Solana treasury firms are rapidly expanding their holdings, with total reserves climbing to 6.49 million SOL, as institutional interest in the network shows no signs of slowing.

The latest disclosures from BIT Mining Limited and Upexi Inc. show the growing momentum behind corporate Solana treasuries, reflecting both long-term conviction and short-term gains from the token’s price rally.

Corporate Bets on Solana Grow as Treasury Gains and Staking Income Accelerate

BIT Mining Limited, a cryptocurrency infrastructure company preparing to rebrand as SOLAI Limited, announced the purchase of an additional 17,221 SOL this week.

The acquisition brings its treasury to more than 44,000 SOL, valued at approximately $9.95 million as of September 10, 2025.

Chairman and COO Bo Yu said the company sees continued value in strengthening its presence within the Solana ecosystem, adding that validator operations will remain central to its strategy of securing the network and capturing staking rewards.

While BIT Mining is still in the early stages of building its Solana portfolio, Upexi Inc. has already emerged as one of the largest corporate holders.

The supply chain and consumer products company shifted in April to focus on a Solana treasury strategy and now reports holdings of 2,018,419 SOL valued at $447 million.

That figure reflects an unrealized gain of $142 million, with most of the company’s tokens staked to generate an annual yield of around 8%. Daily staking rewards currently stand at roughly $105,000.

Upexi’s treasury strategy has also delivered gains on a per-share basis. The firm introduced an “adjusted SOL per share” metric to reflect the effect of capital issuance, staking income, and discounted locked SOL purchases.

As of September 10, adjusted SOL per share stood at 0.0197, or $4.37 in dollar terms, up 56% and 126%, respectively, since launching the initiative.

Chief Executive Allan Marshall described recent weeks as “extremely strong,” citing both treasury performance and higher visibility through participation in finance conferences.

The company has also established an advisory committee to strengthen its positioning, with former BitMEX CEO Arthur Hayes joining as its first member.

Chief Strategy Officer Brian Rudick emphasized Upexi’s execution, pointing to three capital issuances that were “materially in the money” and continued growth in SOL per share as evidence of treasury management success.

BIT Mining, on the other hand, shifted to Solana earlier this year when it unveiled plans to raise up to $300 million to build an SOL treasury and transition away from its legacy focus on Bitcoin, Litecoin, Dogecoin, and Ethereum Classic mining.

Under the strategy, all existing crypto holdings are being converted into SOL, with funds to be raised in phases depending on market conditions.

BIT Mining has also launched DOLAI, a U.S. dollar-denominated stablecoin deployed on Solana in partnership with Brale Inc.

The stablecoin is designed to connect AI agents, merchants, consumers, and institutional finance, while eventually expanding to multi-chain use cases.

BIT Mining, currently the 17th largest public Bitcoin miner by market cap, now sees its future anchored in Solana staking, treasury growth, and blockchain-enabled services.

The surge in treasury activity comes as SOL itself continues its steady climb. The token is trading around $226, up 1.2% on the day and edging closer to its all-time high of $293 set in 2021.

Institutional Treasuries Pour Billions Into Solana as New Vehicles Launch

Institutional interest in Solana is intensifying as major firms prepare multi-billion-dollar treasury strategies on the blockchain.

For example, on August 25, Galaxy Digital, Jump Crypto, and Multicoin Capital entered advanced talks to raise about $1 billion for a new Solana-focused treasury vehicle, with Cantor Fitzgerald advising on the deal.

The plan involves acquiring a publicly traded entity to form one of the largest corporate reserves dedicated to Solana, surpassing the size of all existing treasuries.

Meanwhile, DeFi Development Corp added 196,141 SOL to its balance sheet on September 5, spending $39.76 million at an average price of $202.76 per token.

The purchase lifted its total holdings above 2 million SOL, valued at $412 million, with the firm confirming plans to stake its full position for yield.

On September 8, Forward Industries announced a $1.65 billion private placement led by Galaxy Digital, Jump Crypto, and Multicoin Capital, with existing shareholder C/M Capital Partners joining. The raise, one of the largest Solana-specific financings to date, closed on September 11.

The company said proceeds would fund a new cryptocurrency treasury program focused on SOL purchases, along with working capital and future deals.

Adding to the momentum, Canada-based SOL Strategies began trading on Nasdaq under the ticker STKE on September 10 with $94 million in Solana treasury holdings, becoming the first U.S.-listed Solana-focused public company.

Following a share consolidation to meet exchange requirements, the firm now manages 3.62 million SOL under delegation, including 402,623 from its treasury, and reports record staking participation from nearly 9,000 wallets.

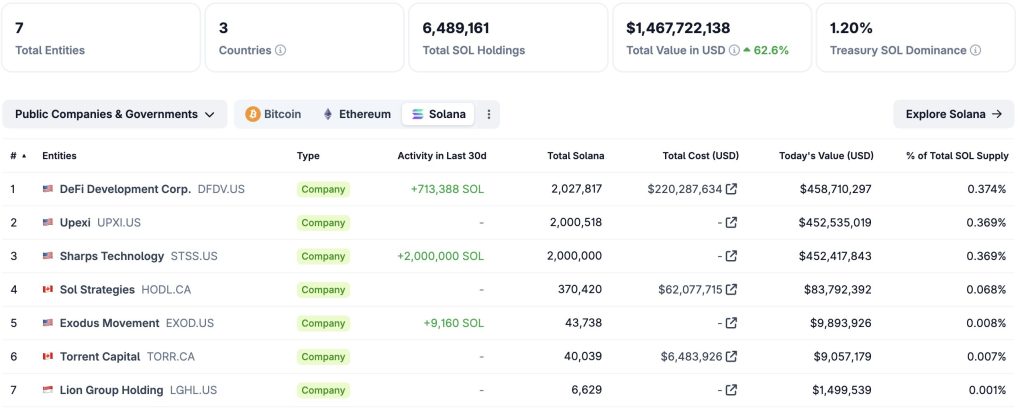

According to CoinGecko’s Solana treasury reserve data, seven entities now hold 1.20% of Solana, valued at $1.4 billion.

Solana Breaks $220 as DeFi TVL Hits Record $12.2B Amid Institutional Accumulation

Solana (SOL) has climbed above $220 for the first time since February, hitting a seven-month high as capital flows and technical signs point to renewed momentum. The rally comes despite a slowdown in new user onboarding, with address creation at a five-month low.

Analysts suggest the surge is being driven by existing holders and institutional accumulation rather than fresh retail inflows.

Large-scale purchases have added to the bullish tone. Data show Galaxy Digital bought 430,000 SOL worth $97 million from Binance within an hour, bringing its 12-hour total to 1.35 million SOL valued at $302 million.

Arkham Intelligence also identified four new wallets receiving 222,644 SOL, worth $48.2 million, from Coinbase Prime in what appears to be coordinated accumulation.

On the DeFi side, Solana reached a new milestone with total value locked (TVL) surpassing $12.2 billion on September 11, edging past its previous record of $12 billion in January.

TVL has grown 15% in the past month and more than doubled from $4.8 billion at the start of 2024.

Solana now leads Ethereum’s Layer-2 networks combined, though Ethereum continues to dominate DeFi with nearly $97 billion locked.

From a technical standpoint, Solana flashes bullish indicators after breaking out of a symmetrical triangle pattern at around $212, suggesting a potential upside of $240.

Other charts also show a double bottom near $198–200, confirmed by a breakout above the $212 neckline, projecting short-term targets of $222–224.

Indicators support the move, with the MACD histogram turning green and the RSI trending higher, showing renewed buying strength.

Analysts note that holding above $210–212 is key for continuation, with resistance seen at $220–224.

A drop below $208 could weaken the setup, but momentum favors a push higher in the near term.

The post Solana Treasury Firms Boost Holdings to 6.5M SOL as Upexi Posts 126% Surge appeared first on Cryptonews.

https://cryptonews.com/news/solana-treasury-firms-boost-holdings-to-6-5m-sol-as-upexi-posts-126-surge/