Stay informed with free updates

Simply sign up to the Capital markets myFT Digest — delivered directly to your inbox.

Last month, MainFT reported that — after eyeing Europe meaningfully for a while — Citadel Securities had finally set up a Eurozone government bond trading team in Paris and was getting stuck into Bunds to begin with.

The reaction was about as acerbic as you’d expect. It’s no secret that a lot of Europeans are instinctively wary of American high-frequency traders (they’re not always popular stateside either, of course). And European banks are not keen on the idea.

Which is why this blog post from the European Stability Mechanism was so interesting. It’s so positive on electronic bond trading that Ken Griffin himself could have written it:

Electronic trading plays a crucial role in ESM and EFSF bond markets, accounting for a majority of the traded volumes and enhancing liquidity in the secondary markets by improving price discovery and making primary market transactions more efficient, especially in challenging market conditions. These advantages allow the ESM to issue bonds more effectively, benefitting its mission to support euro area financial stability.

The ESM is the permanent successor to the European Financial Stability Facility, which was set up to help rescue various stricken Eurozone members back in the day. To finance its various loans to the likes of Greece it issued bonds, which occasionally have to be refinanced. This year the EFSF/ESM will have issued about €26bn.

These bonds are — to Mario Draghi’s regret — one of the closest things Europe has to true “eurobonds” backed by the entire region. The ESM therefore takes an interest in how the European bond market is evolving, and asked two of its analysts, Marko Mravlak and Ioannis Vazouras, to examine the impact of electronic trading.

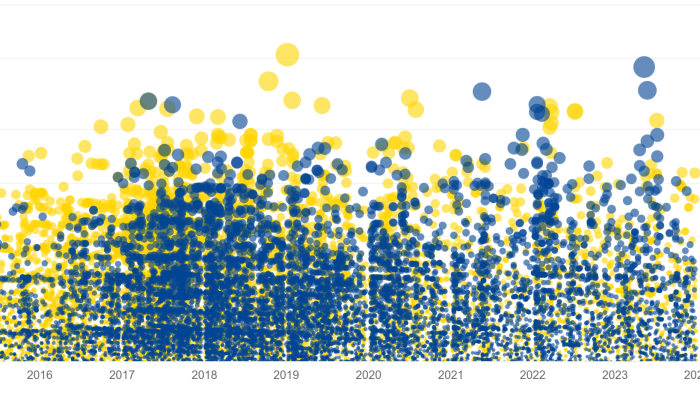

Their main (unsurprising) finding is that it a big deal. The ESM’s data on €1.2tn of trades in its own bonds indicate that the share of electronic trading has climbed from about 40 per cent to 60 per cent over the past decade. In number of trades it has climbed from 55 per cent to 80 per cent.

As you’d expect, smaller trades are particularly electronic, but there’s been a sharp increase in large €50mn-plus trades also happening electronically. Less than half of these happen by voice.

As Mravlak and Vazouras write:

This shift in trading practices suggests that investors now have access to markets of comparable depth on electronic and voice platforms, both in terms of bonds traded and in the participation of other investors. Balanced access to diverse trading methods is necessary as it equips buyers and sellers with broader ways to transact in volatile markets and demonstrates that activity is not merely shifting from voice to electronic platforms, but that both options offer access to similar levels of liquidity across securities and investors. Consequently, electronic trading can now serve as a strategic complement to voice trading, even for high-risk transactions.

OK, OK — but don’t these ultrafast electronic market-makers all conveniently disappear when markets are a bit pukey? Not true, according to the ESM analysts! Or certainly not entirely true.

They looked at what happened with electronic trading volumes when bond market volatility was extreme, such as when Covid-19 sent markets into a tailspin, when the Fed jacked up interest rates in 2022 and the chaos caused by the collapse of Silicon Valley Bank in 2023.

The conclusion was that electronic trading volumes declined by up to 10 per cent of days when bond market volatility hit the 99th percentile, but returned to normal within days. Mravlak and Vazouras concluded:

A well-balanced secondary market that blends traditional voice trading with modern electronic platforms providing market participants comparable liquidity levels supports efficient market functioning, particularly during periods of high volatility. The continued high proportion of electronic trading that we have seen during the Covid-19 market shock and other recent increases in market volatility may explain why ESM and EFSF bond markets have remained active and resilient during these events, thereby contributing to the stability of the euro area financial system.

There are some obvious caveats and nuances, such as the fact that banks also obviously trade bonds electronically. And not all electronic trading is fully algorithmic. But the shift is pretty hard to ignore, and it’s interesting that at least some people in Europe are willing to say it might actually be positive.

Further reading:

— The limits of bond market electronification (FTAV)

— When light floods Europe’s bond market (FTAV)

https://www.ft.com/content/78851a71-c3be-40cb-91ca-95dd9f5a1e0b