Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Yes, we’re going to write about portfolio trading, again. Our previous posts have mostly focused on how a big deal it has become in the US, but a new Barclays report shows it’s now a growing phenomenon in Europe as well.

Barclays has previously estimated that a big fat portfolio trade now hits the US fixed-income market every seven minutes, with volumes topping $1tn annually. Portfolio trading now accounts for as much as a quarter of investment-grade corporate bond trading, and a sixth of junk bond trading.

Calculating the same in Europe is tricky because of the lack of any consolidated tape of bond trades (though that’s about to change) so the UK’s bank’s analysts used an algorithmic approach to identify probable portfolio trades and get a rough estimate.

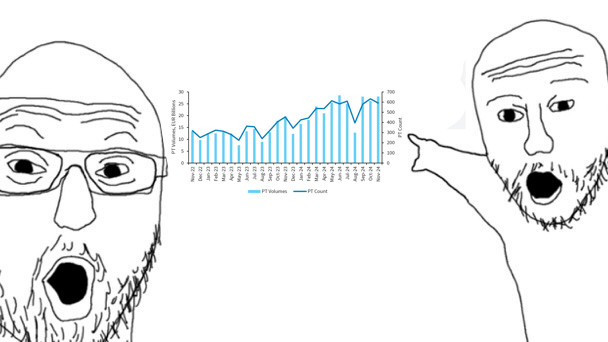

Barclays found that total annual volumes probably topped €250bn in 2024. In frequency, that equates to a portfolio trade happening every 20 minutes on average, down from every 33 minutes just two years ago.

It has become particularly prevalent in investment grade, euro-denominated corporate bond market, where portfolio trading now accounts for 11 per cent of all trading volume. In sterling bonds and euro high yield it has reached a 9 per cent and 7 per cent market share respectively.

Most portfolio trades identified by Barclays happened on electronic platforms like Tradeweb, and involved about 60 bonds worth a total of €40mn on average.

That’s lower than the $50-60mn average in the US, but this is maybe less than you you’d expect, given how much larger and more liquid the US corporate bond market is, and how developed portfolio trading is becoming there.

Zornitsa Todorova, head of thematic fixed income research at Barclays, reckons that portfolio trading volumes in Europe will roughly double to account for about 20 per cent of all dealer-to-client volumes within the next three years.

How big a deal is all this? Well, pretty big if you’re a bond fund manager.

Index-tracking fixed income vehicles often use portfolio trades to rejig their exposures, but it has become a hugely valuable tool for active managers as well, as Todorova highlights. Her emphases below:

Our analysis attributed the majority of portfolio trading volumes in Europe to active investors, though we found that passive investors do use PTs to rebalance portfolios at month-end and to manage inflows and outflows intra-month by buying or selling a ‘slice’ of their holdings that closely resembles the index they track. In addition to these use cases, active managers also frequently use PTs to adjust their portfolios towards specific credit risk dimensions, such as rating, sector or maturity, along with hedging and de-risking.

The fact that active investors are the marginal consumers of PT liquidity is significant for several reasons. Unlike passive investors, who track an index, active investors, in particular open-end mutual funds, frequently trade bonds and depend on liquidity to efficiently enter and exit positions. These investors set marginal prices when they trade, influencing bond spreads and market depth. Their activity also impacts liquidity risk premia, as bonds with lower liquidity command higher yields.

Portfolio trading has the potential to transform credit markets in several ways: by adding more volume to the market, it improves liquidity, lowers the barrier to entry for new investors, and enables new strategies, such as systematic credit.

Further reading:

— ETFs are eating the bond market (FTAV)

https://www.ft.com/content/ef21c9a1-ae27-4ba3-82a9-16be19a774b0