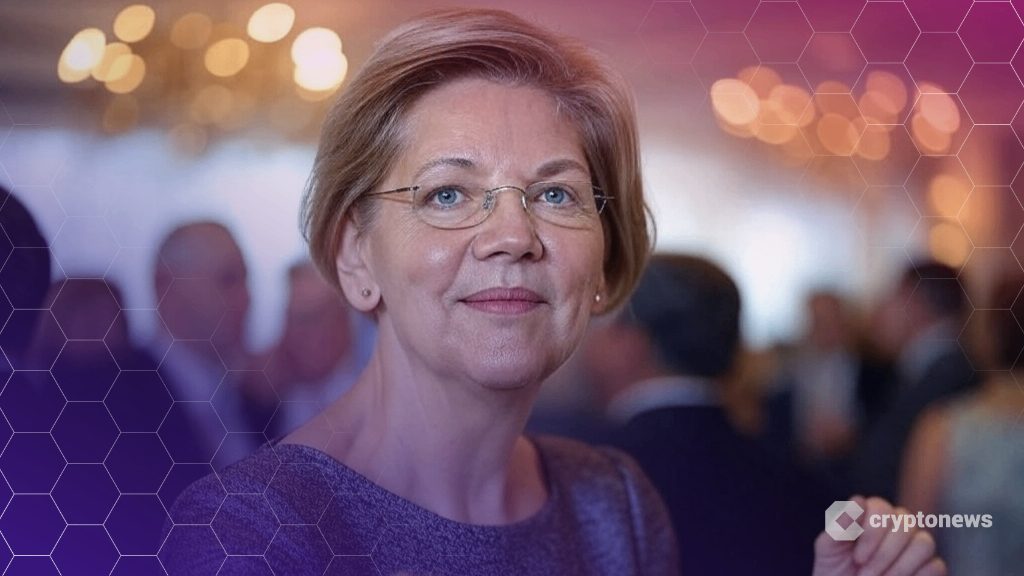

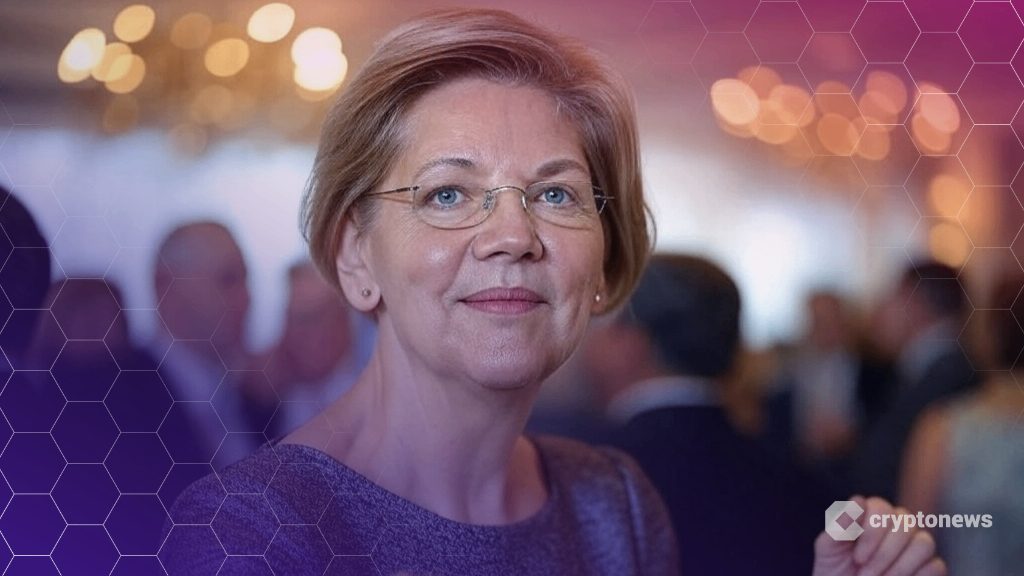

US Senator Elizabeth Warren, alongside Senators Chris Van Hollen and Ron Wyden, has urged the nation’s top banking regulator to investigate potential conflicts of interest involving the Trump family’s cryptocurrency ventures.

Key Takeaways:

- Senators are pressing the OCC over Trump’s potential financial conflicts tied to the stablecoin USD1.

- USD1, launched by a Trump-linked platform, is central to a $2B deal involving MGX and Binance.

- Lawmakers warn the stablecoin poses an “unprecedented conflict of interest” tied to the presidency.

In a letter sent Thursday to Office of the Comptroller of the Currency (OCC) head Jonathan Gould, the senators raised concerns about President Donald Trump’s “continued use of cryptocurrency business ventures to line their pockets.”

The letter specifically questions how the OCC, now the primary regulator of stablecoins under the recently passed GENIUS Act, will safeguard the financial system against undue influence from Trump’s personal business interests.

“The bill does nothing to prevent President Trump, his family, or his affiliates from financially benefiting from the issuance and sale of stablecoins,” the senators wrote.

Trump-Linked Stablecoin USD1 at Center of Senate Inquiry, Warren Says

The focus of the inquiry is USD1, a stablecoin launched in March 2024 by World Liberty Financial, a decentralized finance platform linked to the Trump family.

The senators argue Trump’s financial interests are “intricately tied” to the stablecoin’s success, creating what they describe as “an unprecedented conflict of interest.”

“The launch of a stablecoin directly tied to a sitting President who stands to benefit financially from the stablecoin’s success presents significant threats to our financial system,” the letter said.

The controversy deepened with revelations of a $2 billion deal involving Emirati firm MGX and Binance, using USD1 to facilitate the investment.

The senators called it “a staggering model for corruption,” highlighting that Binance, which pleaded guilty to U.S. anti-money laundering violations, also helped develop USD1’s code.

The letter ends with a demand for transparency, asking if Gould believes he serves at the President’s pleasure and whether he would step down if pressured.

It also urges the OCC to consider an investigation into World Liberty’s competitors, with responses requested by August 14.

USD1 currently ranks as the world’s seventh-largest stablecoin, with a market cap of $2.17 billion, ahead of offerings from PayPal and Ripple, according to CoinGecko.

Trump’s Crypto Holdings Make Up Key Portion of His Fortune

Trump’s crypto-linked holdings are also a substantial part of his personal wealth.

Bloomberg’s Billionaires Index estimates that TMTG stock represents $2.2 billion of Trump’s $6.6 billion fortune.

His broader cryptocurrency investments are believed to have gained at least $620 million in recent months.

However, the move is raising concerns among some industry figures. Nick Carter, general partner at Castle Island Ventures and a Trump supporter, said the overlap between Trump’s political influence and his financial exposure to crypto markets could create a conflict of interest.

“It’s always a headache to have businesses with conflicting interests,” he told Bloomberg.

As reported, nearly 70 nominees and officials in the Trump administration reportedly hold crypto or investments in blockchain companies, with holdings ranging from modest sums to over $120 million.

The group includes Vice President JD Vance and seven Cabinet members or nominees, who collectively disclosed at least $2 million in crypto assets.

The post Senator Warren Presses US Banking Regulator Over Trump Family’s Crypto Business Links appeared first on Cryptonews.

https://cryptonews.com/news/senator-warren-presses-us-banking-regulator-over-trump-familys-crypto-business-links/