U.S. wholesale inflation unexpectedly declined in August, setting the stage for a Federal Reserve rate cut next week and sending Bitcoin higher as traders bet on looser monetary policy.

The Producer Price Index (PPI) for final demand slipped 0.1% in August, the first monthly drop in four months, following a downwardly revised 0.7% increase in July, according to data released Wednesday by the Bureau of Labor Statistics.

Weak PPI, Fragile Jobs Market Put Fed Under Pressure Ahead of Key Meeting

Economists had forecast a 0.3% increase. On an annual basis, the PPI rose 2.6%, well below the 3.3% expected and down from July’s 3.1%.

Core PPI, which strips out volatile food, energy, and trade services, also softened. It increased 2.8% year-on-year, compared with the 3.5% expected, while the monthly measure edged down 0.1%.

The decline was driven by a 0.2% fall in services prices, the steepest since April, while goods prices inched higher by 0.1%.

The weaker-than-expected inflation print reinforced market expectations that the Federal Reserve will cut interest rates when it meets next Wednesday.

Futures markets are fully pricing in a quarter-point cut, with growing speculation that policymakers could opt for a larger 50-basis-point reduction.

The central bank paused its easing cycle in January amid uncertainty over the impact of President Donald Trump’s tariffs, but softening inflation and a weakening labor market have shifted the balance toward renewed stimulus.

The labor market has shown clear signs of strain. Government revisions published this week estimated the economy created 911,000 fewer jobs in the year through March than previously reported.

The August jobs report showed employment growth had nearly stalled, with job losses recorded in June for the first time in more than four years.

President Trump has continued to pressure the Fed for aggressive easing. In a post on Wednesday, he declared, “JUST OUT: NO INFLATION!!! TOO LATE. MUST LOWER THE RATE, BIG, RIGHT NOW. POWELL IS A TOTAL DISASTER, WHO DOESN’T HAVE A CLUE!!!”

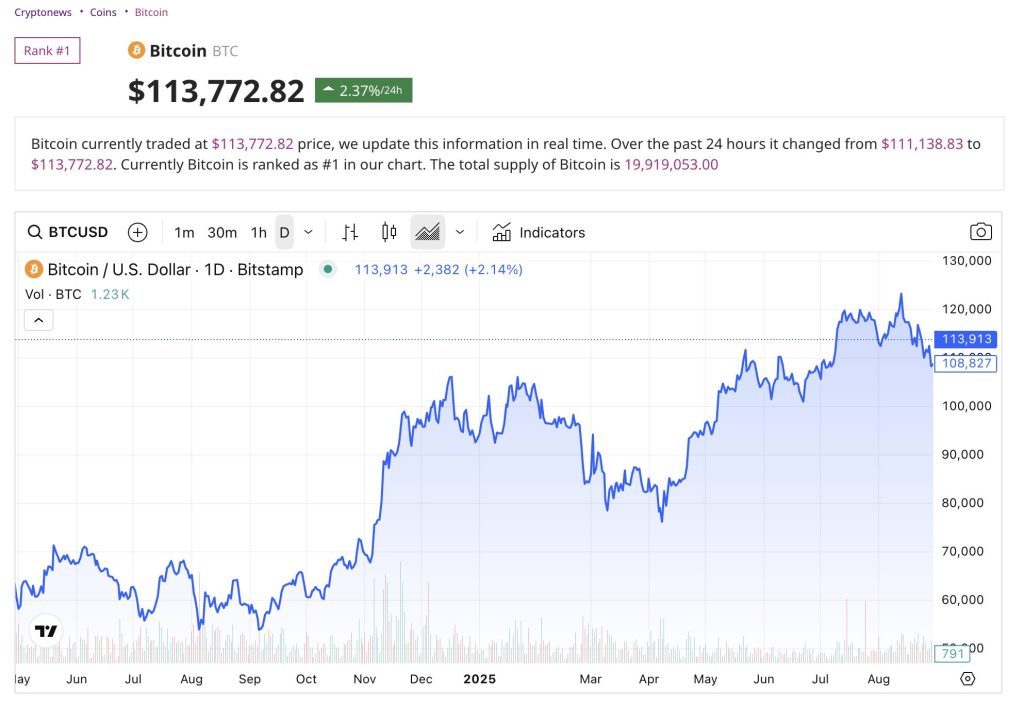

Financial markets responded swiftly to the inflation surprise. Bitcoin surged past the $113,000 mark following the data release, extending gains from an intraday low of $110,700.

The world’s largest cryptocurrency is now trading around $113,913, marking a 2.37% increase over 24 hours and a 2.4% gain in the past two weeks.

Traders are eyeing the prospect of further upside, with some forecasting a move toward the $150,000 level if rate cuts accelerate.

Bitcoin reached an all-time high of $124,128 a few months back and currently trades about 8.4% below that peak. Analysts note that a decisive shift in Fed policy could fuel another rally by weakening the dollar and improving liquidity across risk assets.

Attention now turns to the Consumer Price Index (CPI), due Thursday, which will provide the final major data point before the Fed’s policy meeting.

The combination of easing inflation pressures and labor market fragility is expected to weigh heavily on deliberations.

Fed Chair Jerome Powell has already signaled that risks to employment may outweigh inflation concerns, suggesting the central bank is preparing to act.

CME FedWatch Shows 88% Odds of September Cut

Federal Reserve Chair Jerome Powell said a quarter-point rate cut in September is “highly likely,” offering the clearest sign yet of near-term easing.

Speaking at the Jackson Hole symposium on August 22, Powell acknowledged cooling inflation but warned against assuming a rapid series of cuts, stressing that policy remains “data-dependent.”

He pointed to risks from tariff-driven price pressures and weakening labor market conditions.

July payrolls rose by just 73,000, with earlier figures revised lower, underscoring the Fed’s balancing act between inflation control and economic growth.

Markets reacted with caution. U.S. equities pared early gains, and crypto assets swung in volatile trade as investors weighed the prospect of easing against the possibility of slower liquidity improvements.

The CME FedWatch Tool now shows an 88% probability of a 25-basis-point cut at the September 17 meeting, with major banks including Morgan Stanley and Barclays revising forecasts to reflect imminent easing.

Treasury Secretary Scott Bessent last month urged a steeper 50-basis-point move after inflation data showed core CPI cooling to 3.1% annually.

Crypto markets are positioning for extended rallies. Bitcoin climbed above $113,000 this week, with traders eyeing a potential run toward $150,000 if liquidity improves.

Crypto.com CEO Kris Marszalek told Bloomberg he expects a strong fourth quarter for digital assets if easing begins, citing improved liquidity and institutional adoption.

Bitcoin Accumulation Hits Record as Futures Market Weakens

Bitcoin long-term holders are stepping up their activity even as futures market dynamics signal caution.

According to CryptoQuant, “accumulator addresses,” wallets that buy Bitcoin but never sell, now hold a record 266,000 BTC as of September 5.

These wallets are often linked to long-term conviction investors, underlining confidence in Bitcoin’s role as a store of value amid growing corporate treasury adoption.

Yet technical and on-chain signals point to a critical juncture. Analysts say Bitcoin is sitting on a multi-year ascending trendline that aligns with the “New Whales Realized Price,” creating a powerful support zone.

Holding above this level would preserve the bullish structure, but a break lower could trigger a deep correction. Bearish divergences on RSI and MACD already suggest weakening momentum.

The futures market adds further pressure. Whale participation has declined, with smaller traders driving volume. CryptoQuant notes that futures taker sell pressure has outpaced buys, reflecting bearish sentiment. Unless institutional demand returns, Bitcoin risks remaining range-bound or drifting lower.

On lower time frames, traders are watching volume profile levels. Analyst Dieguito’s chart highlights $114,000 as the Value Area High.

Sustaining above this level could push the price toward $117,600, the point of control. Conversely, failure to hold $111,950 (Value Area Low) may accelerate declines toward $107,250.

For now, the market is balanced between strong accumulation and fading speculative activity. A decisive move above $114,000 could confirm short-term strength, while a breakdown below $111,950 would shift sentiment bearish.

Bitcoin’s mid-term outlook hinges on whether long-term holders’ conviction can outweigh weakening futures dynamics.

The post September Rate Cut Now Imminent After Shock Inflation Data as Bitcoin Eyes 150K appeared first on Cryptonews.

https://cryptonews.com/news/september-rate-cut-now-imminent-after-shock-inflation-data-as-bitcoin-eyes-150k/