The crypto market saw another small drop today, though the situation has improved compared to yesterday, with more coins in the green, as the market consolidates. Nearly half of the top 100 coins per market cap have increased over the past day. At the same time, the cryptocurrency market capitalization has decreased by 2%, currently standing at $3.55 trillion. The total crypto trading volume is at $122 billion.

TLDR:

Crypto Winners & Losers

At the time of writing, four of the top 10 coins per market capitalization are down and four are up over the past day (not taking stablecoins into account).

Bitcoin (BTC) has decreased by 0.9% to the price of $107,940. This is also down from the intraday high of $109.037.

Ethereum (ETH) saw the highest increase in this category by far. While others are up less than 1% per coin, ETH appreciated 3.6% to $2,729.

As for ten coins, they are all down by less than 1%. BTC’s and Solana (SOL)’s 0.9% falls are the highest. SOL now trades at $172.

Of the top 100 coins, nearly half are green, more than double seen yesterday. The highest decrease is Fartcoin (FARTCOIN)’s 4.8% to $1.29.

The highest gainer is SPX6900 (SPX), followed by Toncoin (TON). They’re up 14.3% and 11% to $1.13 and $3.31, respectively. Over the past 24, TON perpetual futures open interest jumped to $190 million, its highest level since February.

The current market dip doesn’t seem alarming. Per various analysts, it’s following the previously established patterns, whereby rallies are followed by short-term downwards corrections and sell-offs. Overall, it’s currently consolidating.

‘The Broader Outlook Remarkably Uncertain’

“Strength in the Bitcoin market remains firm,” says the latest report by blockchain and market data intelligence platform Glassnode.

The report notes that price discovery phases are historically often followed by brief sell-offs. Early profit-takers are exiting and de-risking at new highs.

As the market re-enters a period of price discovery, the unrealized profit has surged. However, with the rise in profitability comes an increase in sell-side pressure. At the same time, when the price rises, “larger volumes of buy-side demand are required to absorb the distributed coins in order for the market to sustain upwards momentum,” Glassnode explains.

Overall, BTC Bitcoin has followed the pattern so far. It hit an ATH, profit-takers seized the opportunity to exit, the price pulled back to $107,000 shortly after the initial breakout, then recovered and consolidated around the $108,000 level.

“Bitcoin is outperforming most asset classes amidst an environment of challenging macroeconomic conditions and geopolitical tensions, making the broader outlook remarkably uncertain. This robust performance is a truly fascinating signal amidst relatively challenging market conditions,” the report highlights.

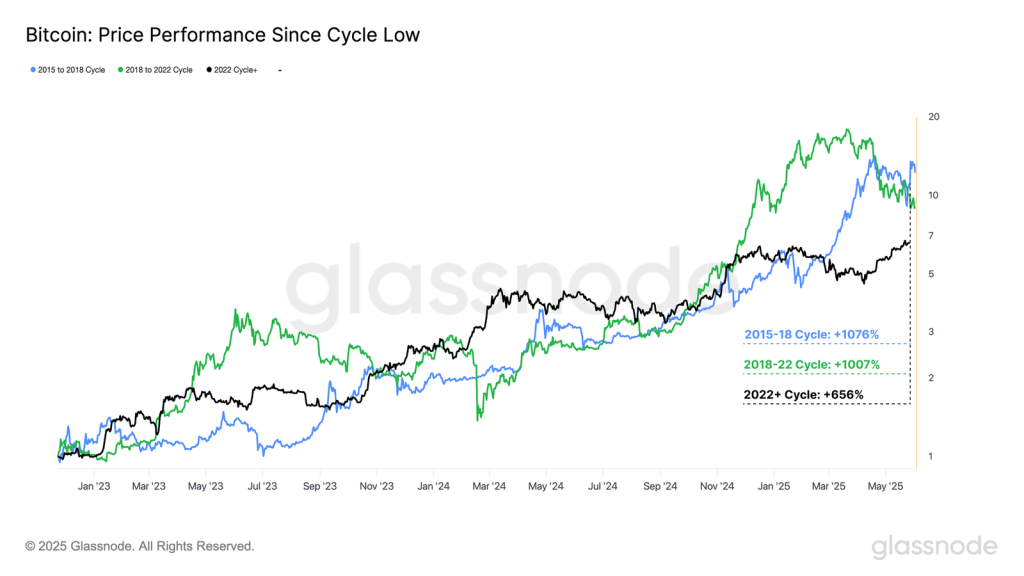

When the analysts compared the price performances of the current cycle to previous ones, they found “a surprising similarity in structure.” Glassnode argues that it’s “a remarkable feat” for BTC to track earlier cycles so closely when accounting for the significantly larger market capitalization today.

“This suggests that the scale of demand for Bitcoin is keeping pace with the growth rate of the asset,” the report concludes.

Levels & Events to Watch Next

As noted, BTC currently trades at $107,940. This is 3.5% lower than the all-time high of $111,814 hit a week ago. The coin has largely been trading around the $108,000 level over the last few hours.

Notably, it broke one support level of $108,731. Should it go lower, we could see it breaking supports at the $107,000 and $105,000 levels as well. On the upside, we’re also looking to see if the coin will break through $109,600 again and push towards $112,000.

Moreover, the Fear and Greed Index has decreased from 68 to 65. Notably, this is also down from 76 seen last week. This is still the green territory and indicates positive market sentiment and increased risk-taking. Nonetheless, the decrease over the week is notable.

Meanwhile, on 28 May, US BTC spot exchange-traded funds (ETFs) saw a net inflow of $432.62 million, led by BlackRock’s $480.96 million. The total net inflow now reached $45.34 billion. US ETH spot ETFs saw $84.89 million in net inflows, significantly higher than yesterday. The cumulative inflow is now $2.88 billion.

The flows haven’t turned negative despite the market decrease. This indicates continual and strong institutional support and adoption. Consequently, this support may fuel the market’s next leg up.

Meanwhile, Japanese Bitcoin treasury firm Metaplanet announced a fresh $21 million bond issuance to fund additional purchases of Bitcoin. Norwegian crypto brokerage K33 raised $6.2 million through zero-interest loans and equity to fund Bitcoin purchases. Also, American video game retailer GameStop acquired 4,710 BTC.

In Russia, the central bank allowed limited access to crypto-linked financial products for qualified investors.

In the US, NYC Mayor Eric Adams has announced plans to build a municipal Bitcoin-backed bond, dubbed ‘BitBond’, and eliminate BitLicense. There are also reports that some of Wall Street’s banking giants are discussing crypto expansion.

Quick FAQ

- Why did crypto move with stocks today?

The crypto market has recorded another slight decrease today, though the situation has improved since yesterday. The stock market also saw a decrease, though the two don’t seem linked. The S&P 500 is down 0.56%, the Nasdaq-100 fell 0.45%, and the Dow Jones Industrial Average decreased by 0.58%. Donald Trump’s back-and-forth on trade policy has resulted in volatile trading in traditional markets over the past few months.

- Is this dip sustainable?

Analysts seem to agree that the rally may continue after a brief pause. Though the crypto market remains supported by strong capitalization and investor interest, regulatory or macroeconomic changes may negatively affect it as well, pulling the prices downward.

The post Why Is Crypto Down Today? – May 29, 2025 appeared first on Cryptonews.

https://cryptonews.com/news/why-is-crypto-down-today-may-29-2025/