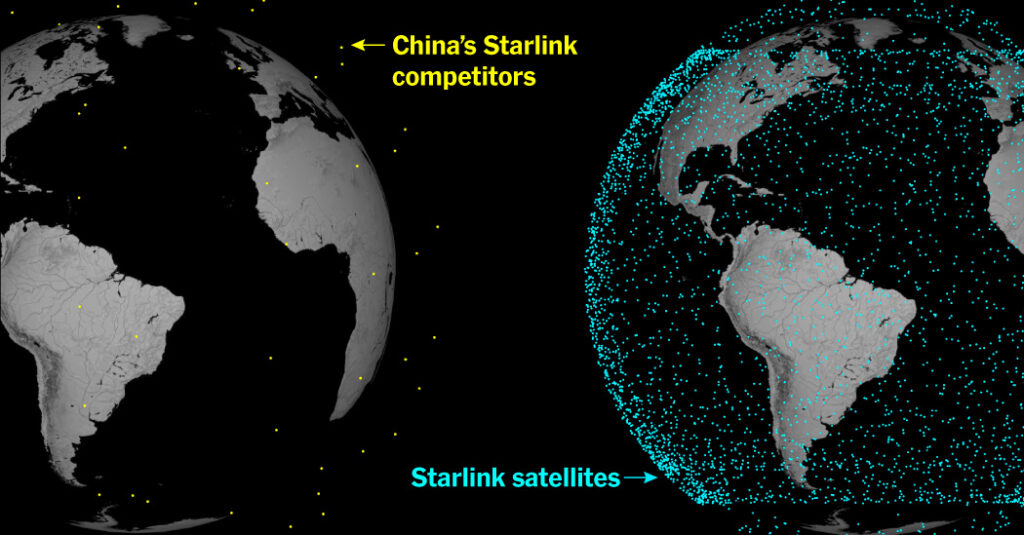

China’s two biggest networks have deployed less than 1 percent of their planned satellites, records show, a measure of how far they are falling behind Elon Musk’s company SpaceX for dominance in space communications.

Satellites in low Earth orbit, up to 1,200 miles above the planet, are increasingly seen as essential for driverless cars, drone warfare and military surveillance. China regards Starlink as a military threat, and Chinese companies have invested heavily in two huge networks, with nearly 27,000 satellites planned between them.

One reason for the unexpectedly slow pace is that the Chinese companies have not cleared a key engineering hurdle.

The first network, or megaconstellation, Qianfan, was scheduled to have about 650 satellites in space by the end of the year. But records show that the company behind the network, Shanghai Spacesail Technologies Co., has put only 90 satellites in orbit since its launches began in August.

The other megaconstellation, Guowang, is even farther behind. Despite plans to launch about 13,000 satellites within the next decade, it has 34 in orbit.

SpaceX has about 8,000 Starlink satellites in orbit and is expanding its lead every month, according to data from U.S. Space Force and CelesTrak, a nonprofit group that gathers space data.

Chinese officials are alarmed by SpaceX, which they viewed as inextricably linked with the Pentagon even before Mr. Musk’s short-lived position in the Trump administration. Researchers for the People’s Liberation Army predict that the network will become “deeply embedded in the U.S. military combat system.” They envision a time when Starlink satellites connect U.S. military bases and serve as an early missile-warning and interception network.

Though Starlink is intended for civilian use, it has become essential for communications and coordinating drone strikes in the war in Ukraine. And SpaceX has contracts with the U.S. government to build and launch satellites, some for espionage and others for targeting enemies and tracking missiles. SpaceX also launches satellites built by other defense contractors.

China’s space agencies and its aerospace companies did not respond to requests for comment.

China, like the United States, recognizes the national security value of being in space. But the government is also encouraging commercial space interests and says it expects to create a $344 billion market.

“Exploring the vast universe and building a space power is our unremitting space dream,” China’s top leader, Xi Jinping, said last year, according to government news media.

It has not gone smoothly.

China hasn’t solved a key rocket problem. SpaceX has.

One of the major reasons for China’s delay is the lack of a reliable, reusable launcher. Chinese companies still launch satellites using single-use rockets. After the satellites are deployed, rocket parts tumble back to Earth or become space debris.

But SpaceX’s workhorse rocket, the Falcon 9, is partly reusable. The rocket’s bottom portion, containing the main engines, returns to Earth upright, intact and ready to be deployed for other missions. That drastically reduces costs and speeds up the time between launches.

This is the innovation that propelled SpaceX far ahead of competitors. Falcon 9 rockets have been used in about 500 missions, according to SpaceX.

But six years after the Falcon 9 began launching Starlink satellites, Chinese firms still have no answer to it.

Reusable rockets must withstand extreme heat during their return to base. They also have to be stable and under control with engines that can restart in different aerodynamic conditions, said Jonathan McDowell, an astrophysicist at the Harvard-Smithsonian Center for Astrophysics who tracks objects in space.

“The question is not just recovering them,” Dr. McDowell said, “but recovering them in a good enough state to launch them again.”

The lack of a reusable rocket is not the only limitation. Manufacturing satellites is a complicated and time-consuming endeavor, and establishing a steady launch cadence is tricky even with reusable rockets. It took SpaceX years to work out the kinks. But experts said that the race for a reusable rocket was central to the future of the Chinese low Earth orbit constellations.

One Chinese government-funded model, the Long March 8, was meant to be reusable. But its developer, China Academy of Launch Vehicle Technology, abandoned that plan. An improved version, the Long March 8R, could “grow up” to be a reliable Falcon 9 equivalent, Dr. McDowell said.

The government has tested nearly 20 rocket launchers in the Long March series.

Another potential launcher alternative is the Zhuque-3, made by the Chinese firm Landspace. The launcher conducted a liftoff-and-recovery test last year and, in another test this June, its engines fired for 45 seconds.

A third alternative, the Tianlong-3, had a setback last year. The rocket took off briefly during what was supposed to be a static test and exploded upon impact.

While the Chinese firms could have a technological breakthrough as early as this year, it will still take them time to get to a reliable cadence, said Andrew Jones, a journalist who has monitored Chinese space launches for the past decade.

“They have to work out the kinks,” Mr. Jones said.

That hasn’t stopped China from marketing its satellite services.

Chinese space companies are drumming up business in countries where governments are wary of relying on Starlink satellites or looking for better prices.

Shanghai Spacesail Technologies Co. says it is negotiating with 30 countries over contracts for access to its Qianfan megaconstellation.

The company signed a deal to provide internet in Brazil last year, soon after a Brazilian judge froze Starlink’s local assets in a dispute with another Musk-owned company, X. Spacesail has other agreements to provide internet in Thailand and Malaysia and has set up a local subsidiary in Kazakhstan.

Its services, however, are yet to come online. In fact, 13 of its 90 satellites did not reach the correct height of orbit, for unclear reasons. This means that they are most likely not functional, Dr. McDowell said.

The satellite internet contracts now under negotiation could become an important feature of economic diplomacy “in a world that is moving from free trade to a more protectionist and more autonomy-based order,” said João Falcão Serra, a research fellow at the European Space Policy Institute.

A country’s decision to sign contracts with Starlink could be seen as “a message to the U.S. and to China” about where its allegiances lie, he said.

There could still be a record number of Chinese launches this year.

Private and government-run companies in China conducted more than 30 launches in the first half of the year, a faster cadence compared with last year.

The missions have put about 150 satellites and two spacecrafts in space, according to official announcements and data compiled by U.S. Space Force. That includes launches into low, medium and farther orbits.

Still, Chinese companies will need to pick up the pace. This is especially true for the megaconstellations, which risk losing the right to operate on their radio frequencies.

A constellation has to launch half of its satellites within five years of successfully applying for its frequencies, and complete the full deployment within seven years, according to rules set by the International Telecommunication Union, a United Nations agency that allocates frequencies.

The Chinese megaconstellations are behind on these goals. Companies that fail to hit their targets could be required to reduce the size of their megaconstellations.

Still, experts say that it is unwise to write them off. Satellite launches in China tend to accelerate in the second half of the year. And a technological breakthrough could radically transform the landscape.

This year and next could signal the transition from Starlink’s dominance to a more competitive field, Dr. McDowell said.

Joy Dong and Chris Buckley contributed reporting. Additional work by Scott Reinhard.

https://www.nytimes.com/interactive/2025/07/23/world/asia/starlink-spacex-musk-china-satellites.html