-scale operations versus just 16 tonnes from industrial mining. Poor infrastructure, unreliable power, and limited investment slow progress. However, recent mining law reforms and better governance through initiatives like EITI are attracting new investors. If Guinea can modernize its operations and expand infrastructure, its gold industry could become a much stronger driver of national growth.

9. Democratic Republic of the Congo (DRC)

The Democratic Republic of the Congo is home to some of Africa’s most significant gold deposits, including the world-class Kibali mine, operated by a joint venture between Barrick Gold and AngloGold Ashanti. Estimated gold production in 2024 reached approximately 90 tonnes, positioning the DRC among the continent’s top producers. Despite this, the country’s gold sector faces ongoing hurdles due to persistent regional conflicts, illicit mining activities, and smuggling that siphon off large volumes of gold from formal markets. According to the Extractive Industries Transparency Initiative (EITI), informal gold production may account for more than half of total output, complicating efforts to track revenue and tax contributions accurately.

Gold mining remains a vital economic pillar in the DRC. The formal mining sector contributes an estimated 8-10% of the country’s GDP and is one of the largest sources of export earnings outside of cobalt and copper. Revenues from large-scale operations help fund local development initiatives through royalties and community agreements. For instance, the Kibali mine has invested millions into building schools, health clinics, and infrastructure improvements in surrounding areas. Employment generated directly and indirectly by the mining sector supports tens of thousands of workers, and many more depend on the associated supply chains and service industries for their livelihoods.

However, the key to unlocking the full economic potential of gold in the DRC lies in formalizing and regulating the artisanal and small-scale mining (ASM) sector, which involves hundreds of thousands of miners. The ASM sector is often marked by hazardous working conditions, environmental degradation, and a lack of government oversight, but it is a critical source of income for local communities. Strengthening regulatory frameworks and investing in ASM formalization programs can improve working conditions, increase government revenue through taxes and royalties, and reduce illicit trade. International partnerships, such as those with the World Bank and International Labour Organization (ILO), are working to support responsible mining practices, enhance traceability, and integrate ASM producers into the formal economy. If these reforms take hold, the DRC’s gold industry could become a stronger engine for economic growth, social development, and stability in the country’s resource-rich eastern regions.

8. Côte d’Ivoire

Côte d’Ivoire’s gold production has seen a steady upward trajectory, with estimated output reaching approximately 48 tonnes in 2024. This growth reflects the country’s strategic focus on expanding mining operations and improving exploration success, particularly in regions such as the Léraba and Ity gold belts. The country benefits from political stability and a favorable regulatory environment, which has encouraged significant foreign direct investment (FDI) into the mining sector. Leading companies like Endeavour Mining and Ity Mining Company have expanded their operations, and new exploration permits are being issued to both junior and major miners, reflecting confidence in Côte d’Ivoire’s untapped gold reserves.

Gold mining is rapidly becoming a cornerstone of Côte d’Ivoire’s economy. According to the National Institute of Statistics (INS) and the World Bank, the mining sector overall contributed around 5% of GDP in recent years, with gold representing the fastest-growing component. Projections indicate that by 2030, gold could become the country’s second-largest economic growth driver, trailing only behind agriculture. This shift is propelled by the sector’s ability to generate substantial foreign exchange earnings through exports, which reached over $2 billion in 2023, representing roughly 30% of the country’s total export revenues. The robust gold export market not only improves the country’s trade balance but also strengthens the local currency and supports macroeconomic stability.

Beyond its direct contribution to GDP and exports, gold mining in Côte d’Ivoire fuels broader economic development. Revenues collected from mining royalties and taxes bolster government budgets, enabling increased spending on infrastructure, healthcare, and education programs, particularly in mining communities. The sector also generates thousands of formal jobs and even more indirect employment in sectors such as transportation, construction, and services. Furthermore, foreign investments attracted by Côte d’Ivoire’s mining-friendly policies have spillover effects on the wider economy, fostering technological transfer, skills development, and enhanced mining governance standards. The government’s recent reforms, including streamlining licensing processes and strengthening environmental regulations, aim to sustain this momentum, ensuring that the gold sector’s benefits continue to grow inclusively and responsibly.

7. Zimbabwe

Zimbabwe produced an estimated 49 tonnes of gold in 2024, maintaining its status as one of Africa’s top gold producers. The sector remains a vital foreign-exchange earner for the country, contributing approximately 15-20% of Zimbabwe’s total export earnings according to the Reserve Bank of Zimbabwe (RBZ) and Ministry of Mines data. Gold mining plays a critical role in sustaining the nation’s economy, especially as Zimbabwe grapples with persistent macroeconomic challenges including currency volatility, inflation, and sanctions that have constrained other sectors like agriculture and manufacturing.

Gold mining is not only important at the national level but also crucial for rural livelihoods. The artisanal and small-scale mining (ASM) sector accounts for nearly 60-70% of Zimbabwe’s total gold output, supporting hundreds of thousands of miners and their families. These informal miners, often operating in remote rural areas, provide essential income and employment in communities where formal job opportunities are scarce. The sector’s significance extends to local commerce, with gold revenues fueling spending on education, healthcare, and basic infrastructure in many rural districts.

Despite its importance, Zimbabwe’s gold sector faces notable constraints that limit its growth potential. Power shortages are a chronic problem, with frequent outages disrupting mining operations and increasing costs, particularly for medium- and large-scale producers. Additionally, the informal mining sector, while vital, poses challenges including regulatory compliance, safety concerns, and environmental degradation. The government has introduced initiatives to formalize artisanal mining, such as licensing schemes and technical support programs, aiming to increase transparency and improve yields. Meanwhile, policy uncertainty and regulatory changes, often influenced by fluctuating mining laws and tax regimes, have created investment hesitancy among international miners, slowing the scale-up of new industrial projects.

Looking ahead, Zimbabwe’s gold sector offers significant upside if these challenges are addressed. Continued government efforts to stabilize the regulatory environment, expand rural electrification, and integrate ASM into the formal economy could unlock more sustainable production growth. With Zimbabwe’s estimated undiscovered gold reserves exceeding 10 million ounces, exploration and modernization initiatives, supported by partnerships with mining companies like Fidelity Gold and Caledonia Mining, could propel Zimbabwe closer to the top ranks in African gold production. Ultimately, gold will remain a cornerstone of Zimbabwe’s economic resilience, balancing its role as a key foreign-exchange earner with its social importance in supporting livelihoods across the country’s rural heartlands.

6. Tanzania

Tanzania is projected to produce around 50 tonnes of gold in 2024, solidifying its position as one of Africa’s leading gold producers. Gold mining is a cornerstone of Tanzania’s economy, contributing roughly 4-5% to the country’s GDP and accounting for approximately 40-45% of total export earnings, according to the Bank of Tanzania and Ministry of Minerals reports. Major gold mines such as Geita, Bulyanhulu, and North Mara, operated by international giants like AngloGold Ashanti, Acacia Mining (now under Barrick Gold), and Shanta Gold, remain significant engines of growth and employment.

The Geita Gold Mine alone has been a flagship operation, producing over 7 tonnes annually, while smaller mines and artisanal mining complement this output. Tanzania’s mining sector supports hundreds of thousands of direct and indirect jobs, from mine workers and contractors to those involved in local supply chains and services. Gold revenues contribute substantially to government coffers through taxes, royalties, and export duties, enabling investments in infrastructure projects, including road networks, healthcare facilities, and educational institutions in mining regions. The social footprint is also evident through community development agreements (CDAs) that fund local schools, water projects, and health clinics, helping to raise living standards in often underserved rural areas.

Recent government reforms aimed at enhancing transparency and improving the investment climate are gradually boosting investor confidence. Measures introduced since 2021, including clearer taxation frameworks, revised royalty structures, and streamlined licensing processes, have addressed some previous concerns related to regulatory unpredictability and fiscal pressures. These reforms are attracting renewed foreign direct investment, critical for the expansion of existing mines and the exploration of new deposits. However, challenges remain, such as balancing government revenue needs with investor profitability and addressing illegal artisanal mining that accounts for an estimated 20-25% of national gold production, often operating outside formal channels.

Looking forward, Tanzania’s gold sector is poised for sustainable growth, supported by significant unexplored mineral potential, estimates suggest untapped reserves exceeding 20 million ounces, and ongoing modernization efforts. If the government continues to build on recent reforms, invests in infrastructure upgrades like power and transport, and integrates artisanal miners into the formal economy, Tanzania can strengthen its role as a regional gold leader. This will further enhance foreign exchange inflows, diversify the economy, and deepen socio-economic benefits for its population, especially in gold-producing regions.

5. Sudan

Sudan produced approximately 50 tonnes of gold in 2024, making it a significant player in Africa’s gold mining landscape. This impressive output is largely driven by artisanal and small-scale mining (ASM), which accounts for about 70-80% of the country’s total gold production, primarily concentrated in the northeastern regions such as the Red Sea Hills and the Nubian Desert. Industrial mining operations contribute the remainder, with projects operated by companies like Managem Group and La Mancha Resources. Despite challenges, gold has rapidly emerged as a crucial substitute for the country’s declining oil sector, now underpinning Sudan’s foreign exchange earnings and national revenue.

The gold sector plays a vital role in Sudan’s fragile economy. As oil production and exports have dwindled due to geopolitical conflicts and sanctions over the past decade, gold exports surged to compensate, now representing roughly 30-40% of total export revenues according to the Central Bank of Sudan and Ministry of Minerals. Gold sales provide critical liquidity for the government, enabling it to finance essential imports, stabilize the national currency, and fund public services. Employment in gold mining, particularly in artisanal communities, supports hundreds of thousands of Sudanese, offering livelihoods in regions with limited economic alternatives. The sector’s tax and royalty contributions, though hampered by informal practices, remain an important source of fiscal revenue.

However, Sudan’s gold mining sector faces significant structural and regulatory challenges. The dominance of informal mining has led to widespread issues including smuggling, which the government estimates results in losses of up to 30-40% of potential gold export revenues. Environmental degradation is another pressing concern, with mercury use and unregulated excavation causing soil contamination, water pollution, and deforestation. Recognizing these issues, the government has embarked on a series of reforms aimed at formalizing the artisanal sector, improving monitoring and traceability, and strengthening legal frameworks in line with international best practices, such as the Extractive Industries Transparency Initiative (EITI). Initiatives include establishing authorized trading centers, licensing ASM operators, and promoting environmentally sustainable mining techniques.

Looking ahead, Sudan’s gold sector holds immense potential for further growth and economic stabilization if reforms continue to gain traction. Expanding formalization efforts and attracting investment into industrial mining could increase production efficiency and transparency, reduce illicit activities, and boost government revenues. Improved infrastructure, including transport and energy access, will be critical for scaling mining operations. If successfully harnessed, gold mining can solidify its role as a cornerstone of Sudan’s economy, providing jobs, fostering regional development, and underpinning national financial stability amid a challenging economic landscape.

4. Burkina Faso

Burkina Faso produced approximately 58 to 60 tonnes of gold in 2024, cementing its position as one of Africa’s leading gold producers. The country’s gold mining sector has been the main engine of economic growth over the past decade, accounting for over 70% of Burkina Faso’s total export revenues as reported by the Ministry of Mines and World Bank data. Major mining operations, including the Houndé, Essakane, and Taparko mines, operated by global companies like Barrick Gold, Endeavour Mining, and Roxgold, have driven this production surge. These large-scale industrial mines are complemented by numerous artisanal miners, who contribute a significant, albeit less formal, portion of total output.

Gold mining’s contribution to Burkina Faso’s economy extends well beyond exports. The sector represents roughly 10-12% of the country’s GDP, according to the IMF and African Development Bank reports, making it the single most important industry in terms of economic output and fiscal revenue. Mining taxes, royalties, and export duties feed into government coffers, financing infrastructure projects, healthcare, and education. Employment-wise, the gold industry supports an estimated 150,000 to 200,000 formal jobs directly, with many more in ancillary sectors such as transportation, hospitality, and equipment supply. In rural areas, where agriculture has traditionally dominated, gold mining has become a crucial alternative source of income and economic resilience.

However, Burkina Faso’s gold sector faces significant security and operational challenges. The rise of insurgent threats and regional instability, particularly in the northern and eastern mining regions, has disrupted operations, increased costs, and slowed exploration. Despite these risks, mining companies have shown resilience and commitment to expansion. New projects like the Kiaka mine (operated by Semafo) and Bomboré (by Roxgold) are expected to add substantial production capacity in the coming years, signaling confidence in the sector’s long-term prospects. Additionally, Burkina Faso is pursuing a strategic value retention policy through the planned development of a domestic gold refinery, aimed at processing more gold locally rather than exporting raw ore. This refinery project aligns with broader African initiatives to boost downstream beneficiation, increase local value addition, and capture more revenue within the country.

Looking forward, Burkina Faso’s gold mining industry remains a linchpin for economic stability and growth. Continued investment in security measures, infrastructure improvements, and regulatory reforms will be critical to safeguarding existing mines and attracting new exploration. The government’s focus on formalizing artisanal mining and improving environmental standards also aims to balance growth with social and ecological sustainability. If these efforts succeed, Burkina Faso is poised to maintain or even expand its leading role in African gold production, while deepening the sector’s positive impact on rural livelihoods, public finances, and national development.

3. Mali

Mali produces approximately 67.7 tonnes of gold in 2024, maintaining its position as one of Africa’s top gold producers. The country’s gold industry is a cornerstone of its economy, underpinning around 25% of Mali’s GDP and accounting for a staggering 75% of the nation’s total export earnings, according to reports from the World Bank and Mali’s Ministry of Mines. Major mines such as Sadiola, Loulo-Gounkoto, and Syama, operated by global mining giants like Barrick Gold and AngloGold Ashanti, drive industrial gold production. In addition, artisanal mining, which is widespread, plays a crucial role in local employment and rural livelihoods.

Gold mining in Mali is not only a key source of foreign exchange but also a vital contributor to government revenues through taxes, royalties, and export duties. These funds support public spending on infrastructure, education, healthcare, and social programs, particularly in rural regions where poverty remains a significant challenge. The sector directly employs tens of thousands of workers and indirectly supports hundreds of thousands through supply chains and local commerce. For many communities, gold mining represents the primary avenue for economic opportunity beyond subsistence agriculture.

However, Mali’s gold sector faces significant risks that could impact future production. Persistent militant violence and insecurity, especially in the northern and central regions, have led to disruptions in mining activities and posed serious challenges to operational safety. These security concerns increase costs and complicate logistics, sometimes forcing temporary mine shutdowns or production slowdowns. Moreover, high-profile disputes such as the ongoing tensions between the Malian government and Barrick Gold have introduced additional uncertainty. The government’s recent decision to increase its stake in the Loulo-Gounkoto mine and seek greater control over gold assets highlights the complex political and regulatory landscape influencing the sector.

Despite these challenges, production is forecasted to climb, with resumed operations and new exploration projects potentially boosting output toward around 74 tonnes in the medium term. Mali’s government and industry stakeholders are working to strengthen security measures, improve regulatory frameworks, and encourage greater local participation in mining benefits. Efforts to formalize artisanal mining aim to enhance productivity, reduce environmental impact, and increase fiscal contributions. Given gold’s outsized role in Mali’s economy, sustaining growth in this sector remains critical for maintaining foreign exchange reserves, supporting rural development, and stabilizing the national budget amid broader economic pressures.

2. South Africa

South Africa is estimated to produce around 100 tonnes of gold in 2025, maintaining its status as one of Africa’s leading gold producers, though it has slipped from its historic position as the world’s top producer. Gold mining remains a vital pillar of the country’s economy, particularly for the Gauteng province, home to Johannesburg, the heart of South Africa’s mining industry and financial services. The gold sector contributes roughly 10% to the country’s mining GDP and supports thousands of direct jobs, while indirectly sustaining many more across related sectors such as engineering, transportation, and finance.

Historically, South Africa’s gold mines propelled the nation’s industrial growth and urbanization, generating immense wealth and foreign exchange. Today, gold still plays a crucial role in the country’s export earnings, although its share has declined due to diversification into other minerals like platinum, coal, and diamonds. The country exported about R65 billion (approximately USD 3.8 billion) worth of gold in 2023, according to the South African Chamber of Mines, reinforcing its significance as a foreign exchange earner. Gold revenues contribute to government coffers through mining royalties, corporate taxes, and employment levies, funding social programs and infrastructure development, particularly in mining regions such as North West and Free State provinces.

However, South Africa’s gold sector faces serious headwinds. The bulk of production comes from deep-level underground mines, such as those in the Witwatersrand Basin, some of which are over 100 years old. These aging mines pose escalating operational challenges, including increased costs, safety risks, and declining ore grades, which impact profitability and output. Labor relations add further complexity: frequent strikes, wage disputes, and demands for better working conditions have occasionally disrupted production. Moreover, power supply constraints and rising energy costs weigh heavily on the sector, limiting expansion potential.

To counter these challenges, South Africa’s mining industry is investing in mechanization, automation, and new exploration technologies to extend mine life and improve efficiency. The government is also promoting mining sector reforms to attract investment and encourage sustainable practices, balancing environmental concerns with economic imperatives. Despite the decline from its peak, South Africa’s gold industry remains a cornerstone of its mining-driven economy, sustaining communities, generating vital foreign exchange, and contributing to economic stability. Continued innovation and strategic policy will be crucial to maintaining this legacy and unlocking future growth.

1. Ghana

Ghana is Africa’s top gold producer, with an estimated production of around 130 tonnes in 2024 and projections to reach approximately 5.1 million ounces (about 159 tonnes) in 2025, driven by expansions in major mines like Obuasi, Tarkwa, and Ahafo South. The country’s gold sector is a cornerstone of its economy, accounting for over 60% of total export earnings and consistently ranking among the top global gold producers. Ghana’s mining industry contributes roughly 6% to the nation’s GDP, underpinning fiscal revenues, foreign exchange inflows, and employment.

The Obuasi mine, operated by AngloGold Ashanti, is a flagship asset, recently revived after a temporary closure, expected to significantly boost output in the coming years. Tarkwa and Ahafo, owned by major international companies, also continue to produce substantial volumes. Beyond large-scale mining, Ghana’s artisanal and small-scale gold mining (ASGM) sector remains vibrant, contributing an estimated 20-30% of total gold production, providing livelihoods to hundreds of thousands, especially in rural areas. The government’s efforts to formalize this sector aim to increase transparency and reduce illegal mining, known locally as “galamsey,” which poses environmental and regulatory challenges.

Gold’s impact on Ghana’s economy is profound. Mining revenues generate vital tax income and royalties, which fund infrastructure projects, health care, and education initiatives, particularly in mining communities. The sector supports roughly 400,000 direct jobs and millions more in ancillary services like transport, equipment supply, and local trade, reinforcing broad economic linkages. Furthermore, gold exports remain a critical source of foreign exchange, stabilizing Ghana’s currency (the cedi) and supporting balance of payments amid global economic volatility.

In recent years, the government has introduced reforms through the Ghana Minerals and Mining Act (GoldBod) to strengthen regulatory oversight, enhance transparency, and combat smuggling, which previously resulted in significant revenue leakages. These reforms, combined with investments in infrastructure and energy supply, aim to improve production sustainability and ensure that gold continues to be a reliable economic lifeline. With favorable geology, strategic policy, and global demand for gold projected to remain strong, Ghana is well positioned to consolidate its role as Africa’s gold leader well into the next decade.

https://www.africanexponent.com/top-10-gold-mining-countries-in-africa-2025/