The tokenized real-world assets market has surged to $26.5 billion following 70% growth in 2025, yet new research warns that rapid expansion could trigger an “on-chain subprime crisis” through what analysts call the “RWA Liquidity Paradox.“

Tristero Research released a comprehensive study warning that tokenization creates dangerous mismatches between slow-moving physical assets and the hyper-fast blockchain market.

The research argues that wrapping illiquid assets, such as buildings, loans, and commodities, in liquid digital shells amplifies systemic risk rather than reducing it.

Market Growth and Trillion-Dollar Projections Defies Structural Concerns

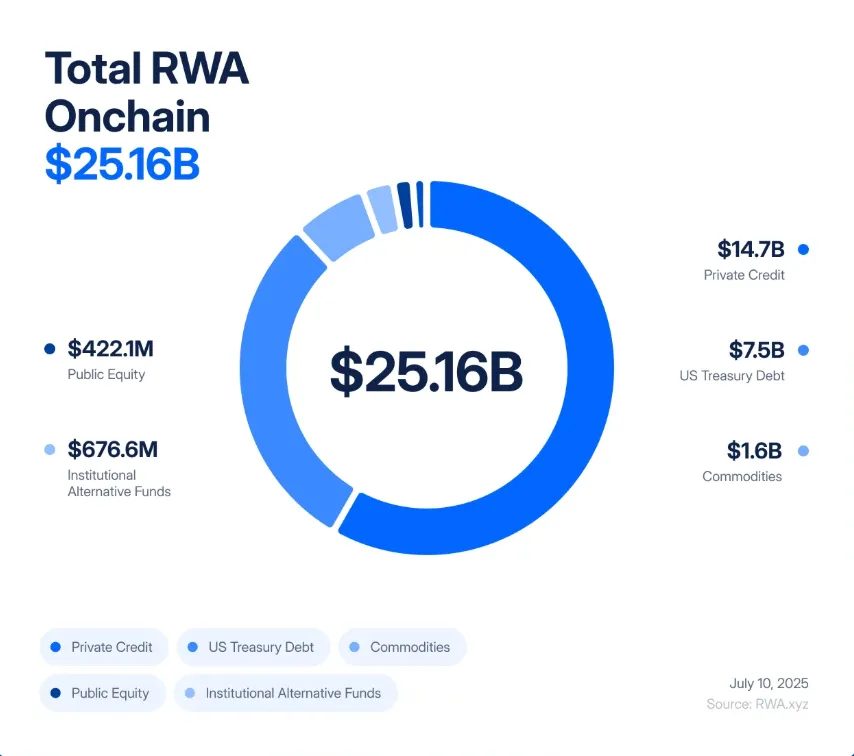

The warning comes as the sector experiences massive growth. RWA tokenization has expanded 245 times since 2020, growing from $85 million to the current $26.5 billion market valuation.

Private credit and U.S. Treasuries dominate nearly 90% of tokenized value, while Ethereum maintains 55% market share.

Industry projections remain bullish despite the warnings. Animoca Brands’ research suggests the sector could tap into a $400 trillion traditional finance market, while Skynet’s 2025 RWA Security Report forecasts growth to $16 trillion by 2030.

Tokenized U.S. Treasuries alone are projected to reach $4.2 billion this year.

The regulatory climate has improved significantly with the passage of the GENIUS Act, the first major crypto legislation approved by Congress.

The bill provides regulatory clarity for stablecoins and tokenization companies, allowing institutions and technology firms to operate under established frameworks.

Major players have positioned themselves strategically. BlackRock issues tokenized Treasuries, Figure Technologies has billions in private credit on-chain, and real estate deals from New Jersey to Dubai trade on decentralized exchanges.

The Liquidity Paradox Warning: 2008 Financial Crisis Might Repeat Itself

Tristero Research’s analysis centers on fundamental structural flaws in current tokenization approaches.

The firm argues that tokenization doesn’t change asset characteristics. Office buildings, private loans, and gold bars remain slow and illiquid, despite digital wrappers that facilitate instant trading.

The research compared this to the 2008 financial crisis, when subprime mortgages were transformed into complex securities through Mortgage-Backed Securities and Collateralized Debt Obligations, creating apparent liquidity from illiquid foundations.

The mismatch between slow mortgage defaults and fast-moving derivatives amplified local problems into global shocks.

RWA tokenization risks repeating this pattern at blockchain speed. The research cited a commercial property token in New Jersey where the building’s legal transfer requires weeks of title checks and county filings. However, its digital representation trades 24/7 on decentralized exchanges.

The research outlines potential crisis scenarios. In one example, a private credit protocol with $5 billion in tokenized SME loans faces real-world defaults while oracles update monthly.

Market prices fall before official valuations adjust, triggering automated liquidations that create feedback loops, crashing the entire system within minutes.

A second scenario involves tokenized commercial properties where custodian hacks or natural disasters compromise legal claims.

On-chain tokens collapse immediately while underlying assets remain intact, creating bad debt across DeFi protocols that used the tokens as collateral.

Additionally, the analysis warns of “RWA-squared” derivatives, which are second-layer products that bundle tokenized assets into indices and structured products.

These instruments promise diversification but share correlation through DeFi infrastructure, meaning oracle failures or protocol governance problems could crash all RWA derivatives simultaneously.

Regulatory Progress and Market Expansion

The GENIUS Act’s passage created immediate opportunities for compliant technology companies.

Speaking with Cryptonews, Dave Hendricks, Vertalo’s CEO, said the legislation benefits builders more than banks, as institutions seeking speed to market will likely acquire rather than develop blockchain capabilities internally.

Similarly, Walter Hessert from Paxos shared with Cryptonews that the Act validates years of compliant infrastructure development alongside enterprises like Stripe, Mastercard, and PayPal.

The regulated digital dollar infrastructure now enables large-scale RWA tokenization with stablecoins serving as essential on-chain settlement mechanisms.

As a result, partnership opportunities emerged between traditional financial institutions and blockchain technology companies.

Banks bring client relationships and regulatory expertise while tech firms provide infrastructure and compliance frameworks.

For instance, IBM is developing tokenization frameworks for enterprise assets and bank money to address technical and governance challenges.

However, challenges persist beyond regulatory clarity. While speaking with Cryptonews, Ryan Zega from Aptos Labs identified integration gaps between on-chain networks and off-chain financial systems as primary obstacles.

Because of this, he suggested that “there’s a continuing need to educate policymakers, financial institutions, and the public on the practical benefits of this technology beyond headlines and speculation. That understanding will be key to long-term adoption.”

The post Tristero Research Warns RWA Tokenization Could Trigger ‘On-Chain Subprime Crisis’ appeared first on Cryptonews.

https://cryptonews.com/news/tristero-research-warns-rwa-tokenization-could-trigger-on-chain-subprime-crisis/