One scoop to start: The Pentagon, US Treasury and state department have all concluded that Nippon Steel’s $15bn acquisition of US Steel poses no national security risks, even though President Joe Biden is expected to block the deal.

And a rocketing valuation: Elon Musk’s SpaceX has been valued at $350bn in a new deal to buy employees’ shares, making the rocket and satellite maker the world’s most valuable private start-up.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday to Friday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

-

TPG’s David Bonderman dies at 82

-

Mega supermarket deal devolves into legal fight

-

Private equity gets a slice of American football

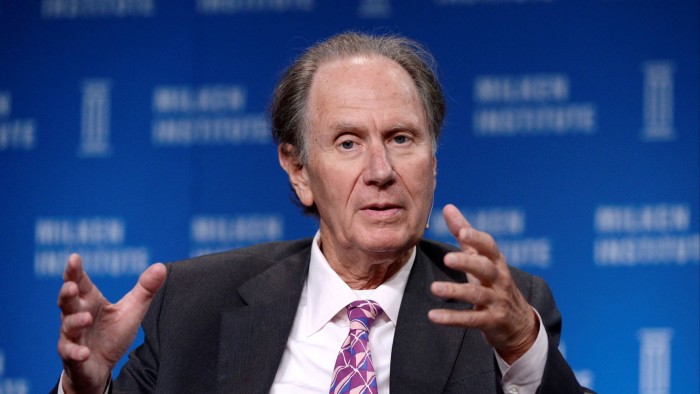

Private equity pioneer David Bonderman dies

One of the pioneers of the $4tn private equity industry was a late bloomer in buyouts.

He spent his first four decades building an eclectic career that spanned arguments in front of the US Supreme Court, battles to preserve New York’s iconic skyline, and even high-profile desegregation efforts as a member of President Lyndon Johnson’s administration.

The man we’re talking about of course is David Bonderman, the co-founder of TPG and pioneer of private equity alongside Henry Kravis and Stephen Schwarzman, who has died at 82.

As a financier, Bonderman made a name for himself in the 1990s at the dawn of a golden era of private equity. Then in his late forties, Bonderman quickly earned enormous windfalls restructuring troubled companies and assets. Eventually, he chased some of Wall Street’s largest-ever takeovers.

But his career started decades earlier as a lawyer. At Tulane University in the 1960s, Bonderman pushed for the desegregation of one of the South’s pre-eminent law schools before becoming a civil rights litigator under president Johnson.

After moving to the private sector at Arnold & Porter, he famously defended Raymond Dirks, a stock analyst who had been charged with insider trading. He ultimately won an appeal at the Supreme Court, which catapulted him to securities law fame.

All the while Bonderman cultivated an interest in preservation. He won the eye of billionaire oil man Robert Bass while litigating a successful fight against the demolition of New York’s beaux-arts masterpiece Grand Central Terminal.

Bonderman found his way to Texas and under Bass’s tutelage tried his hand at high-stakes dealmaking, where he met Jim Coulter, who would eventually become his co-founder at TPG.

Bonderman and Coulter in the early 1990s rescued Continental Airlines, turning a $64mn investment into a $700mn windfall. They also made a fortune reviving troubled asset portfolios after a wave of bank failures, creating the foundation of TPG, which now manages nearly $250bn in assets.

By the mid-2000s, TPG was among a handful of large buyout shops that were leading a wave of ever-larger, more leveraged takeovers that reached $20bn valuations.

Its two largest deals were participating in the takeover of Texas utility TXU and casino operator Harrah’s — two of the biggest private equity takeovers of all time.

Neither ended well. They both filed for bankruptcy, where nearly all of TPG’s multibillion-dollar investments were wiped out.

But in the past decade or so, the group staged a comeback with timely investments in the likes of Uber and Airbnb — and a massive presence in impact and climate-based investments.

In 2022, Bonderman and Coulter took the final step in solidifying the group’s rank among the biggest private equity groups: they took TPG public.

“David was an internationalist meaning that he had a very broad view of the world,” Coulter said in an interview with the FT. “He had an appreciation for people and personalities of all types and he had a broad set of relationships.”

Lawsuits fly after collapse of $25bn supermarket merger

Lina Khan nabbed a huge win on Tuesday when Albertsons walked away from what would have been the largest supermarket merger of all time.

But the outgoing chair of the Federal Trade Commission also snubbed the company’s controlling shareholder, Cerberus Capital Management, who was poised to reap billions from the sale to rival Kroger.

The New York-based distressed investing and private specialist made its first investment in Albertsons nearly two decades ago. It has slowly become the supermarket chain’s largest shareholder, with a nearly 30 per cent stake.

As Albertons grew to one of the US’s largest supermarket chains, so did Cerberus’s potential payout.

The secretive private equity firm has already earned more than $4bn in interim payments since it first invested in 2006.

The tie-up of Kroger and Albertsons was expected to make Cerberus’s fortune even greater. The shareholder won another $4bn in the form of a dividend payment it earned as part of the $25bn deal.

Had the deal closed, Cerberus would have won $8bn more, according to FT calculations at the time of the proposed merger.

On Wednesday, the situation quickly devolved into a legal fight.

Albertsons said it would sue Kroger over failing to exercise “best efforts” and to take “any and all actions” to win regulatory approval for the deal, which was blocked in a double-whammy on Tuesday by two judges, and the FTC sued to block the deal earlier this year.

Albertsons wants its $600mn termination fee, plus additional relief “reflecting the multiple years and hundreds of millions of dollars it devoted to obtaining approval for the merger”.

Meanwhile, Kroger said Albertsons had brought claims that were “without merit” and committed “repeated intentional breaches and interference” throughout the merger process.

Cerberus, for its part, seems to be doubling down for the long haul. While the group said it was “disappointed” by the court ruling, it had “no intention” of selling its billions in Albertsons stock.

The NFL’s members’ only club

Private equity has spent the past few years angling for lucrative ways to make money in sports. And this year, they can sink their teeth into an untapped treasure chest: American football.

The first two deals to buy stakes in National Football League teams arrived on Wednesday, with credit giant Ares Management and sports-focused private equity investor Arctos.

Ares is buying a 10 per cent stake in the Miami Dolphins, while Arctos led a group to purchase a minority stake in the Buffalo Bills (owned by oil billionaire Terry Pegula).

These are certainly only the first of many.

NFL owners control who gets approved to own a direct stake in teams, meaning Ares and Arctos have just gained access to one of the most exclusive members’ clubs in the country.

In August, the owners approved a major overhaul to ownership rules, which for the first time, allowed private equity groups to invest in teams — if they get the owners’ blessing.

The terms for these investments are massive. Ares is buying the Dolphins stake from billionaire real estate mogul Stephen Ross at a valuation of $8.1bn, said people briefed on the deal.

The NFL was long considered the crown jewel of sports investing. The teams have unleveraged balance sheets, which means they’re recession-resistant.

“It’s the most valuable global sports property from an economic standpoint,” said one prominent dealmaker.

Arctos and Ares have big portfolios of sports investments, they just hadn’t yet tapped into the NFL. Arctos owns stakes in the Los Angeles Dodgers baseball team and the Qatari-owned football team Paris Saint-Germain.

Ares has completed deals with several football teams including Chelsea, Olympique Lyonnais and Inter Miami, plus the McLaren Racing F1 team.

The other firms that got approval — Sixth Street and a consortium made up of Blackstone, Carlyle, CVC, Dynasty Equity and Ludis — could soon follow with stakes of their own.

Job moves

-

Deutsche Bank has hired Luba Kotzeva as the head of power, utilities and energy transition in Europe, according to an internal memo seen by DD. She joins from Lazard. The bank also named Tom Moxham as head of infrastructure in Europe.

-

Bank of America promoted 387 employees to managing director, 16 per cent more than last year, Bloomberg reports.

Smart reads

Crypto ally Use of the cryptocurrency Tether has been connected again and again to criminal activity, the FT reports. The company’s close ally, Howard Lutnick, is heading for the White House.

Petrodollar windfall The new chief of Qatar’s $500bn wealth fund says the firm will deploy cash “more aggressively” as it prepares for a huge influx that could double its size, the FT reports.

Tax dodge Most working Americans pay taxes that help fund Medicare, the programme that provides health insurance for older citizens, ProPublica reports. But not on Wall Street.

News round-up

UK fintech Stenn collapsed after Russia money laundering case drew scrutiny (FT)

Bain launches $4.3bn counterbid against KKR for Japan’s Fuji Soft (FT)

Adidas headquarters raided in second day in €1bn tax evasion probe (FT)

Two shareholder advisers side with Boohoo in Mike Ashley row (FT)

Macy’s cuts profit outlook after employee hid $150mn in expenses (FT)

Court blocks The Onion’s attempt to acquire Infowars (FT)

Luxury real estate brokers charged with sex trafficking (FT)

Bank of England plans tougher liquidity rules for insurers following ‘critical gaps’ (FT)

Klarna fined $50mn and reprimanded by Swedish regulator (FT)

Due Diligence is written by Arash Massoudi, Ivan Levingston, Ortenca Aliaj, and Robert Smith in London, James Fontanella-Khan, Sujeet Indap, Eric Platt, Antoine Gara, Amelia Pollard and Maria Heeter in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please send feedback to due.diligence@ft.com

Recommended newsletters for you

India Business Briefing — The Indian professional’s must-read on business and policy in the world’s fastest-growing large economy. Sign up here

Unhedged — Robert Armstrong dissects the most important market trends and discusses how Wall Street’s best minds respond to them. Sign up here

https://www.ft.com/content/6eaffd67-cb5f-40a0-86c6-4326201af7bf