The Swedish “buy now, pay later” pioneer stated Tuesday that its new design would assist customers discover the gadgets they need by utilizing extra superior AI advice algorithms, whereas retailers will be capable of goal prospects extra successfully.

Rafael Henrique | SOPA Images | LightRocket by way of Getty Images

Klarna on Wednesday introduced a world partnership with Uber to energy funds for the ride-hailing large’s Uber and Uber Eats apps.

The partnership will see the Swedish monetary know-how agency added as a cost choice within the U.S., Germany, and Sweden, Klarna stated in a press release.

In the U.S., Germany, and Sweden, Klarna will roll out its “Pay Now” choice, which lets prospects repay an order immediately in a single click on, within the Uber and Uber Eats apps. Users will be capable of monitor all their Uber purchases within the Klarna app.

The firm may even provide a further cost choice for Uber customers in Sweden and Germany which permits customers to bundle purchases right into a single, interest-free cost that will get taken out of their month-to-month wage.

Interestingly, the corporate is not rolling out installment-based purchase now, pay later plans, arguably its hottest service providing, on Uber’s platforms — solely quick funds and month-to-month funds.

Sebastian Siemiatkowski, CEO and Co-Founder of Klarna, stated in a press release Wednesday that the deal represented a “significant milestone” for the corporate.

“Consumers can Pay Now quickly and securely in full, which already accounts for over one third of Klarna’s global volumes, and more easily manage their finances in one place,” Siemiatkowski stated.

Klarna declined to reveal monetary phrases of its take care of Uber.

Big pre-IPO service provider win

The Uber deal marks one of the vital important service provider wins for Klarna of late, and comes because the European fintech large is rumored to be gearing up for a blockbuster preliminary public providing that would worth the agency at north of $20 billion.

Klarna started having detailed discussions with funding banks to work on an IPO that would occur as early because the third quarter, Bloomberg News reported in February, citing unnamed sources conversant in the matter.

CNBC couldn’t independently confirm the accuracy of the report. Klarna has stated that it does not touch upon market hypothesis.

Such a market flotation would mark one thing of a turnaround for a corporation that noticed $38.9 billion erased from its valuation in 2022, when deteriorating macroeconomic situations stoked by Russia’s invasion of Ukraine brought about a reset of sky-high tech valuations.

Klarna reached an eye-watering $45.6 billion in a 2021 funding spherical led by SoftBank, earlier than seeing its market worth fall to $6.7 billion the next 12 months in a so-called “down round.”

The agency not too long ago launched a month-to-month subscription plan within the U.S. to lock in “power users” forward of its anticipated IPO.

The product, known as Klarna Plus, prices $7.99 per 30 days, and allows customers get their service charges waived, earn double rewards factors and entry curated reductions from companions together with Nike and Instacart.

Last 12 months, Klarna reported its first quarterly revenue in 4 years after reducing its credit score losses by 56%.

The firm posted working revenue of 130 million Swedish krona within the third quarter of 2023, swinging to a revenue for a lack of 2 billion Swedish krona in the identical interval a 12 months earlier.

Buy now, pay later increase

Klarna is considered one of many “buy now, pay later” providers that enable customers to repay their purchases over a interval of month-to-month installments.

The cost methodology has turn out to be more and more widespread amongst shoppers to pay for on-line and in-person buying purchases, as a substitute for bank cards which cost curiosity and excessive charges.

However, it has additionally stoked considerations in regards to the affordability of such providers, and whether or not it’s the truth is encouraging some shoppers — significantly youthful folks — to spend greater than they’ll afford.

In the U.Okay., the federal government has proposed draft legal guidelines for regulating the purchase now, pay later trade.

The U.S. Consumer Financial Protection Bureau has stated beforehand it plans to topic purchase now, pay later lenders to the identical oversight as bank card firms.

Meanwhile, the European Union final 12 months handed a revised model of its Consumer Credit Directive to incorporate purchase now, pay later providers underneath the scope of the foundations.

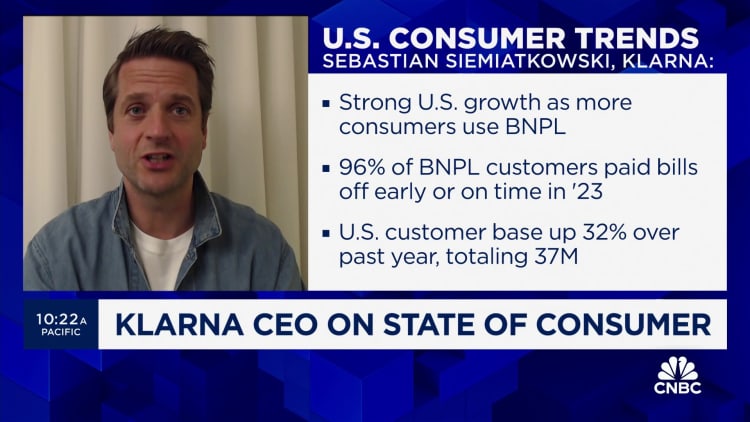

For its half, Klarna has defended the purchase now, pay later mannequin, arguing it affords prospects a less expensive means of accessing credit score compared to conventional bank cards and shopper loans.

The firm additionally says it welcomes regulation of purchase now, pay later merchandise.

https://www.cnbc.com/2024/04/24/klarna-scores-payment-deal-with-uber-ahead-of-anticipated-ipo-.html