One scoop to start: Graham Robinson, a top biotech and technology lawyer, is set to depart Skadden Arps for Kirkland & Ellis, according to people familiar with the matter, as the jockeying for talent among Big Law firms continues to heat up despite a slowdown in dealmaking.

And a sharp Lex note: In a fallow year for mergers and initial public offerings, it’s fitting that the largest US transaction of the year should be a combination of both, Lex writes.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday to Friday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

Lutnick cashes out

In many ways, Cantor Fitzgerald is the hot investment bank right now.

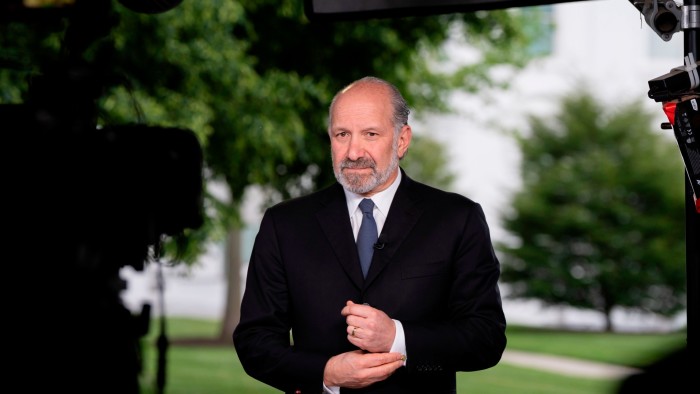

That’s thanks in no small part to former chief Howard Lutnick becoming US commerce secretary and one of the most senior crypto advocates in Donald Trump’s White House.

Now, as part of his entry into the US administration, Lutnick is cashing out of his Cantor holdings and leaving the brokerage he previously headed in the hands of his family.

Lutnick is selling his holdings in BGC and Newmark, netting him a combined $361mn, the FT reports.

He’s separately transferred his ownership stake in Cantor Fitzgerald into trusts for the benefit of his children, which will be controlled by his son Brandon.

An investor group led by 26North, the asset manager founded by Apollo Global Management co-founder Josh Harris (fresh off an FA Cup win), will take a minority holding in the business.

The move means that the wider Lutnick family will continue to benefit from Cantor, which is perceived as having close ties to the administration.

Cantor has nearly single-handedly revived the Spac market (more on that later).

But the big upside for the brokerage comes in the form of the Trump administration’s crypto-friendly agenda. Last month, Cantor partnered with SoftBank, Tether and Bitfinex on a $3.6bn crypto vehicle that the company says will benefit from Trump’s policies.

In the meantime, Lutnick will avoid paying any immediate taxes on the gains from his BGC and Newmark sales.

It’s a common arrangement for Wall Street executives who join the government: they’re often required to divest their holdings to avoid conflicts of interest, and the rules are structured to avoid penalising them for that.

Nonetheless, the sales are bound to attract scrutiny: whenever a big name on Wall Street joins the administration, there are whispers that they’re cashing out without paying Uncle Sam his dues.

US deputy defence secretary Steve Feinberg has a potentially more lucrative and complex untangling from his private capital business, Cerberus Capital Management.

Are Spacs back?

Spacs are experiencing something of a comeback thanks to the Lutnick empire, which is now led by Howard’s children and a triumvirate of bankers including infamous healthcare dealmaker Sage Kelly.

Blank-cheque companies, which raise money first and then find a target to merge with, had their heyday in the bubble of 2020 and 2021.

But rising interest rates the following year ended Spac euphoria and most cratered. It didn’t help that then Securities and Exchange Commission chair Gary Gensler reined in the industry.

But Trump’s return to the White House has ushered in a more lenient policy, and it’s showing up in deal flow. Spac offerings have raised $9bn this year, on par with the $9.6bn raised in all of 2024, according to Dealogic.

A group of smaller boutiques now dominate the sector, though several of them have links to the big pandemic-era dealmakers.

Cohen & Company leads the pack. Since 2022, it’s advised on 54 “de-spac” deals since 2022, between Spacs and groups looking to go public.

Its chair is Daniel Cohen, the son of banking entrepreneur Betsy Cohen, who was a serial Spac sponsor back in 2020 and 2021.

Cohen & Company’s head of Spac investment banking is Brandon Sun, who was Deutsche Bank’s Spac man until 2022.

Sun left the German bank after his name appeared on a bill at a strip club, though he said he did not attend the event.

Hot on the heels of Cohen & Company is Cantor Fitzgerald, which has got in on the action in a big way since Trump entered office. This year, it’s tied with the Cohen outfit for Spac IPOs.

There are plenty more of the usual suspects, but one name that stands out is Michael Klein.

Klein’s a connected dealmaker often working on multiple complex projects while making it rain in the Middle East. Yet, he still managed to find time to raise more than $400mn in an upsized IPO for Churchill Capital X, the latest of his forays into the Spac universe.

Citigroup, the bank where Klein helped bring Spacs into the mainstream over a decade ago, has underwritten most of his deals. This time, Klein is leaning on BTIG, a small brokerage that is investing in Churchill Capital X, as its sole underwriter.

UBS trials AI ‘avatars’ for analysts

Picture the scene. You’re at your laptop watching a bank analyst pitch you their latest moneymaking scheme.

Only, the analyst isn’t really there: the person on screen is an AI-generated “avatar”, reading an AI-generated script.

At UBS, this is already happening.

The bank started rolling out AI-generated videos of its analysts in January after clients asked for more research to be delivered in video format. It hopes to free up staff to focus on more productive tasks.

“Think about how we, in our consumer lives, consume so much more video content now than we did five years ago,” UBS’s Scott Solomon told the FT’s Simon Foy.

Solomon, head of global research technology at the investment bank, said UBS had seen greater demand for video content in recent years, coinciding with the huge rise in popularity of apps such as TikTok.

UBS’s avatars work similarly to deepfakes, the AI-generated videos that use past audio and video clips of a person to generate new footage.

Analysts who opt in to the scheme walk into a studio, where Synthesia software captures their likeness and their voice.

The analysts use a large language model to analyse reports they’ve written and generate a script. After they’ve reviewed the script, it’s turned into a lifelike video using their avatar.

On every video, there’s a note to say the content was created by AI and UBS said it would never “mislead or try and pass this off as a real analyst”. “It’s in no way trying to replace the flesh and blood analyst,” Solomon said.

The Zurich-based bank wants to create about 5,000 avatar videos a year once the initiative is up and running.

But for now, it’s had to slow its rollout for some employees. It turns out the technology struggles with some accents.

The accent “would flatten a bit and you might lose a little bit of what makes you you”, said Solomon.

Job moves

-

Allen & Overy ex-managing partners Wim Dejonghe and David Morley have founded a consultancy to advise on private capital investments into the legal sector. Dejonghe was the architect of the merger between A&O and New York’s Shearman & Sterling last year.

-

Novo Nordisk has ousted chief executive Lars Fruergaard Jørgensen. Novo said it would provide further details on its search for a replacement “in due course”. Jørgensen would continue in his role for a period to ensure a smooth transition, it added.

-

Tesla has appointed Jack Hartung to its board of directors. Hartung is chief strategy officer of Chipotle Mexican Grill and served as the restaurant chain’s chief financial officer for more than 20 years.

-

JAB Holding Company has named José Cil as chair of its restaurant platform, which includes Pret A Manger, Caribou Coffee, Panera Bread, Einstein Bros Bagels and Espresso House. Cil will also chair each of those businesses. Until 2023 he was chief executive of Restaurant Brands International.

Smart reads

Watch out Nick Hayek, the cigar-smoking Swatch boss, revels in needling analysts, the FT writes. Some investors hope for a shake-up.

Apollo’s cornerstone Private capital group Apollo has an ambitious plan to remake Wall Street with its asset-based lending business, writes William Cohan in the FT.

Severed fingers Hacking crypto wallets has become harder. Now criminals are using crude tools to inflict pain on executives and their families, the Wall Street Journal reports.

News round-up

EY accused of ‘serious’ failings in audits of collapsed NMC Health (FT)

Ivy League endowments sell private equity stakes amid buyout downturn (FT)

Rio Tinto strikes near $1bn deal in Chilean lithium project (FT)

23andMe sold out of bankruptcy to Regeneron (FT)

Bank of England explores ways to loosen ringfencing rules for UK banks (FT)

Nvidia chief announces major Taiwan chip investments (FT)

Rise in loans to US non-bank financial groups raises systemic risk fears (FT)

Diageo plans big asset sales as industry grapples with lower demand (FT)

Due Diligence is written by Arash Massoudi, Ivan Levingston, Ortenca Aliaj, Alexandra Heal and Robert Smith in London, James Fontanella-Khan, Sujeet Indap, Eric Platt, Antoine Gara, Amelia Pollard, Maria Heeter, Kaye Wiggins, Oliver Barnes and Jamie John in New York, George Hammond and Tabby Kinder in San Francisco, Arjun Neil Alim in Hong Kong. Please send feedback to due.diligence@ft.com

Recommended newsletters for you

India Business Briefing — The Indian professional’s must-read on business and policy in the world’s fastest-growing large economy. Sign up here

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here

https://www.ft.com/content/7ba199e8-9d30-4660-9aa6-2cd5ce2cc2e8