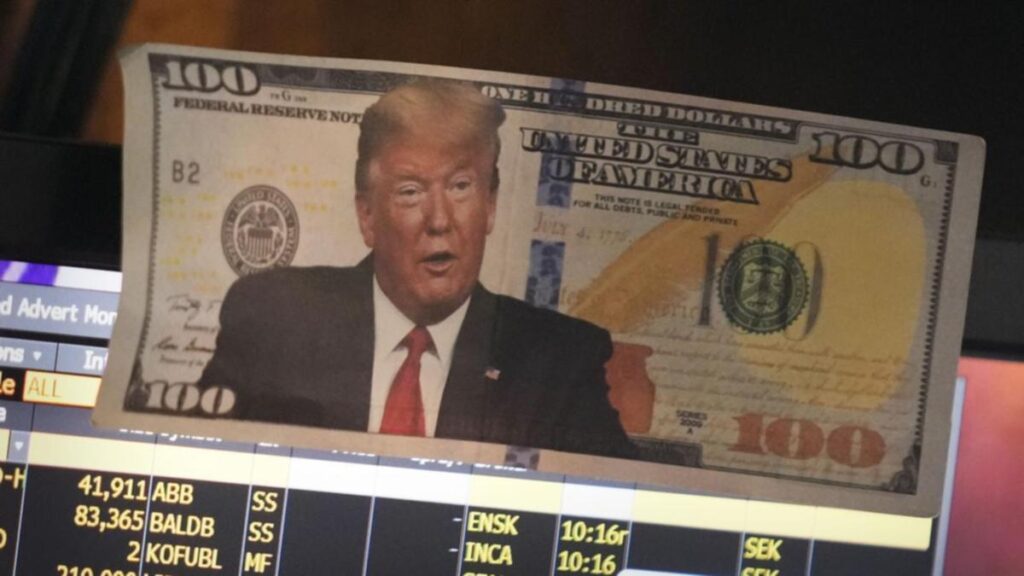

Wall Street’s main indexes are edging up, as investors assessed President Donald Trump’s executive orders after taking office, while awaiting his first move on trade policy.

Trump did not lay out any concrete plans on the universal tariffs and additional surcharges on close trade partners as previously promised, but said he was thinking about imposing duties on Canadian and Mexican goods as early as February 1.

While investors remain cautious about Trump’s tariff policies, which could spark a global trade war and fresh inflation pressures, brokerage Goldman Sachs lowered its forecast for a universal tariff this year to 25 per cent from about 40 per cent seen in December.

In early trading on Tuesday, the Dow Jones Industrial Average rose 258.04 points, or 0.59 per cent, to 43,745.87, the S&P 500 gained 26.73 points, or 0.45 per cent, to 6,023.39 and the Nasdaq Composite gained 13.90 points, or 0.07 per cent, to 19,644.10.

The domestically focused small-cap Russell 2000 index rose one per cent to touch a one-month high.

Nine of the 11 S&P 500 sectors rose, with real estate leading the gains with a 1.4 per cent increase.

Apple slid 3.7 per cent after brokerage Jefferies cut its rating on the iPhone maker to ‘underperform’.

Automakers General Motors and Ford, which are most sensitive to tariffs due to their vast supply chains, edged up 1.6 per cent and 0.8 per cent, respectively, while Elon Musk-led Tesla dropped 3.1 per cent.

“It’s impossible to know exactly what the Trump administration will do…in the past, tariff rhetoric turned into trade deals that turned into negotiating tactic and it was never universally applied. So, I think the market right now is taking a wait-and-see attitude towards that,” said Art Hogan, chief market strategist at B Riley Wealth.

During the first year of Trump’s first administration, the S&P 500 rose 19.4 per cent, while the benchmark index rose nearly 68 per cent through his first term, but saw bouts of volatility, stemming in part from a trade war Trump fought with China.

Last week, the S&P 500 and Dow registered their biggest weekly percentage gains since early November, helped by strong bank earnings and signs that underlying inflation was cooling.

However, inflation is still above the Federal Reserve’s two per cent target, and fuelling worries that Trump’s policies could delay the central bank’s pace of monetary policy easing.

Economists see the Fed leaving borrowing costs unchanged when it meets next week and traders see the first interest rate cut coming in July, according to data compiled by LSEG.

3M rose 4.5 per cent after posting upbeat fourth-quarter profits. Charles Schwab rose seven per cent after the brokerage firm’s profit rose 44 per cent in the fourth quarter.

Walgreens fell 12.3 per cent after the Justice Department accused the pharmacy operator of filling unlawful prescriptions for addictive painkillers and other drugs.

Moderna rose 9.3 per cent after securing $US590 million ($A948 million) from the US to hasten development of its bird flu vaccine.

Advancing issues outnumbered decliners by a 4.14-to-1 ratio on the NYSE and by a 2.15-to-1 ratio on the Nasdaq.

The S&P 500 posted 32 new 52-week highs and no new lows, while the Nasdaq Composite recorded 78 new highs and 33 new lows.

https://thewest.com.au/business/markets/wall-st-edges-higher-with-focus-on-trumps-trade-policy-c-17463191