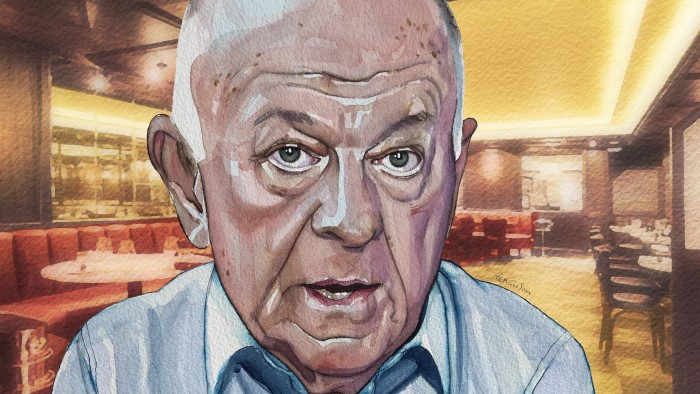

Peter Hargreaves does not mince his words. Shortly after arriving at Cafe Murano, a stylish Italian restaurant on St James’s Street in the West End of London, he tells me that he rarely ventures this far for business meetings, preferring instead to make Zoom calls from the comfort of his home in Bristol.

“People would say, ‘Peter why don’t you come to London and have lunch in our boardroom?’” He pauses, then says emphatically, “Why the bloody hell do I want to do that? I’d say if you want to see me, come and see me.”

I’m honoured that Hargreaves, who has just turned 78, has made the journey into London for lunch, although he says it was only after arranging to have dinner with his wife and friends in the evening.

We’re here to discuss Hargreaves Lansdown, the UK’s biggest “do it yourself” investment company, through which individuals can buy investments and pensions. He co-founded the business with his friend Stephen Lansdown in 1981 from his spare bedroom in Bristol. It now serves 1.9mn customers with a total of £157bn in assets.

Having built and grown Hargreaves Lansdown during the Thatcher era, becoming one of the wealthiest 100 people in Britain as a result (both he and Lansdown are now billionaires), Hargreaves is a staunch Conservative.

“Margaret Thatcher wasn’t the best prime minister that’s ever been. She was the best prime minister in the world that’s ever been,” he says, in an accent that is part Lancastrian (he was born and raised in Lancashire) and part West Country (where he lives now).

“One thing that most people forget is why did Britain turn from the sick man of Europe to the most successful economy in Europe? Margaret Thatcher,” he says again. “Rishi [Sunak] rang me during lockdown — I Zoomed with him — and he asked me a couple of things . . . He said, ‘So why did the economy do so well post-Thatcher?’ I said, ‘You don’t know? She got rid of regulation.’ It’s the biggest threat in this country.”

Hargreaves gave £1mn to the Conservative party in 2019, which he says was to stop the then Labour leader Jeremy Corbyn from winning. “I regret it, unbelievably,” he says of the donation. “I wish I’d never done it. The British electorate weren’t stupid enough, it was an enormous landslide. So I didn’t need to do it.”

He also donated £3.2mn — the second-largest individual amount, he says — to the Leave campaign in 2016. Nearly a decade on from the referendum, what does he think of Brexit? “We’re still in the EU. We should have said, ‘We’re gone! We’re out!’” He explains that the UK should have removed more EU regulations and put tariffs on car imports from Germany, France and Italy. “We’re still partly in [the EU]. This lot, who are in at the moment,” he says referring to the Labour government, “they’ll let us slide back in . . . but we won’t have a vote.”

I ask him what he thinks of Britain’s economy, which doesn’t seem to be thriving. “That’s because we’ve had bloody socialism. We had that period with [Nick] Clegg and [David] Cameron. Then Cameron wins outright and so the country says, ‘We’re voting right.’ What does Cameron do? He goes left!”

We’re sitting near the door of Cafe Murano, in the hope that it’s a slightly quieter spot as the lunch service gets into full swing. After much deliberation over our starters, Hargreaves opts for the beetroot salad with figs and goat’s curd from the set menu, while I go for the grapefruit cured trout with crushed pistachio. “Vinegary,” he says of his starter. “It was a bit too vinegary. I quite like vinegar so it’s no problem.” My trout is heavy on the grapefruit juice, too. Luckily I quite like grapefruit.

We order a carafe of Soave wine, which is promptly delivered to our table. “You want me to try that, do you?” he says to the waitress. “I’ve just got loads of vinegar in me mouth.” He has a sip. “There’s nothing wrong with it,” he says, humorously, I think.

“Did I tell you Rory Stewart was on the train?” he says suddenly, referring to the former Conservative MP. “We had a very brief conversation and I said I’m absolutely petrified with this lot,” he says of the government. “They don’t know what they’re doing. I said they’re worse than your lot!”

I’m keen to hear how Hargreaves and his friend Lansdown came up with the idea of their eponymous business in the first place.

Hargreaves Lansdown revolutionised investing when it launched in 1981, by allowing ordinary people to buy investment funds directly through the company, rather than having to pay an expensive financial adviser. It has become one of the country’s most valuable companies, with a spot in the FTSE 100.

Hargreaves, whose personal fortune is an estimated £1.8bn, had more humble beginnings. He grew up in Clitheroe, Lancashire, and worked in the family bakery from a young age. “It was great, I saw business at its most basic. My father actually had a tin and he’d put silver coins in it every week to pay for the gas bill.”

After finishing school, Hargreaves worked at a Blackburn-based accountancy firm before a stint at audit giant KPMG. A period of working for Burroughs in the early 1970s — now part of American technology company Unisys — gave Hargreaves experience in selling computers and, crucially, in sending direct marketing mail, which would later inspire his focus on marketing at Hargreaves Lansdown.

He then turned down a job at Bristol-based investment firm Sandham Davis, a position that Stephen Lansdown fortuitously took up. Not long after, Hargreaves changed his mind and joined the company in September 1979, and quickly became friends with Lansdown.

An opportunity to work with another individual selling investment funds, called unit trusts, then cropped up, which Hargreaves accepted. “In those days, we’d run adverts with a coupon for your name and address and we [would send out] newsletters. It was called junk mail, but you couldn’t get on our list unless you asked to be. People invested through us. Then I thought, I’m going to do this myself. I went to see Steve one night. His wife was seven or eight months pregnant,” he recalls. “She backed us. She said, go for it.”

At the time, individuals had tended to buy shares through commission-chasing stockbrokers or life assurance through consultants. Financial advice was largely the preserve of the wealthy. So Hargreaves Lansdown would offer unit trusts directly to ordinary people.

“The press liked that idea, so we did get good coverage in the national papers,” he beams. “Even though we were a tiny little firm. And basically, our marketing got better and better and better — we were fucking fantastic at it.”

Hargreaves Lansdown became known as a “do it yourself” company through which people could invest in funds for a relatively small fee, though it now offers a wider range of services from online share trading to pension products. It built its reputation for slick marketing through the influential Wealth 150 (now Wealth Shortlist) list of funds that it would promote to clients. The company would obtain a discount on the fees charged by these funds, meaning that customers generally paid lower prices to invest in them, while Hargreaves Lansdown — until a decade ago — kept a cut.

Menu

Cafe Murano

33 St James’s Street, London SW1A 1HD

Two-course set lunch £25

– Figs and goat’s curd, beetroot salad

– Mackerel, fennel and apple slaw

Cured trout £18

Seafood risotto £28

Pannacotta £8.50

Espresso martini £15

Carafe of Pieropan Soave Classico £38

Flat white £3.80

Total inc service and charity donation £155.70

The business floated in May 2007, just before the global financial crisis, with shares priced at 160p, making it worth about £759mn. Hargreaves said one investment company complained that the share price was too expensive when it floated. “I said you’re right, it is, but it’ll probably go higher,” Hargreaves laughs. He was correct: the company joined the FTSE 100 four years later.

By 2010, Hargreaves had decided it was time to step down as chief executive. Soon after, in 2015, he came off the board as a director. He remained the company’s largest shareholder, though, owning about a fifth of its stock. Then, in August, the company’s board agreed for the business to be sold to private equity firms, including CVC Capital Partners, for £5.4bn.

Our main courses arrive. Hargreaves has gone for the mackerel. It’s “very nice”, he says. “What is that, by the way,” he asks, looking at mine. I tell him it’s seafood risotto. “I’ve never been into risotto,” he says.

Our lunch date is well timed: it is the day after Hargreaves Lansdown shareholders voted in favour of selling the company to the private equity firms. It is a symbolic moment for Hargreaves, as his partner Lansdown, who was the second-largest individual shareholder, has decided to cash out, cutting his ties with the business after more than four decades.

Hargreaves decided to offload half his shareholding for £534mn while keeping the other half invested in the private business. The deal was designed to allow shareholders to trade their stock in for cash, or instead take a stake in the private company.

But it courted criticism. Some shareholders reckoned the company and its founders should have held out for a better price from another potential bidder. They also argue that some investors would not be able to hold a stake in the company because regulations limit investment in private businesses.

I ask why Hargreaves decided to sell half his stake at a share price of £11.40 as part of the deal, when shares were worth £24 in 2019. “If you read the directors’ report, they stated categorically that . . . it would take five to six years to get the share price back up to a point of £11.40,” he says.

Was it not galling to be selling way below £24, though? he pauses for a moment. “Of all the things that have ever happened in the world to me, it was the most upsetting of anything,” he laments. “It didn’t need to happen. Hargreaves says he believes that “the share price would probably be £40” if the company had kept a tighter grip on costs and generated bigger profits.

I decide to mention the elephant in the room: Neil Woodford, once one of the most successful UK fund managers, before his sharp fall from grace. He’d joined the fund group Invesco Perpetual (now Invesco) in 1988, and within two decades was running as much as £30bn on behalf of small investors. Hargreaves Lansdown backed Woodford through much of his time at Invesco, promoting his fund on their Wealth list.

When Woodford left to set up his own shop, in 2014, Hargreaves Lansdown promoted his flagship Equity Income fund, even as it began to nosedive. The fund was eventually forced to stop trading in 2019, leaving many investors stuck in the fund and nursing losses. Almost 300,000 people were invested through Hargreaves Lansdown, accounting for £1.6bn of the fund’s total £3.7bn.

“You know I wasn’t there when that happened?” Hargreaves says defensively. I ask if he means he was no longer chief executive at the time. “I wasn’t even a director,” he says.

How did it feel to watch Hargreaves Lansdown’s customers suffer as their money was trapped in Woodford’s funds? After all, it was one of the UK’s biggest retail investment scandals. Hargreaves is silent before eventually saying: “I was seriously fucking pissed off.”

Although Woodford was investigated by the Financial Conduct Authority, the UK’s watchdog, Hargreaves Lansdown was not probed. “They didn’t do anything wrong, Hargreaves Lansdown, they really didn’t,” he says. “They didn’t contravene any regulation. The quandary they must’ve had was if they changed their stance [on Woodford], the stampede of money out of the Woodford fund would have been a complete bloodbath.”

The waitress comes over to ask if we would like dessert. “This young lady wants a dessert,” he says, gesturing to me. I opt for the pannacotta. “I’m going to be very naughty indeed,” he says. “I’ll have an espresso martini. There’s no martini in it. It’s coffee, vodka and lots of sugar.”

I want to ask Hargreaves, as someone who founded an investment company, where he puts his own money.

But first, I mention that I’d heard he was frugal. “That’s an understatement,” he says proudly. “[My dad] was worse than me — he made Ebenezer Scrooge look like a philanthropist.” I tell him not to worry about spending today because the FT will be footing the lunch bill. “I think I can afford it,” he laughs.

His cautious attitude to money is reflected in how he ran Hargreaves Lansdown: the company did not borrow, or acquire other companies, to grow. “I can never see the point of spending money for the sake of it. It’s a famous expression, isn’t it? Never spend a penny when a ha’penny will do.”

Hargreaves’s charity, the Hargreaves Foundation, is also run on a shoestring, he says. He gave the charity a donation of £100mn in Hargreaves Lansdown shares when it was set up in 2020, which was deemed to be one of the largest contributions in recent years — although the value has since fallen because of the drop in share price.

“Nearly every bugger that’s run a FTSE 100 company has been given a knighthood. I created one!” he exclaims, clearly annoyed, even though he was awarded a CBE a decade ago. “I’ve also created one of the biggest foundations in the UK. I have a huge black mark against me, of course — Brexit.”

I ask him where he invests his own wealth. Aside from his holding in Hargreaves Lansdown, his next largest investment is Blue Whale, a fund he helped launch in 2017 by providing an initial £25mn for the manager Stephen Yiu. The fund focuses on fast-growing companies, such as the US tech giant Nvidia.

Aside from money, what else is he interested in? Horseracing and gardening come up and also, surprisingly, trainers. A former avid runner, Hargreaves says he has an extensive collection of trainers, adding that he owns a pair of On shoes, the brand backed by tennis player Roger Federer. “I bought a pair because I liked the look of them. They’re a bit hip — as I am, of course.”

I mention that, despite his frugality, he owns a private jet. “It was a mistake,” he admits. “We’d have been better off chartering one. The kids use it a bit.” Hargreaves and his wife Rosemary live near their son, daughter and grandchildren, “about 200 yards from one lot and about a six-minute walk from the others”.

He adds that his daughter has asked him to pick up an item she wants from a shop in London while he is visiting. I look around the restaurant to gesture for the bill, but the staff are busy. In the meantime, I ask if Hargreaves is a keen football fan, knowing that Lansdown has a large stake in Bristol City. He leans in and whispers “Arsenal”, before admitting that his son is more of an ardent supporter. I settle up and Hargreaves pulls on his coat. “I’ve got to go and buy this bloody thing for me daughter now,” he says, raising an arm in farewell and walking off.

Emma Dunkley is an asset management reporter at the FT

Find out about our latest stories first — follow FTWeekend on Instagram and X, and subscribe to our podcast Life and Art wherever you listen

https://www.ft.com/content/b005d23c-8d50-4ce4-bf37-115320b1a88f