In Summary

- China has emerged as a major source of financing for African nations, with loan commitments reaching $182.28 billion between 2000 and 2023.

- By 2020, Chinese lenders accounted for roughly 12% of Africa’s total external debt, which had grown to $696 billion.

- Since independence, African nations have experienced a significant rise in loan debts, with total external debt estimated at $1.1 trillion in 2022.

Deep Dive!!

Since gaining independence, many African countries have faced significant financial challenges tied to external debt. In the past, sovereign debt defaults was once a rare term, but today, it has become more frequent due to global shocks, mismanagement, political instability, and weak economic structures.

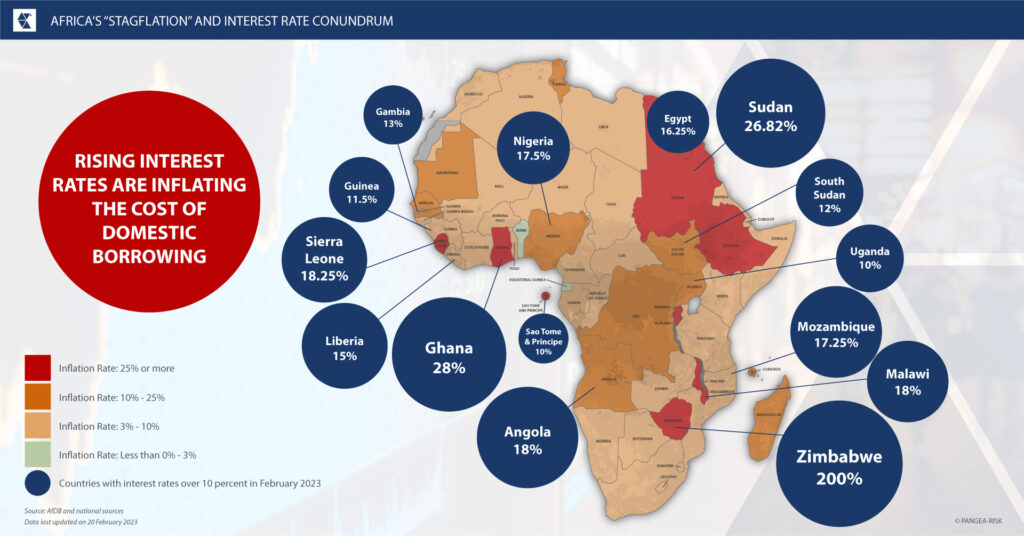

Since gaining independence, foreign debts and debt sustainability remain a major concern as African governments grapple with rising interest payments, inflation, currency devaluation, and dwindling foreign reserves.

This debt burden has been exacerbated by factors like global economic shocks (like financial crisis, COVID-19, war in Ukraine, etc.) and structural weaknesses within African economies. The composition of debt has also shifted, with commercial debt increasing its share while bilateral debt has decreased.

In this article, we examine the Top 10 African countries that have defaulted on their sovereign debt since independence, highlighting the historical context, causes, and consequences of each default. Understanding these cases provides critical insights into Africa’s financial landscape and the ongoing efforts toward economic stability and responsible borrowing.

10. Burkina Faso / Mali (Post-2020)

Coups and international sanctions from the United Nations, ECOWAS, and the European Union led to suspended debt payments by Burkina Faso and Mali. Their default represents the emerging fragility-risk countries defaulting due to governance shocks. However, payments resumed after sanctions were eased.

9. Cameroon (2004, 2007)

Cameroon defaulted twice on servicing its foreign debt in 2004 and 2007 due to pre-HIPC debt distress. However, it restructured its $480 million bond and exited default via successful forgiveness deals.

8. Niger (2023)

The military coup in the West African country, leading to a highly publicized sanction by the ECOWAS caused Niger Republic to miss the repayment of a $51M Eurobond in 2023. The impact resulted in regional isolation and frozen assets. To date, the country’s debt resolution remains uncertain.

7. Zimbabwe (2000s–present)

Due to hyperinflation, political misrule, and currency collapse, Zimbabwe has stopped servicing its foreign debt obligations since the early 2000s. The default has resulted in public service collapse and economic instability.

6. Sudan (2002, 2022)

Sudan defaulted on its debt repayment obligation in 2002 and 2022 due to internal conflict and international sanctions. The sanctions have led to the country’s inability to repay its approximately $22.1 billion Paris Club debt. The situation has led to poor economic restructuring tied to stalled peace and political transition.

5. Côte d’Ivoire (2011)

Post-election crisis in Cote d’Ivoire in 2011 led to the country missing a $29 million Eurobond interest payment. However, the country issued a $2.3 billion restructured bond and restored investor confidence quickly.

4. Mozambique (2016)

In 2016, the revelation of a $2 billion hidden loans scandal caused the IMF to blacklist and suspend Mozambique, plunging the country into a debt crisis. The country went into a debt-to-GDP surge amounting to approximately 101%, but restructuring was achieved in 2019.

3. Ethiopia (2023)

Ethiopia missed a $33 million repayment coupon on its $1 billion Eurobond post-civil war and reserve drain. However, to curb the effects, the company joined the G20 Common Framework, and restructuring is currently ongoing.

2. Ghana (2022)

In 2022, Ghana halted its $28.4 billion external debt servicing due to economic collapse. However, the country has brokered an IMF bailout, with approximately 70%+ of its revenue going to debt servicing.

1. Zambia (2020)

Zambia recorded the first COVID-era African default and missed a €42.5 million Eurobond payment. The country’s debt-to-GDP debt profile ballooned to 140% due to infrastructure and pandemic costs. In 2024, the country brokered its first successful restructuring under the G20/IMF Common Framework.

https://www.africanexponent.com/top-10-african-countries-that-have-defaulted-on-debt-repayment-since-independence/