Stay informed with free updates

Simply sign up to the Investments myFT Digest — delivered directly to your inbox.

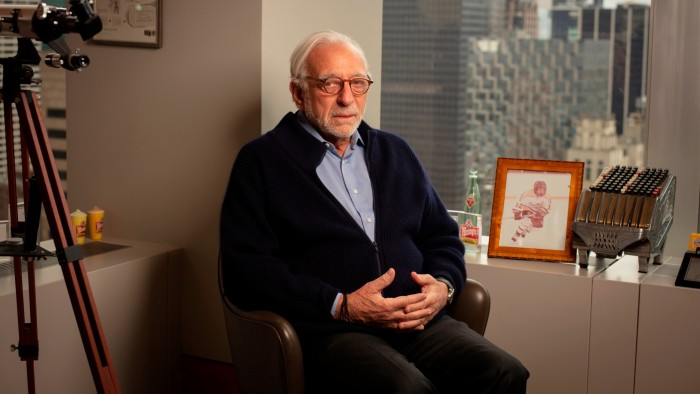

A lot has happened at Unilever since Nelson Peltz’s activist hedge fund, Trian Partners, started building a stake in the company three years ago.

The consumer staples giant has since been through two chief executives, sold a bunch of non-core brands and is in the midst of spinning out its ice cream business via an Amsterdam stock market listing later this year.

If one were to look at the bare figures, this activity has yet to feed through into earnings — though this may change when Unilever publishes half-year figures this month. Pre-tax profit stood at €8.6bn (£7.4bn) in December 2021 (the month before Trian’s investment was first revealed by the Financial Times) and three years later it had edged up to €8.9bn. Earnings per share have marginally declined from €2.33 to €2.30 over the same period.

Achieving meaningful change in such big businesses takes time, though, and on the main metric that matters for investors — the share price — there has been progress.

Based on public disclosures of trades, Trian acquired its shares at an average price of 4,044p a share. With the shares now trading 4,488p, the activist is sat on a gain of about 11 per cent in simple price terms, although it will have also made gains through shareholder payouts. According to FactSet, Unilever shares have generated a compound annual return of just shy of 10 per cent since Trian’s stake was divulged.

Peltz has also moved on to fresh battles. He failed to secure a seat on Disney’s board last year, but his fund did win a seat at Rentokil Initial.

The desire to take some cash off the table is therefore understandable, and on July 1 it was revealed that Trian had sold £25.6mn of Unilever shares. That said, this is only a fraction of its overall holding — 579,000 shares equates to less than 2 per cent of its remaining holding of 32.2mn shares.

Trian said the sale was made for “portfolio management purposes”. Peltz “looks forward to continuing to work with the company’s board and management team to create long-term shareholder value”.

https://www.ft.com/content/d4dd384d-9eaa-46ab-87cc-8352e4c196cb