Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

It’s that magical time of the year again, when we once again worry that the broken US political system will result in the unnecessary sovereign default of the world’s premier reserve asset and usher in financial Ragnarok.

The US budget sausage-making has been overshadowed by the tariff shenanigans, but Treasury secretary Scott Bessent earlier this week helpfully reminded people that his department would soon also have a firm-ish date for when the US government will run out of money.

From Politico on Tuesday:

Bessent said Treasury was still tallying the massive influx of federal tax receipts that came in around the April 15 filing deadline as it works to come up with a more precise forecast for when the U.S. will exhaust its borrowing capacity — known as the X-date.

The date is widely seen as a de facto deadline for congressional Republicans to pass their megabill of tax, border and energy policies because GOP leaders have included a debt limit hike as part of the party-line package, avoiding the need for Democratic votes.

Bessent previously said that he would update Congress on the X-date in the first half of May. He said Tuesday that estimate would be “forthcoming.”

“Just as an outfielder running for a fly ball, we are on the warning track,” Bessent said during testimony before a House appropriations subcommittee Tuesday. “And when you’re on the warning track, it means the wall’s not far away.”

. . . yay . . .

Although the chances of the US government haphazardly defaulting on its debts is still vanishingly small, the price of credit default swaps on Treasuries has climbed markedly in recent weeks.

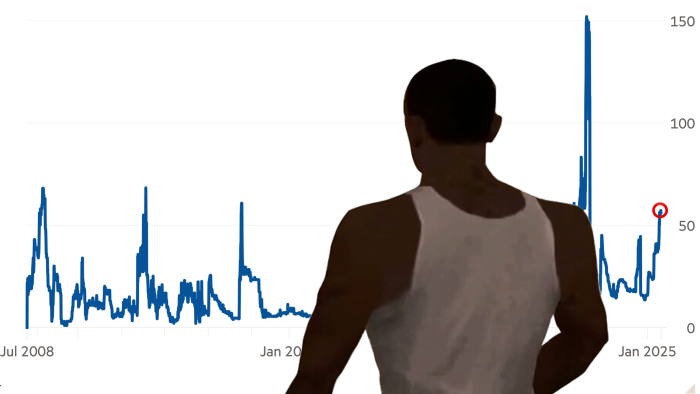

Here’s a long-term price chart of one-year US CDS prices. You can probably spot the previous debt ceiling shenanigans.

As you can see, we haven’t yet hit the fear level that we did in 2023 — when then-Treasury secretary Janet Yellen warned of “bedlam” if the debt ceiling wasn’t increased — but this is already comparable to previous low-key freak-outs. And the X-date is still probably months away.

There are several other signs that at least some investors are beginning to take the risk of the US defaulting semi-seriously. According to Barclays, the outstanding volume of CDS on US debt has climbed by almost $1bn this year, to $3.9bn . . .

. . . and US CDS trading volumes have also picked up notably this year (the spike in trading volumes around the US presidential election is interesting).

In fact, over the past three months, US CDS have been the 12th most actively traded single-name CDS contract in the world.

So what kind of implied odds on default does this equate to? Well, the calculation is made a little tricky by the fact that the price of the cheapest-to-deliver bonds has obviously varied quite a bit over the years. For example, in May 2023 it was $56 and today it is about $48.

Overall, the current prices of the CDS and the relevant Treasury bond implies a default probability of just above 1 per cent, according to Barclays. On the other hand, the low cheapest-to-deliver bond price means that the payout ratio is MUCH higher today, at about 80 times.

Ker-CHING.

Further reading:

— JPMorgan’s US debt default Q&A (FTAV)

https://www.ft.com/content/0705aa9d-bfa4-4814-ad7a-66bbc64d1b8b