Japanese energy consulting firm Remixpoint has raised approximately 31.5 billion yen ($215 million) through a financing round dedicated exclusively to Bitcoin investments.

The company announced that its short-term objective is to acquire 3,000 BTC, although this target may be adjusted based on Bitcoin’s market price and Remixpoint’s stock performance (3825.T).

In a July 9 statement translated from Japanese, Remixpoint explained, “We have become even more convinced of Bitcoin’s future, and this decision is the result of extensive discussions to enhance corporate value from a risk-return perspective, while also keeping future options open.“

Japanese Remixpoint Building on Existing Bitcoin Strategy

Remixpoint has been accumulating Bitcoin since September 2024, establishing itself as a significant corporate holder in the cryptocurrency space.

According to Bitcoin treasuries data, Remixpoint ranks as the 30th publicly listed company by Bitcoin holdings with 1,051 BTC, surpassing firms like Nano Labs and The Smarter Web Company at the time of writing.

The company’s commitment to Bitcoin was demonstrated earlier this year when it approved a ¥1 billion ($7 million) Bitcoin purchase following a board resolution in May.

Beyond Bitcoin, Remixpoint has expanded its digital asset holdings to include Ethereum (ETH), Solana (SOL), and Avalanche (AVAX).

In September 2024, the firm invested approximately $351,700 to acquire 130.1 ETH, 2,260.5 SOL, and 12,269.9 AVAX tokens.

The Japanese firm’s crypto commitment extends to executive compensation, with the company becoming the first Tokyo Stock Exchange-listed entity to pay its CEO and President entirely in Bitcoin.

According to the report, CEO Yoshihiko Takahashi characterized this decision as a “clear signal” of his commitment to corporate value and shareholder-focused governance.

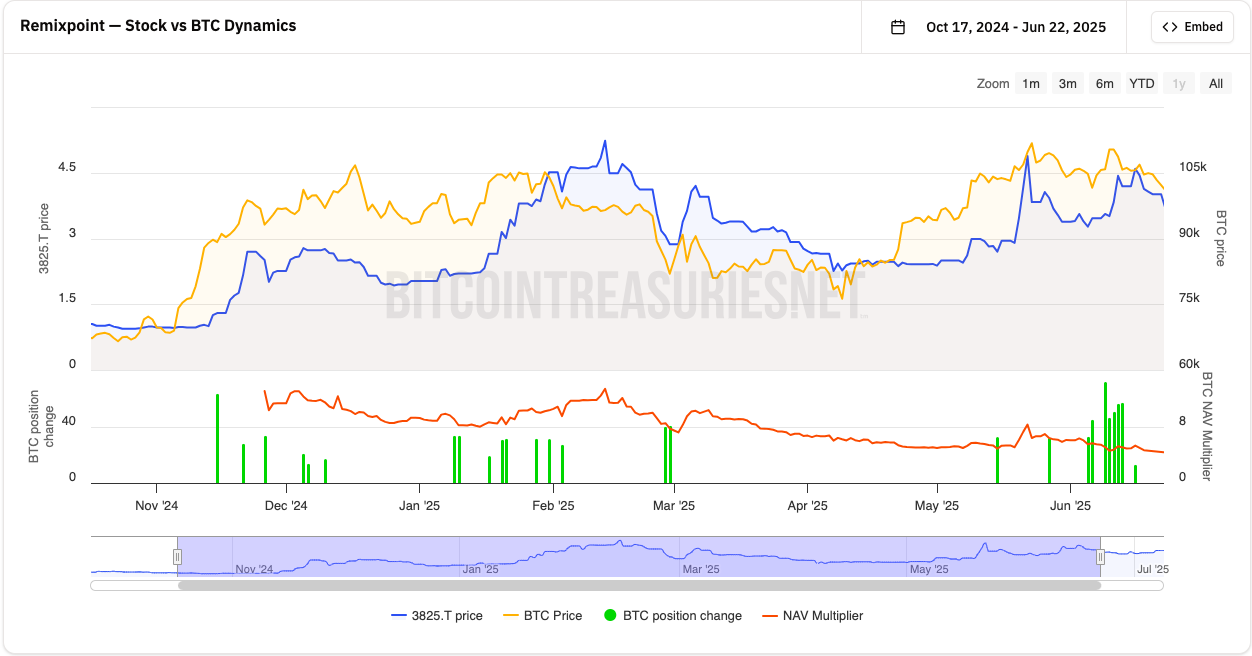

Moreover, Remixpoint’s stock price has demonstrated a strong correlation with Bitcoin’s performance, benefiting from the cryptocurrency’s success.

When Bitcoin reached its lows of $77,000 in April, 3825.T shares traded at ¥328 ($2.26). As Bitcoin climbed above $109,000 in May, the stock price more than doubled to ¥701 ($4.88).

At press time, Remixpoint shares trade at 592 yen, reflecting a 3.86% increase in the last 24 hours and over 64% year-to-date gains, according to Google Finance.

Growing Japanese Corporate Bitcoin Adoption

Remixpoint’s strategy aligns with an emerging trend among publicly listed companies that incorporate Bitcoin into their balance sheets.

While U.S.-based companies like MicroStrategy have popularized this approach, Remixpoint joins a growing list of Japanese firms adopting similar models.

Metaplanet, another Bitcoin-focused Japanese company, has consistently expanded its holdings of BTC.

On Monday, Metaplanet purchased an additional 2,205 BTC, bringing its total Bitcoin holdings to 15,555 BTC, valued at approximately 225.8 billion yen ($1.7 billion).

In April, NASDAQ-listed Japanese beauty and cosmetic surgery clinic operator SBC Medical Group Holdings completed a Bitcoin purchase worth over $418,000.

Moreover, Japan’s evolving regulatory landscape is supporting the increased adoption of cryptocurrencies.

The country is preparing to formally recognize crypto assets as financial products under its Financial Instruments and Exchange Act and is moving toward approving Bitcoin ETFs.

These developments are expected to encourage more Japanese companies and citizens to embrace Bitcoin and cryptocurrency investments.

Government officials are also considering Bitcoin as a reserve asset.

Satoshi Hamada, a member of parliament from the Party to Protect the People from NHK, has called for the establishment of a national Bitcoin reserve, similar to recent proposals from lawmakers in Argentina, Russia, and other countries.

The post Japanese Firm Remixpoint Secures $215 Million Funding to Purchase 3,000 Bitcoins appeared first on Cryptonews.

https://cryptonews.com/news/japanese-firm-remixpoint-secures-215-million-funding-to-purchase-3000-bitcoins/