Key Takeaways:

- Traditional banking methods join digital payment systems.

- New processes reduce friction and simplify crypto transactions.

- Enhanced security and clear rules boost user confidence.

- This approach may widen access in underserved areas.

Although Bitcoin (BTC) has long been perceived as a store of value, analysts in 2024 predicted that its next major use case could emerge in the form of payments, driven by shifting regulations and increasing infrastructure support.

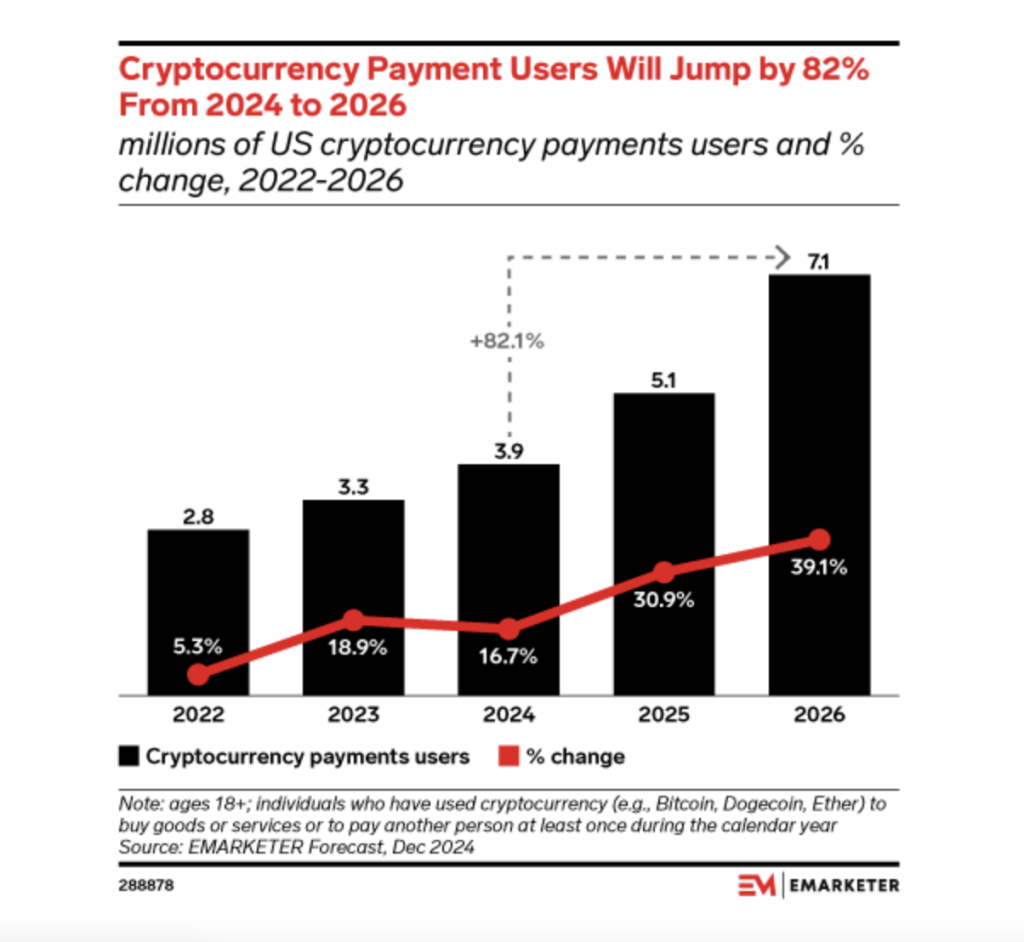

According to EMARKETER, crypto payment adoption was expected to grow by 82.1% over two years beginning in 2024, supported by friendlier regulations and expanding payment provider networks.

A Bitget Wallet report also highlighted security concerns as the biggest barrier to crypto payment adoption.

The report, which surveyed 4,599 users, found that over 37% of respondents considered security risks the main obstacle to using cryptocurrency for payments.

Other concerns included irreversible transactions and a lack of legal protection.

Simplifying Crypto Payments With Traditional Platforms

In response to ongoing security and usability issues, some platforms have started to streamline the crypto payment process to encourage broader usage.

Bakhrom Saydulloev, a product lead at payments infrastructure firm Mercuryo, told Cryptonews that crypto payments had shown consistent growth despite wider market fluctuations.

“The data supports this outlook, as Mercuryo is observing steady growth in payment volumes across our ecosystem despite broader market fluctuations,” said Saydulloev.

Saydulloev noted that user experience remains a major hurdle.

“Many products remain unnecessarily complex, fostering friction at every step from account opening to completing transactions,” he remarked. “Beyond these issues, users simply want what they expect from any payment system: low costs, speed, and safety.”

Saydulloev noted that Mercuryo had begun integrating traditional payment methods to address these issues.

For example, the company partnered with Revolut Pay, a mainstream online payment platform, to make buying and selling crypto more accessible.

“Revolut Pay simplifies buying crypto assets to a single click,” Saydulloev said. “The platform also has reinforced security features, including biometric technology and passcodes that secure the crypto purchasing process for users.”

Crypto exchange CEX.IO has also adopted traditional methods to simplify crypto transactions. Alexander Kerya, vice president of product management at CEX.IO, said the platform recently integrated with MoneyGram to support cash-in and cash-out services for USDC.

“This integration facilitates crypto cash-in and cash-out services, enabling seamless conversion of Circle’s USDC stablecoin into physical cash and vice versa,” Kerya said.

Kerya added that he believes the growing collaboration between traditional finance (TradFi) and crypto services is gradually blurring the lines between these two industries.

Regulatory Support for Crypto Payment Adoption

These platform efforts coincide with evolving regulatory frameworks that support safer adoption.

Bitget Wallet’s report shows that 27% of investors are worried about the lack of legal protection. This signals the need for better safeguards and regulatory clarity around crypto payments.

Saydulloev highlighted regulatory progress in the EU and UK. Frameworks such as the Markets in Crypto-Assets Regulation (MiCA) now allow credit institutions to issue crypto assets under their existing banking licenses.

“Rather than hindering innovation, these regulations create essential trust by establishing consistent rules and protections, which are prerequisites for wider adoption,” Saydulloev commented.

Coinbase has also focused on easing friction around crypto payments, particularly stablecoins. A company spokesperson noted that free USDC transfers and fiat onramps make it easier for users to send and receive crypto.

Coinbase’s layer-2 network, Base, also allows near-instant crypto transactions with very low fees.

Statistics from CoinGate, a payment platform, show that stablecoins are becoming a preferred method for crypto payments.

In 2024, stablecoins accounted for 35.5% of transactions on the platform, with USDT making up 97.2% of those, followed by USDC at 2.5% and DAI at 0.3%.

Global Demand for Faster, Accessible Crypto Payments

While adoption in developed regions remains gradual, crypto payments are gaining traction in emerging markets with limited banking access.

Bitget Wallet’s data showed that 46% of users prefer crypto payments over fiat due to speed and efficiency.

Interest was particularly strong in Africa and Southeast Asia, where 52% and 51% of respondents, respectively, expressed interest in using crypto for payments.

Rich Rine, an initial contributor at Core DAO, told Cryptonews that in developing regions, crypto is more than just an alternative—it’s often the first access to financial infrastructure.

“In regions with large unbanked or underbanked populations, crypto payments are a 0 to 1 leap in trust and access,” Rine said. “It’s not about replacing a legacy system; it’s about gaining access to a system in the first place.”

Rine added that for adoption to grow in the US and Europe, payment solutions must compete with existing systems that offer fraud protection and chargebacks.

“This likely requires clearer regulatory frameworks – especially around stablecoins – and tighter integration between TradFi and decentralized finance (DeFi),” he said.

For example, he suggested that banks could offer fraud protection and chargeback services on top of stablecoin rails, helping users benefit from fast infrastructure without sacrificing security.

Beyond security and infrastructure, financial incentives may also shape the future of crypto-based transactions.

“This adds complexity, but also introduces the idea that payments themselves could become productive, not just functional,” he said.

Building Trust and Access

The drive to simplify crypto payments speaks to a deeper call for secure and inclusive financial services.

Traditional banks and digital providers now work side by side to build systems that users can rely on.

Their combined focus on safety and usability has the power to expand access for those left behind by older models. This collaboration opens new doors for trust and participation in financial affairs.

Think about how this blend of old and new might expand opportunities for you and your community.

Frequently Asked Questions (FAQs)

Integrating established banking methods with digital assets offers a smoother transaction experience. This approach combines secure, familiar processes with quicker crypto transfers, lowering hurdles for daily payments.

A streamlined process reduces transaction friction for both merchants and consumers. By integrating secure, known banking practices, it provides faster service and ease of use, promoting smoother digital trade.

Regulators and industry players must establish clear, consistent rules that merge secure traditional practices with modern digital tools. This cooperative effort fosters trust and promotes broader user confidence.

The post Simplifying Crypto Payments Using TradFi Will Drive Adoption appeared first on Cryptonews.

https://cryptonews.com/news/simplifying-crypto-payments-using-tradfi-will-drive-adoption/