In Summary

- Nigeria leads as the continental giant, with a projected $3.6 billion market in 2025, driven by its massive youth population, mobile adoption, and intense passion for football.

- South Africa and Kenya represent mature, high-value markets, characterized by sophisticated digital ecosystems, high per-user spending, and deep mobile money integration, respectively.

- East African nations show high growth potential, fueled by very high participation rates and the deep integration of mobile payments, despite smaller overall revenue than the top markets.

Deep Dive!!!

Wednesday, 12 November 2025 – The African sports betting industry has solidified its status as one of the world’s most dynamic and rapidly expanding markets, a transformation driven by a powerful convergence of technological adoption, demographic trends, and deep-seated sporting passion. The proliferation of affordable mobile technology and the continent-led revolution in mobile money services have dismantled traditional barriers to entry, creating a seamless ecosystem for digital wagers. This technological leap, combined with a vast, youthful population and an unwavering cultural devotion to football, has ignited a betting boom that is reshaping the entertainment and financial landscapes from Cairo to Cape Town.

This analysis presents a definitive ranking of the Top 10 African countries with the largest sports betting markets, based on a comprehensive evaluation of verified 2024 data and 2025 projections. Our methodology synthesizes key performance indicators, including Gross Gaming Revenue (GGR), active player volumes, transactional values, and the maturity of retail and digital infrastructures. The ranking reflects not only the sheer scale of each market but also its unique characteristics—from the mobile-first monetization of Kenya and South Africa to the high-volume, participation-driven economies of Uganda and Tanzania.

Understanding this hierarchy is crucial for grasping the broader economic and social currents at play. These markets represent more than just revenue figures; they are complex ecosystems involving intense operator competition, evolving regulatory frameworks, and significant technological innovation. The following breakdown provides a detailed look at the engines of this growth, highlighting the distinct factors that position Nigeria as the continent’s undisputed leader and illuminate the promising frontiers that are poised to define the next chapter of African iGaming.

10. Morocco

Morocco’s sports-betting market showed steady expansion in 2025, forming part of a broader gambling sector that analysts estimate at roughly $1.14 billion for the year, with sports betting contributing an estimated $170–180 million of that total. These figures come from recent market studies tracking Morocco’s online and land-based gambling segments, and they reflect healthy year-on-year growth driven by rising digital access and stronger consumer spending on entertainment.

The country’s regulatory environment is a mixed picture, which has shaped how the market develops. Land-based wagering, lotteries and horse racing operate under state concession models and established operators such as La Marocaine des Jeux et des Sports, while online offerings occupy a more constrained space where some forms of internet gambling are restricted or tightly regulated. Despite that, mobile sports betting has seen strong uptake among younger adults, supported by increasing smartphone penetration and secure mobile payments, and operators have adapted by focusing on licensed sports books and retail channels. Industry reporting notes ongoing tendering and contract activity among major suppliers, signalling commercial interest even as regulators refine the rules.

Looking ahead, Morocco’s sports-betting segment appears set to scale further as digital adoption rises and event cycles such as AFCON stimulate short-term spikes in wagering activity. Market research firms forecast modest compound growth out to 2029, while industry commentary highlights opportunities in mobile product innovation, age-targeted responsible-gaming measures and tighter operator regulation to unlock more of the latent market. At the same time, stakeholders caution that clearer online licensing rules and robust consumer-protection frameworks will be essential to convert casual bettors into a sustainably monetised, regulated market.

9. Ethiopia

Ethiopia has emerged as one of Africa’s most dynamic and rapidly expanding sports betting markets in 2025, following a landmark liberalization of its telecommunications sector and the subsequent surge in mobile internet penetration. The government’s decision to grant licenses to international operators, coupled with the aggressive rollout of 4G and 5G networks by Safaricom Ethiopia and its competitors, has unlocked access to a previously untapped population of over 30 million young, potential customers. According to market analysis featured in Gambling Insider’s Q3 2025 African Market Report, the number of active monthly betting users in Ethiopia grew by over 200% in the first half of 2025 alone, signaling an explosive adoption rate that has captured the full attention of major international bookmakers.

This rapid growth is translating into significant, albeit nascent, financial figures. Industry briefings from leading operators entering the market project that the Ethiopian sports betting market is on track to generate an estimated $150-$200 million in Gross Gaming Revenue (GGR) for the full 2025 calendar year. While this places it behind more mature markets, the year-on-year growth rate is unparalleled, consistently cited as being in excess of 300%. The primary driver remains football, with the English Premier League and the Ethiopian Premier League constituting the vast majority of wagers. The market’s frontier status is characterized by intense competition for market share, with operators investing heavily in localized marketing campaigns and partnerships with popular local sports influencers to build brand loyalty from the ground up.

The potential for future scaling is immense, though not without its challenges. Market reports from the International Center for Responsible Gaming (ICRG) in 2025 have highlighted that Ethiopia’s regulatory framework is still in its developmental phase, creating a crucial need for robust consumer protection measures to be implemented alongside commercial growth. Despite this, the underlying fundamentals, a population of over 120 million, a median age of just 19.5 years, and a mobile money ecosystem that is growing at an exponential rate, solidify Ethiopia’s status as the continent’s most promising growth frontier. As one industry executive noted in a 2025 briefing, “Ethiopia isn’t just a new market; it is potentially the next Kenya, and everyone is racing to establish a foothold before the landscape becomes saturated.”

8. Ghana

Ghana has cemented its status as a major West African iGaming hub, with a market that expanded materially throughout 2024 and is poised for continued growth in 2025. The country’s high mobile adoption rate, exceeding 60% of the population, provides a fertile ground for digital betting platforms. According to iGaming Today’s 2024 Market Review, Ghana’s total iGaming gross gaming revenue (GGR) reached approximately $750 million in 2024, with sports betting accounting for the dominant share, estimated at over 70% of the total. This robust activity is underpinned by a competitive landscape of licensed operators, including local and international brands, all vying for market share through aggressive marketing and promotional offers tied primarily to European football leagues.

The regulatory environment, governed by the Gaming Commission of Ghana, has been instrumental in fostering a structured market. The Commission’s issuance of new licenses and its efforts to curb unlicensed operations have increased consumer confidence and channeled betting into the taxable economy. A key trend identified in 2024 was the rapid growth of in-play or live betting, which now constitutes nearly half of all sports wagers placed in the country. This shift is facilitated by widespread smartphone usage and affordable data plans, allowing users to engage with matches in real-time. The market’s maturity is also reflected in the diversification of betting options, with basketball and tennis gaining significant traction alongside the perennial favorite, football.

Looking ahead to 2025, specialist reports project Ghana’s total iGaming revenue to approach $900 million, with sports betting maintaining its large share. The market’s potential for further growth lies in deeper penetration into secondary cities and rural areas, as well as the continued integration of mobile money services like MTN Mobile Money and AirtelTigo Cash for seamless deposits and withdrawals. Ghana’s combination of a stable regulatory framework, high mobile penetration, and a youthful, sports-loving population ensures its place as a top-tier market on the continent.

7. Tanzania

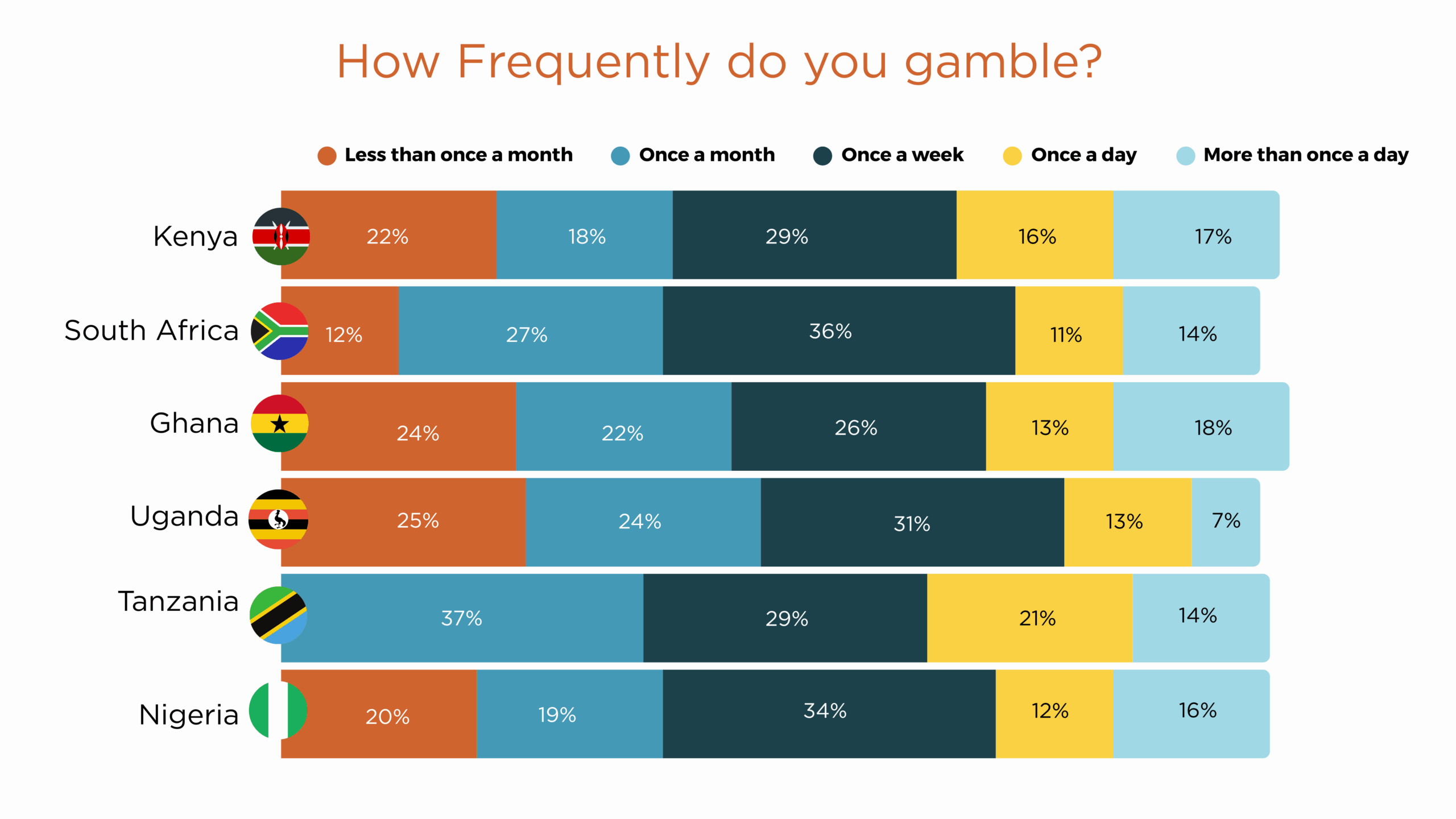

Tanzania represents one of East Africa’s most vibrant sports betting economies, characterized by high participation rates and a rapidly expanding operator presence. The market is driven by a deep-seated passion for football, with the Tanzanian Premier League and major European competitions generating the bulk of betting activity. A 2024 report from Business Insider Africa highlighted that Tanzania boasts one of the highest player-to-population ratios in Africa, with an estimated 35% of the urban adult population having engaged in some form of sports betting. This high engagement is supported by a dense network of retail kiosks in major cities like Dar es Salaam and Mwanza, complemented by a fast-growing mobile betting segment.

Industry summaries from 2024 indicate that the total transactional volume for the Tanzanian sports betting market surpassed $1.5 billion for the year, with Gross Gaming Revenue (GGR) estimated at approximately $400 million. This substantial volume is facilitated by the deep integration of mobile payment systems, notably M-Pesa and Tigo Pesa, which simplify the betting process from deposit to winnings withdrawal. The competitive landscape is intense, with a mix of pan-African giants and local operators investing heavily in sponsorships of local football clubs and celebrity endorsements to capture market share. This has made sports betting a highly visible and accessible part of the daily entertainment landscape.

The Tanzanian government, through its Gaming Board, has been active in regulating the sector, focusing on licensee compliance and consumer protection. While the market is already substantial, its growth trajectory remains strong. The increasing availability of affordable smartphones and data is accelerating the shift from retail to mobile betting, opening up new demographic segments. With a large, young population and a stable regulatory environment, Tanzania is positioned to continue its ascent as a key regional market for both retail and mobile sports betting.

6. Uganda

Uganda stands out for having one of the most active betting populations in Africa relative to its size, fueled by a potent combination of high engagement, affordable stake sizes, and ubiquitous mobile-money integration. Surveys conducted in 2024, as cited by allAfrica.com, revealed that Uganda has participation rates exceeding 40% among urban males aged 18-35, one of the highest concentrations on the continent. The market is characterized by a thriving retail kiosk network that serves as a social hub, but it is the seamless integration with mobile money that truly powers the ecosystem. Services like MTN Mobile Money and Airtel Money are the lifeblood of the industry, enabling instant, low-value deposits and withdrawals that align perfectly with the market’s preference for frequent, small-stake betting.

This high-volume, low-margin model has proven immensely successful. In 2024, Uganda’s sports betting market generated an estimated Gross Gaming Revenue (GGR) of $350 million, a figure that underscores the immense transactional volume flowing through the system. The market is dominated by football betting, with a particular focus on predicting exact scores (jackpot bets) that offer life-changing prizes and capture the public’s imagination. The regulatory framework, overseen by the National Lotteries and Gaming Regulatory Board, has worked to formalize the sector, though challenges related to advertising and problem gambling remain topics of ongoing public and parliamentary debate.

For 2025, Uganda is projected to maintain its position as a top-10 market by revenue and volume. Its growth is now being driven by the increasing sophistication of the user base, with a noticeable trend towards multi-betting and in-play wagering. The deep penetration of mobile money has not only facilitated betting but has also created a digital financial footprint for a large segment of the population, contributing to broader financial inclusion. Uganda’s model demonstrates how a focus on accessibility and micro-transactions can create a disproportionately large and active betting market.

5. Egypt

Egypt possesses one of the largest and most complex gambling markets in Africa, anchored by its massive population of over 110 million and a powerful cultural affinity for football. While religious restrictions mean that most forms of gambling are prohibited for the Muslim majority, a regulated, land-based sector exists primarily to serve tourists and the non-Muslim population through venues in Cairo, Alexandria, and the Red Sea resorts. However, the broader market, particularly online sports betting, is substantial. Independent market estimates in 2024 placed the total value of Egypt’s broader gambling market close to $900 million, with sports betting representing the dominant segment due to its accessibility via international online bookmakers.

This creates a unique market dynamic where a significant portion of the volume is generated through offshore, online platforms that are widely accessed using international payment methods and VPNs. The demand is undeniable, driven by the country’s fanatical support for clubs like Al Ahly and Zamalek, as well as the English Premier League. The government’s approach has been one of tacit tolerance towards online betting on international sites, focusing its regulatory efforts on the licensed land-based casinos that contribute to tourism revenue. This has allowed a vast, partially regulated online market to flourish, making Egypt a key target for international sportsbooks despite the official restrictions.

Projections for 2025 suggest the market will continue its rapid growth, potentially exceeding $950 million in total value. The key drivers are the increasing digital literacy among the youth, the proliferation of sports content on satellite TV and streaming services, and the continuous improvement of internet infrastructure. While the regulatory future remains uncertain, the sheer scale of Egypt’s population and its profound passion for sports guarantee that it will remain a heavyweight in the African betting landscape, representing a immense, if challenging, opportunity for the global industry.

4. Kenya

Kenya is the archetypal African mobile-first betting market and remains an economic powerhouse in the continental industry. The symbiotic relationship between sports betting and the M-Pesa mobile money platform has created a uniquely efficient ecosystem for placing wagers and receiving payouts. This has led to remarkably high per-capita activity. Industry reports from Slotegrator’s 2024 analysis confirm that the Kenyan gambling market was valued in the range of $0.8–0.9 billion, with sports betting responsible for an estimated 80-85% of this activity. The market is characterized by a high frequency of betting, with many users engaging in daily, low-stake wagers, particularly on virtual sports and in-play football markets.

The maturity of the Kenyan market is evident in its sophisticated user base and intense operator competition. Beyond M-Pesa’s dominance, other factors driving growth include a dense retail network of betting shops that serve as community fixtures and the widespread adoption of sophisticated products like live, in-play betting. However, the market has also faced headwinds. The government’s imposition of a 20% excise tax on betting stakes in 2024 led to operator protests and a temporary contraction, demonstrating the market’s sensitivity to regulatory and fiscal policy. Despite this, consumer demand has proven resilient, underscoring the deep integration of betting into the nation’s leisure activities.

For 2025, Kenya is expected to maintain its top-five position through a combination of market consolidation and product innovation. Operators are increasingly focusing on customer retention through personalized offers and loyalty programs, as the era of explosive user growth begins to plateau. The focus is shifting towards maximizing value from the existing, highly engaged user base. Kenya’s journey offers a blueprint for other mobile-led markets but also a cautionary tale about the challenges of operating in a maturing and increasingly regulated environment.

2. South Africa

South Africa’s gambling market is the most mature, diverse, and highly regulated on the African continent. While the national figures from the National Gambling Board include massive revenue from casinos, lotteries, and limited-payout machines, the sports betting segment is substantial and thriving. Data from the Department of Trade, Industry and Competition for the 2024/25 financial year shows that the total gross gambling revenue (GGR) for South Africa was approximately ZAR 38 billion (roughly $2.05 billion). Within this, the sports betting sector contributed over ZAR 5.5 billion (approx. $300 million) in GGR, showcasing a large, dedicated, and highly monetized segment.

The South African market benefits from a robust regulatory framework, advanced infrastructure, and higher disposable incomes compared to most other African nations. Betting is a mainstream activity, with a strong culture of wagering on rugby, cricket, and horse racing in addition to football. The market is split between a well-established network of retail betting outlets and a rapidly growing online and app-based sector, which now accounts for the majority of new growth. Licensed operators offer a sophisticated product range, including extensive in-play markets and advanced betting features, catering to a knowledgeable and demanding customer base.

South Africa’s position near the top of the rankings is secured not by the sheer volume of bettors, as in Nigeria, but by the high average spend per customer and the overall maturity of the gambling ecosystem. The market is characterized by stability and high barriers to entry, ensuring that only compliant, well-capitalized operators can thrive. With a continued consumer shift towards digital platforms and the introduction of new, innovative betting products, South Africa’s sports betting industry is poised for steady, sustainable growth, solidifying its status as the continent’s most advanced and monetized market.

1. Nigeria

Nigeria is the undisputed leader of Africa’s sports betting industry, a behemoth that dwarfs all other national markets in terms of both revenue and the number of active participants. The market’s scale is a function of Nigeria’s large population, a massive youth demographic, high mobile phone penetration, and an insatiable appetite for European football. According to a widely cited projection in iGaming Today’s 2025 Africa Forecast, Nigeria’s total gambling market is expected to reach a staggering $3.6 billion in value for 2025, with sports betting driving the vast majority of this figure. This represents a significant portion of the entire continent’s betting activity.

The Nigerian ecosystem is a whirlwind of intense competition and innovation. A “thick retail network” of thousands of physical betting shops across every city and town provides widespread access, but the real engine of growth is mobile betting. Operators leverage sophisticated digital marketing, celebrity endorsements, and aggressive bonus structures to acquire customers in a fiercely competitive landscape. The deep integration of local payment methods, including bank transfers and a plethora of mobile money options, removes friction from the betting process, enabling the high-volume, frequent wagering that characterizes the market. The most popular products remain pre-match and in-play football betting, though virtual sports and casino products are growing rapidly.

Nigeria’s dominance is set to continue for the foreseeable future. The market’s sheer size and growth trajectory make it the primary focus for any international operator seeking a presence in Africa. However, this rapid expansion has also attracted increased regulatory scrutiny, with the National Lottery Regulatory Commission (NLRC) focusing on operator compliance, advertising standards, and responsible gambling measures. Navigating this complex and dynamic environment is key, but there is no doubt that Nigeria will remain the continent’s betting powerhouse for years to come.

We welcome your feedback. Kindly direct any comments or observations regarding this article to our Editor-in-Chief at [email protected], with a copy to [email protected].

https://www.africanexponent.com/top-10-african-countries-with-largest-sports-betting-market-in-africa-2025/