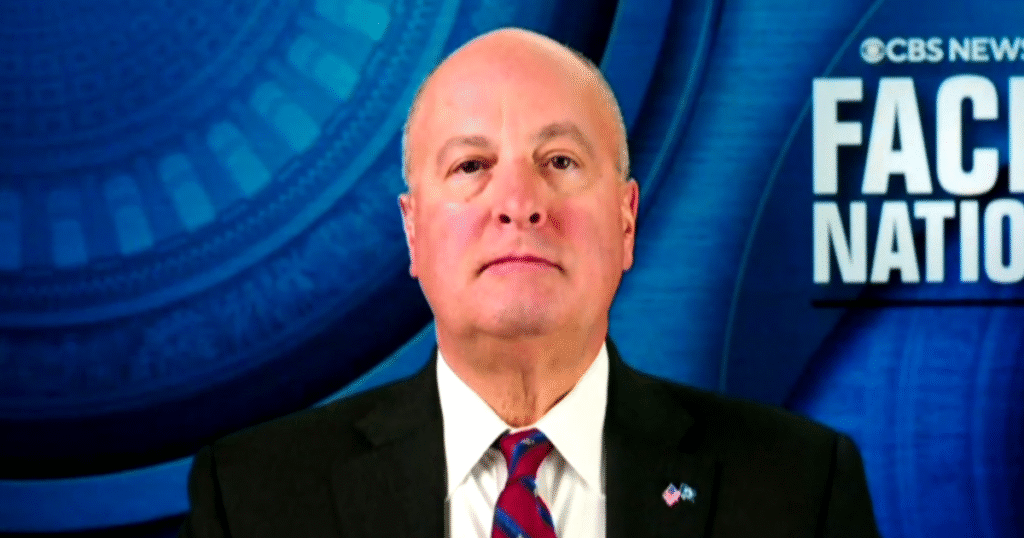

The following is the transcript of the interview with USAA CEO Juan Andrade that aired on “Face the Nation with Margaret Brennan” on Nov. 2, 2025.

MARGARET BRENNAN: We’re joined now by Juan Andrade, CEO of financial services company USAA. Many of its nearly 14 million customers are in the military or veterans, and he joins us from San Antonio. Sir, Secretary Bessent said on this program just last Sunday that by November 15, the troops and service members aren’t going to be paid. What level of anxiety are you seeing among your customers?

USAA PRESIDENT JUAN ANDRADE: Margaret, thank you for having me on your show. What we’re seeing today is uncertainty, anxiety and, for some, real hardship, and that’s really within the- the active duty community. It’s also important to note that 30% of federal employees are also veterans or military spouses. So this is more than an impact to a household budget. This can really undermine morale and focus, and our goal is to provide stability for people who are living paycheck to paycheck and who are frankly losing ground.

MARGARET BRENNAN: Well, I’ve seen that you’re offering interest free loans to customers. Is- is that everyone, or just specifically active duty military? And- and if they can’t qualify for a loan, what do they do?

ANDRADE: So we’re offering our government shutdown program to all eligible members of USAA. So as you said, that’s currently about 14 and a half million people, and at this point, we’ve acted swiftly and decisively. In the first 48 hours of the shutdown, we funded 150 million in zero interest loans. We are now up to 400 million to date. But that’s also in addition to payment extensions that we’ve done on credit cards, auto loans, mortgages. We’ve also waived fees for overdraft and we’ve also had flexible insurance arrangements across our property, casualty, life and health insurance businesses.

MARGARET BRENNAN: Four hundred million in zero interest loans. So people are already looking to try to figure out how to make ends meet. We looked, and a quarter of all active duty military members are food insecure, according to the Department of Agriculture, that was well before this shutdown. That means they don’t have a good diet, or they’re not able to afford food. We already saw strain on a lot of that active duty military. Can you give us a sense of- of what this means for someone now, to- to look at the calendar and know November 15, there’s no pay coming?

ANDRADE: Yeah, and- and- and I agree this is one of the reasons why we’ve already funded 400 million in loans at this point in time. People are preparing for an uncertain period of time, and this is very important to them, particularly if we think about our younger enlisted and particularly those with families. Dual incomes in military families is not a luxury, it’s a necessity. So these are people that we’re very worried about, and we want to make sure that they’re stable through this period of time. The other part of this, and frankly, the reason for doing these zero interest loans is we want to make sure that they don’t turn to high interest rate payday loans or high interest rate credit cards at the same time.

MARGARET BRENNAN: And the unemployment rate among civilian military spouses is almost five times the national average, to your point, that they need dual income. Many can’t do that, but the Congressional Budget Office projection is that there will be an economic cost, that the shutdown itself could lead to seven to 14 billion in lost growth. What’s the impact on the communities like yours, where you were living, down in Texas, you know, in areas where there are bases around this country?

ANDRADE: Sure, I think you see it in a few ways. I think one is definitely on consumer spending. Right now, people are prioritizing basic needs, whether it’s health or food at this point in time, so they’re definitely cutting back on- on discretionary spending. I think that’s part of that. The other aspect of it is you’re going to see more people who are food insecure, and this is one of the reasons why we have also been supporting our local communities. Our offices are all located near major military installations, and we have donated millions to military aid societies who are best positioned to provide food and other services in installations, and we’ve also been donating to local food banks in our communities.

MARGARET BRENNAN: So how does this compare to the last extended shutdown that we had during the first Trump administration?

ANDRADE: The- the last shutdown basically has not- did not last as long. I think that was a big part of that. And we also had the certainty that the military would be getting paid. Now, clearly, up until now, they have been getting paid. The question of the uncertainty that we’re seeing from our members is what happens over the next couple of weeks.

MARGARET BRENNAN: Because you were already planning for that November 15- when you say the shutdown wasn’t this long, you’re assuming the government does not get funded for how long? How long can you keep doing this?

ANDRADE: We’re already- we’re already planning for a second loan to members, so we’ve had a number take us up, certainly on the first offer of loan. Now, they’re taking us up on the second offer of loan, and we’re prepared to assist. That’s our-our job, and to take care of our members in the military community. So we will keep up with this. And if we have to do more, we will do more.

MARGARET BRENNAN: All right. Well, we- we are thinking of your customers at this time, we will continue to track what happens with that real world impact. Thank you, Mr. Andrade.

ANDRADE: Thank you, Margaret.

https://www.cbsnews.com/news/juan-andrade-usaa-ceo-face-the-nation-transcript-11-02-2025/