Indonesia’s annual crypto tax revenue jumped sharply in 2024, marking its highest level since the government introduced taxation on digital assets in 2022.

According to officials from the Directorate General of Taxes, the country collected 620 billion rupiah (around $38 million) last year, a 181% rise from the 220 billion rupiah recorded in 2023.

The sharp increase reflects a broader surge in local crypto activity. Officials attributed the growth to a rise in transaction volumes, which reportedly reached 650 trillion rupiah ($39.67 billion) in 2024.

This aligns with Indonesia’s growing crypto user base, which now stands at over 20 million people, surpassing the number of stock market investors.

Crypto Tax Revenue in Indonesia Surged in 2024, but 2025 Off to a Slower Start

However, the momentum may not last. Year-to-date figures for 2025 show a steep drop in tax revenue, with collections sitting at just 115 billion rupiah ($6.97 million) as of July. Officials point to crypto market volatility as a key factor behind the fluctuations.

“Crypto is a long-term investment. The price can drop,” said Hestu Yoga Saksama, Director of Tax Regulations I at the Directorate General of Taxes. “It could spike, it could drop—it depends on what kind of fever it is. If the fever is high, then the reception will be good.”

The tax was first introduced in 2022 and includes both Final Value Added Tax (VAT) and Article 22 Income Tax on crypto trading. In its first year, crypto taxes brought in 246 billion rupiah. The drop in 2023 raised concerns before the market rebounded sharply last year.

To manage this growing sector, the government introduced several new regulations in 2025. Among them are updated ministerial decrees that set out tax rules for crypto asset trading and amend existing tax frameworks to reflect the evolving digital asset space.

Indonesia has also reclassified crypto assets from commodities to financial assets. This move brings the sector under the oversight of the Financial Services Authority (OJK), indicating a shift in how the country views crypto’s role in its broader financial system.

Yon Arsal, an advisor to the Minister of Finance, emphasized the need for collaboration. “It’s not enough to simply expand the scope,” he said. “We must also coordinate. We’re encouraging better coordination with our external stakeholders, including the Financial Services Authority.”

Indonesia Raises Crypto Taxes on Foreign Exchanges, Cuts VAT for Buyers

The government also rolled out tax reforms in August designed to shift activity toward domestic crypto platforms. Taxes on foreign exchanges were raised from 0.2% to 1%, while domestic platforms saw a smaller hike from 0.1% to 0.21%. Buyers, however, are no longer subject to VAT, creating an incentive for local trading.

Crypto mining operations weren’t left out. VAT on mining has doubled from 1.1% to 2.2%, and a special 0.1% income tax for miners will be removed in 2026. After that, mining income will be taxed under regular personal or corporate tax rates.

Speaking to CryptoNews, Gregory Cowles, Chief Strategy Officer of Intellistake.ai, noted that “crypto taxation needs to strike a balance. It’s fair that governments want their share, but overly aggressive or unclear policies risk pushing users offshore or into informal channels.”

He continued, saying, “Especially in emerging markets, crypto is often more than just speculation; it’s a workaround for currency instability or limited access to banking. If taxation becomes too punitive, it could stifle that utility.”

Despite the volatility challenges, officials view crypto taxation as a growing source of revenue. The government’s ability to capture earnings from the booming digital asset market, particularly among younger investors aged 18 to 30, is seen as a long-term opportunity.

Still, the unpredictable nature of crypto prices poses a challenge for revenue planning. As Yoga noted, “It really depends on the market. If activity drops, so does the revenue.”

As 2025 unfolds, the country’s crypto tax collections may continue to reflect the highs and lows of a volatile but rapidly expanding sector.

Gregory Cowles further noted that “If governments start to treat crypto tax income as a stable budget item, they may be setting themselves up for disappointment.”

Indonesia Ranks 3rd Globally for Crypto Adoption as Youth Trading Soars

Indonesia’s crypto sector is seeing a sharp rise in activity, fueled largely by its young population. Over 60% of the country’s crypto investors are aged between 18 and 30, according to data from the Commodity Futures Trading Regulatory Agency (Bappebti).

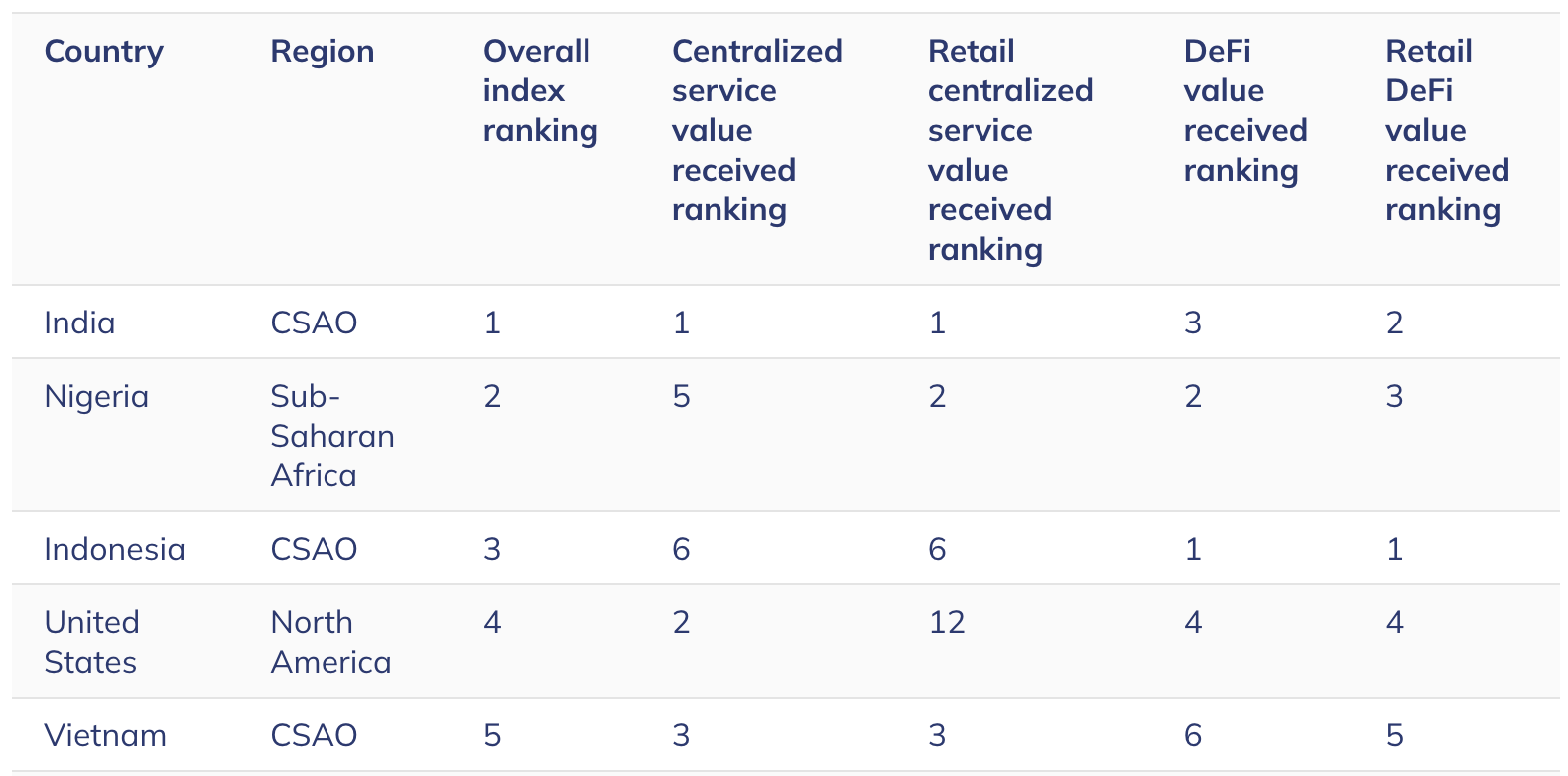

This surge in young investor participation has helped position Indonesia as the third-highest country on Chainalysis’s Global Cryptocurrency Adoption Index.

In 2024, Indonesia recorded more than $30 billion in crypto transactions by October, a steep rise from $6.5 billion the previous year.

While still below the 2021 peak of $54 billion, this marks a 352% year-over-year increase. The number of registered crypto traders in the country also grew, reaching 21 million.

At the regulatory level, the country is undergoing a shift in oversight. The transfer of authority from Bappebti to the Financial Services Authority (OJK), initially planned for January 2025, was delayed due to the absence of supporting government regulations.

Once finalized, the OJK is expected to provide a more structured regulatory framework aligned with global standards, including clearer rules on trading, taxation, and exchange operations.

The post Indonesia’s Crypto Tax Revenue Skyrockets 181% – But Volatility Raises Red Flags appeared first on Cryptonews.

https://cryptonews.com/news/indonesias-crypto-tax-revenue-skyrockets-181-but-volatility-raises-red-flags/