Joseph Lubin-backed SharpLink Gaming, Inc. (Nasdaq: SBET), the world’s largest corporate holder of Ethereum, reported a major expansion in its crypto treasury holdings for the week of July 14 to July 20, 2025.

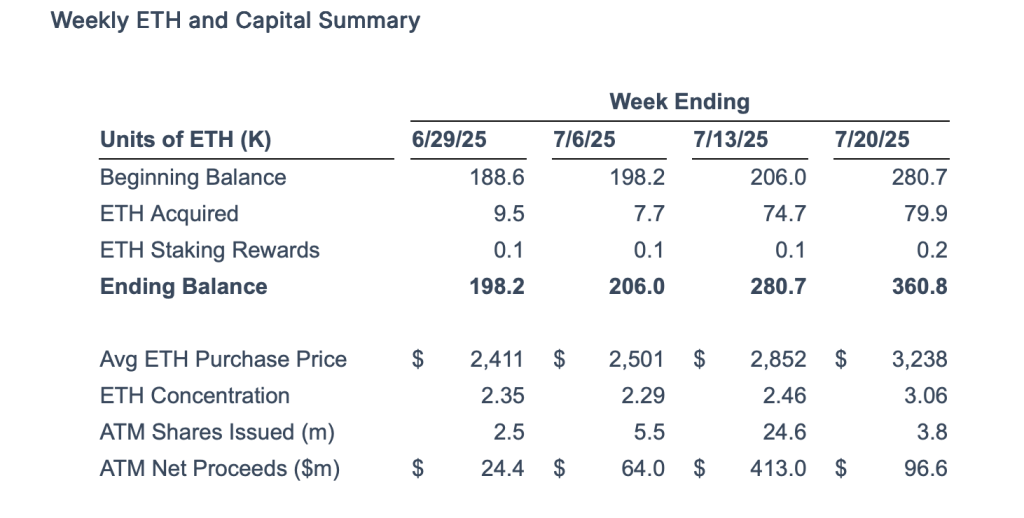

The company’s ETH balance rose to 360,807 ETH, reflecting a 29% increase from the previous week. This growth was driven by the purchase of 79,949 ETH—the largest weekly acquisition in the company’s history. The average purchase price for the week was $3,238 per ETH.

SharpLink’s ETH concentration, which measures the ratio of ETH holdings to total capital, rose to 3.06—up 53% since the company launched its digital treasury strategy on June 2.

Since initiating this approach, SharpLink reports it has earned 567 ETH through staking rewards. Despite this accelerated buildup, the company still holds $96.6 million in unused net proceeds from its At-The-Market (ATM) facility, set aside for additional ETH purchases.

Chairman Joseph Lubin, who also serves as co-founder of Ethereum and CEO of Consensys, notes the company’s methodical approach.

“We continue to strategically leverage our ATM facility to build our ETH treasury in pursuit of our long-term growth objectives,” Lubin states.

“The continued strength of ETH and our ability to acquire large volumes at opportunistic prices support our aim to continue enhancing ETH concentration and shareholder value through disciplined execution of our treasury growth strategies,” adds Lubin.

“It’s looking good for Ethereum. Serious financial actors and even nation states are recognizing the value of a platform that has been running nonstop for over a decade,” said Lubin in a recent interview posted on SharpLink’s X page.

Support for the Genius Act and Regulatory Progress

SharpLink also expressed strong support for the recent signing of the Genius Act into law by President Donald J. Trump. The newly passed legislation offers a regulatory framework for digital assets and smart contracts in the United States, a development the company views as essential for future blockchain innovation.

For firms like SharpLink, the law offers clarity on compliance and lays the foundation for broader institutional adoption. Lubin explains how this regulatory clarity strengthens the company’s strategy.

“With the Genius Act now law, the regulatory uncertainty that has surrounded crypto innovation is finally easing. We believe this ushers in a more supportive environment for companies like SharpLink to not only operate and grow, but also to harness the full potential of Ethereum,” he said.

$SBET Price Action

SharpLink showed signs of recovery, rising 10.6% to $27.94, suggesting renewed interest possibly driven by recent updates to the company’s ETH treasury strategy.

The current market cap stands at $2.6 billion, and while key metrics such as P/E ratio and dividend yield are not disclosed, the stock remains well above its 52-week low of $2.26.

As the digital asset sector gains momentum, SharpLink is positioning itself as a long-term leader within the Ethereum ecosystem.

By prioritizing ETH in its treasury model and earning through staking, the company demonstrates strong conviction in Ethereum’s future. Its combination of treasury execution, legislative support, and blockchain integration reinforces SharpLink’s vision to play a lasting role in the next phase of digital finance.

The post SharpLink ETH Bet Deepens: 80K Coins Bought, 567 Earned, Stock Jumps 10% appeared first on Cryptonews.

https://cryptonews.com/news/sharplinks-eth-holdings-reach-360807-with-567-eth-earned-from-staking/