Stay informed with free updates

Simply sign up to the Global Economy myFT Digest — delivered directly to your inbox.

It definitely doesn’t feel like it, but this is an era of remarkable economic tranquility. In fact, the degree of stability in the global economy is probably unprecedented.

Don’t take our word for it. Here’s a chart (via Toby) showing the 20-year rolling standard deviations of US economic growth, going all the way back to the beginning of the 19th century:

Sure, different countries will show subtly different things. In some countries it might look very different. But the US is reasonably representative of a broader trend in the global economy.

Despite how turbulent things often feel, the economy is a lot steadier now than it used to be, with even major events — such as the financial crisis of 2008 and Covid-19 and its inflationary aftermath — only causing modest, shortlived upticks in economic turbulence. At least compared to the upheavals that we’ve seen throughout history.

However, there’s plenty of volatility elsewhere.

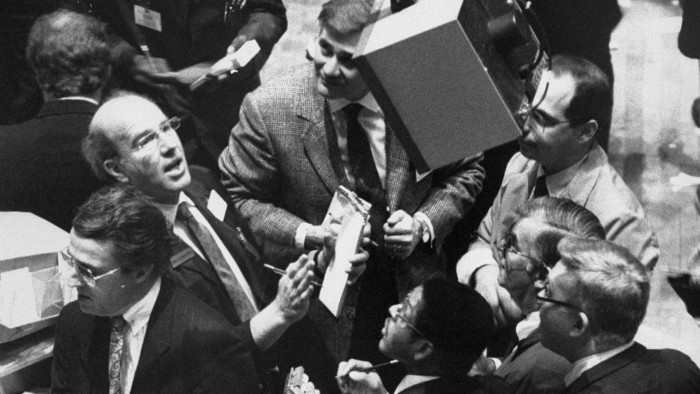

This chart — from data supplied by Deutsche Bank — shows all the times US stock market volatility has suddenly jumped by 1.5 standard deviations or more. As you can see, bursts of volatility like this were fairly rare for half a century, but have since the 1990s become both more common and more violent.

In the 50 years after WWII, US equities suffered 13 of these volatility spikes, and the average realised volatility of those episodes was 34.2 (and that includes the record jump in volatility on 1987’s Black Monday). In the 30 subsequent years there have been 16 volatility spikes, with the vol peaks averaging 43.

That we seem to be suffering more sudden shocks isn’t a new observation. Not even remotely. But it’s worth highlighting how recent events underscore how it remains true.

A lot of people attributed the volatility of volatility to the zero-interest-rate-policy era, but as April’s tumult shows — if the events of the 1990s and 2000s didn’t do a good enough job — that this was always a facile take.

Volatility was indeed lower on average in the ZIRP era. The Vix index — which measures the near-term volatility implied by options prices, as opposed to actual realised volatility — averaged just under 17 in 2010-2019, compared to its long-run average of a shade below 20.

But even since 2020 the Vix has only averaged 21.35, pretty close to the average since its 1992 inception. This despite three fairly major stock market upheavals since then. In other words, we’re in an era of lower average volatility, but more sudden and ferocious shocks when then calmness does shatter.

So why are financial markets more prone to sudden shocks, when the economy is seemingly much more stable than it was in the past?

Deutsche Bank’s Jim Reid has argued that it is a combination of the post 1970s fiat currency regime, financial market liberalisation, and persistently rising debt levels. This has birthed financial system that he thinks is more vulnerable to frequent disruption but also capable of engineering strong recoveries — with one major caveat:

The catch, however, is that each recovery starts with a larger debt overhang than the last, sowing the seeds for the next crisis. It’s a self-reinforcing boom/bust cycle.

While the recent Liberation Day episode differs somewhat from traditional shocks, you could argue that the same trends we identified have encouraged the imbalanced global trading system that prompted the tariff shock. In addition the reversal to the Liberation Day policy and subsequent strong bounce in markets was likely sparked by concerns around the amount of debt the US now has and the impact the policy was having on bond markets.

Overall, I continue to believe that volatility shocks and mini-crises are hardwired into today’s financial architecture. Over the past few decades, we’ve typically solved each crisis with more leverage or aggressive monetary policy. But with inflation and yields now higher than they’ve been for most of this period — and with growing concerns around fiscal sustainability — we may be far nearer to the end of this era than the beginning.

Perhaps. FT Alphaville favours more technical explanations, such as the explosive rise in derivatives-powered leverage across financial markets; how a volatility feedback loop has been embedded by the widespread use of VAR models and volatility-targeting strategies; and the evolving nature of liquidity in the modern era of high-frequency trading. Your theories go in the comments.

Further reading:

— How a volatility virus infected Wall Street (FT)

https://www.ft.com/content/16feefb7-e968-4531-8d96-ca4d7cded330