“Badwill” sounds like something that could sour a business deal. Instead, it can be the cherry on the cake. The accounting tweak, more commonly called “negative goodwill”, will add $34.8bn to the profits of UBS. That compares to the price of just $3.5bn the Swiss wealth manager agreed to pay for troubled rival Credit Suisse.

The question for investors is whether the double negative counts as a single positive for UBS.

Badwill is crystallised when an acquirer buys a target below the fair value of its net assets. Accountants register it as a gain via the income statement when they add those intangible assets to the balance sheet. Regulators permit some or all of the amount to count towards capital buffers.

Credit Suisse disclosed shareholders’ equity of $48.8bn at the end of 2022. UBS will warily put the smaller figure of $34.8bn through its income statement. Its bean counters have built in a discount to allow for potential hits to Credit Suisse’s balance sheet. These range from asset value haircuts to expected litigation costs of $4bn.

The sum is still substantial. But investors had hoped for more. In a presentation, UBS estimated that after the deal closes this quarter it would have buffer capital of $81bn, defined as common equity tier one capital. That is $8bn below the total forecast by Barclays analysts.

Moreover, $34.8bn is tiddly, measured against $275bn of risk-weighted assets that UBS will absorb from Credit Suisse.

So how should we view UBS’s badwill bonanza? The first point is that this is a paper gain. It is not in cash, payable to shareholders in dividends. The second issue is that the value of badwill could easily be squeezed on the balance sheet by the discovery of further skeletons in Credit Suisse’s boneyard of a closet.

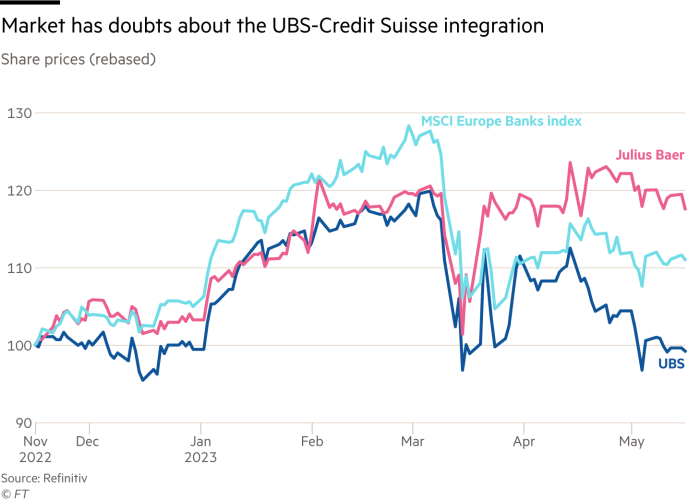

The market rightly remains fixated on whether UBS chief executive Sergio Ermotti can integrate Credit Suisse to create a larger, more profitable bank. That will determine whether UBS can catch up with sector indices it currently lags behind. To deploy an accounting cherry attractively, you first need a cake to put it on.