Digital finance provider Currency.com has expanded further into the U.S. market by acquiring regulatory approval in the state of Tennessee.

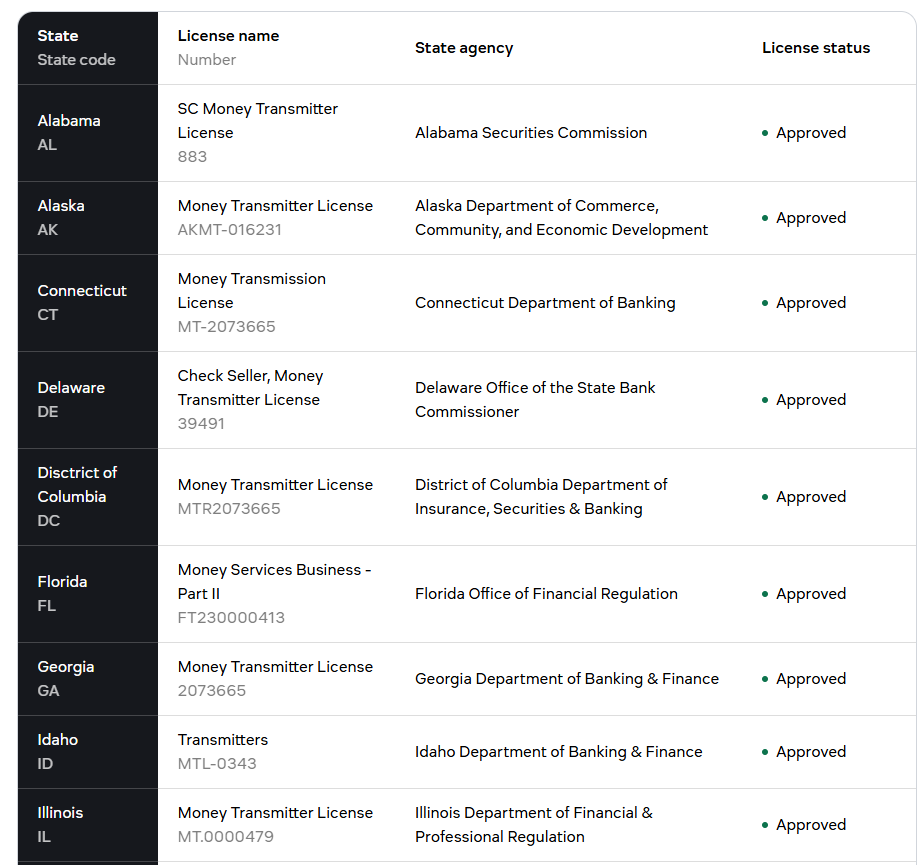

According to the company, this is its 31st U.S. Money Transmitter License (MTL). This brings it a step closer to its strategic goal of getting full licensure across all 50 states.

The Currency.com team said it was encouraged by Tennessee’s crypto-friendly initiatives over the past three years. Tennessee politicians have also been actively engaged over the years in crypto-related matters at the federal level.

As for the company itself, it plans to secure “regulatory approval across the country preemptively.” It will hasten these efforts for the remaining licenses. Additionally, Currency.com will also be forming local compliance and operational teams.

This state-by-state strategy will position it to “rapidly scale its offering once nationwide crypto regulation is firmly established.” It’s all a part of “a broader vision to establish a fully regulated, future-proof financial platform in the U.S.—one capable of supporting both institutional clients and individual users.”

CEO Konstantin Anissimov commented that the company wants to become a leading player in the U.S. digital finance space.

“We’re securing the necessary licenses today so we can hit the ground running when the regulatory landscape matures. Tennessee is another critical step toward that vision,” he said.

According to an update on the company’s crypto FAQ page, customers can now buy, sell, hold, and transfer these two cryptocurrencies directly through PayPal’s platform.

Previously, users could only access SOL and LINK via third-party services like MoonPay while using PayPal as a payment method.

PayPal’s Latest Crypto Move Marks…

(Re)Turning to the U.S., One at a Time

Currency.com says it serves businesses, enterprise clients, and retail users. It is operational in more than 100 countries, with “a growing network of regulatory approvals” in the United States, the European Union, and the Middle East.

Per the website, the company is registered with the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) as a money services business (MSB). It’s neither a registered broker-dealer nor a member of the Financial Industry Regulatory Authority (FINRA) or the Securities Investor Protection Corporation (SIPC).

Internationally, Currency.com is regulated by the Financial Supervision Commission of Poland as a Virtual Asset Service Provider under the Polish Regulatory Framework.

Meanwhile, crypto companies seem to have amped up their efforts to (re)enter the U.S., after years of regulatory challenges. While the regulatory clarity is not there, the environment is somewhat more crypto-friendly.

For example, Deutsche Bank and Standard Chartered are now exploring options to expand their crypto operations in the United States.

Within the country itself, some of Wall Street’s major banks are reportedly exploring crypto expansion. However, according to four unidentified executives, banks hesitate to be the first to make this step, fearing a rule change. Instead, they are waiting for initial test cases to pass.

Overall, we’re likely to see this trend continue.

Why Is Crypto Up Today? Crypto Winners & Losers

At the time of writing, of the top 10 coins per market capitalization, nine are green. Only one has seen a decrease, but so minor that…

The post Currency.com Secures MTL License in Crypto-Friendly Tennessee, Accelerating 50-State Ambition appeared first on Cryptonews.

https://cryptonews.com/news/us-expansion-currency-com-secures-mtl-license-in-tennessee/