Fundstrat Chief Investment Officer Tom Lee has predicted that Ethereum will rally in the near term to $5,500, with an ambitious year-end target of $12,000.

During his August 26 guest appearance on the Amitis Investing program, Lee disclosed that institutional Wall Street sentiment toward Ethereum has shifted dramatically following the U.S. Senate’s passage of the GENIUS Stablecoin legislation.

Lee emphasized that Ethereum is the foundational blockchain infrastructure for traditional finance (TradFi), currently supporting over $145 billion in stablecoin supply.

This substantial market dominance is among the primary reasons he considers ETH one of the largest macro investment opportunities of the coming decade.

Tom Lee’s Ethereum Prediction Follows BitMine’s $7.65B Treasury Accumulation Strategy

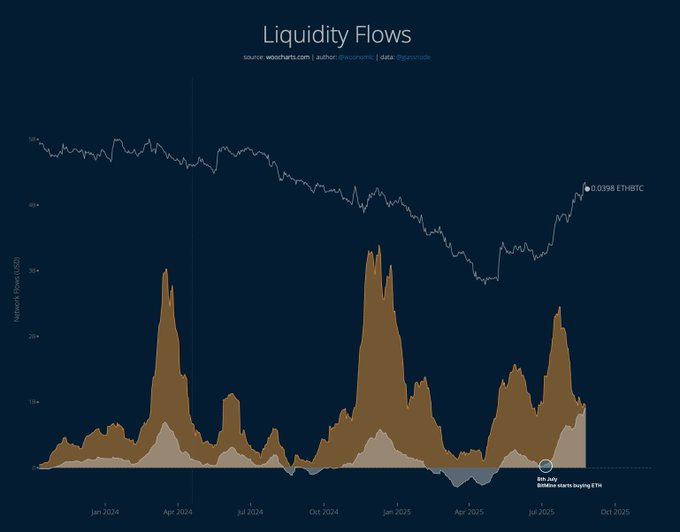

Following Lee’s launch of the ETH treasury firm BitMine, substantial capital flowed into Ethereum.

Investment managers and retail investors have been systematically reallocating funds from Bitcoin to Ethereum, with daily rotation volume averaging $900 million.

Between June 30, when Tom Lee initiated BitMine’s Ethereum accumulation strategy, Ethereum’s market capitalization expanded by over $255 billion.

Standard Chartered analyst Jeff Kendrick recently observed that ETH treasury companies are becoming increasingly large in terms of capital flows compared to their Bitcoin counterparts.

From a regulatory arbitrage standpoint, Kendrick believes these Ethereum-focused treasury entities possess greater expansion potential compared to Bitcoin treasury companies.

Tom Lee’s internal analyst, who accurately predicted last week’s Ethereum decline to $4,075 before the subsequent rally to an all-time high of $4,900, has provided new analysis to the BitMine leadership.

On August 26, Tom Lee anticipated Ether’s price floor to materialize within hours, coinciding with BitMine Immersion Technologies’ acquisition of an additional $21.28 million in ETH, increasing total holdings to 1.72 million ETH worth $7.65 billion.

This forecast aligned with insider analyst Mark Newton’s technical evaluation, which suggests Ethereum will advance toward new peaks near $5,100 before targeting the $5,500 level.

In a subsequent CNBC interview, Lee reinforced his ETH projections with bold price targets ranging from $12,000 to $16,000 for Ether, stating his belief that “Ethereum is experiencing its Bitcoin 2017 moment.”

Tom Lee gained recognition in 2017 when he appeared on CNBC advocating for a $55,000 Bitcoin target, while the cryptocurrency was trading at $2,000.

Wall Street professionals initially dismissed his projection as unrealistic.

He’s now applying similar conviction to Ethereum, and numerous investors are taking notice of his analysis.

Ryan Adams, a crypto investor and analyst at Bankless, considers Lee’s ETH predictions to be absolutely extraordinary.

He noted that Tom Lee has accumulated nearly $10 billion worth of ETH over the past 50 days, representing approximately 1.4% of the total ETH supply.

Should Lee achieve his 5% accumulation target and ETH surpass $12,000, Adams projects that BitMine could surpass Strategy as the world’s largest publicly held digital asset treasury company.

Major holders are now leveraging Ethereum’s momentum and capital inflows to position for new all-time highs.

On-chain intelligence from Arkham reveals that nine whale addresses recently purchased a combined $456.8 million worth of ETH through BitGo and Galaxy Digital’s over-the-counter services.

Technical Analysis: Why Overcoming $4,800 Could Trigger Massive ETH Rally

From a technical analysis perspective, the ETH 1-hour chart shows short-term bullish momentum with key support zones clearly defined.

Price action has recently rebounded from the $4,200-$4,460 demand zone, with additional long positions established around $4,500, indicating confident accumulation during price dips.

The chart analysis suggests that expectations for ETH to penetrate the $4,950-$5,000 resistance zone align with potential breakout targets from the developing harmonic pattern structure.

Currently, ETH is consolidating near $4,580 following a pullback, while momentum indicators display a recent bullish crossover, suggesting continued recovery potential.

Provided the demand zone maintains support during any retracement, the outlook remains positive. The next key resistance level is $4,950- $5,000.

However, failure to maintain support above $4,600 could trigger a deeper correction before the next upward attempt.

The post Tom Lee Predicts Ethereum Rally to $5,500 Soon, $12,000 by Year-End – Is This Realistic? appeared first on Cryptonews.

https://cryptonews.com/news/tom-lee-predicts-ethereum-rally-to-5500-soon-12000-by-year-end-is-this-realistic/