Last week the European Commission said it was preparing to introduce tariffs on Russian oil imports entering the EU through Hungary and Slovakia.

It comes as US President Donald Trump has piled pressure on NATO members to stop buying Russian energy, in a bid to end the Russia-Ukraine war. At the UN last week he said, “They’re funding the war against themselves. Who the hell ever heard of that one?” Trump was referring to the more-than one billion euros ($1.35bn) EU countries are still paying to Russia each month for fossil fuels.

In this explainer, Al Jazeera outlines the latest figures on Europe’s oil and gas imports from Russia, why some countries remain dependent on Russian energy and which other nations are now purchasing Russian fuel.

Which European states are still buying Russian energy?

According to the Centre for Research on Energy and Clean Air (CREA), which tracks physical flows of fossil fuels, the EU spent 1.15bn euros ($1.35bn) on Russian fossil fuels in August.

The five largest importers accounted for 85 percent of that total, buying 979 million euros ($1.15 billion) worth of Russian oil and gas. The remaining 15 percent came from countries including Spain, Bulgaria, Romania, Italy, Greece, Croatia, Slovenia, Austria and Poland.

The top buyers of Russian energy include:

- Hungary: 416 million euros ($488m)

- Slovakia: 275 million euros ($323m)

- France: 157 million euros ($184m)

- Netherlands: 65 million euros ($76m)

- Belgium: 64 million euros ($75m)

Hungary and Slovakia both purchased Russian crude oil and pipeline gas, while France, the Netherlands and Belgium imported liquefied natural gas (LNG), which is natural gas cooled into a liquid so it can be transported by ship instead of through pipelines.

Europe’s heavy reliance on oil and gas

Together, oil (33 percent) and natural gas (24 percent) account for more than half of Europe’s energy supply. Coal contributes 11.7 percent, followed by nuclear at 11.2 percent, biofuels at 10.9 percent, solar and wind at 6.1 percent, and hydropower at 3.1 percent.

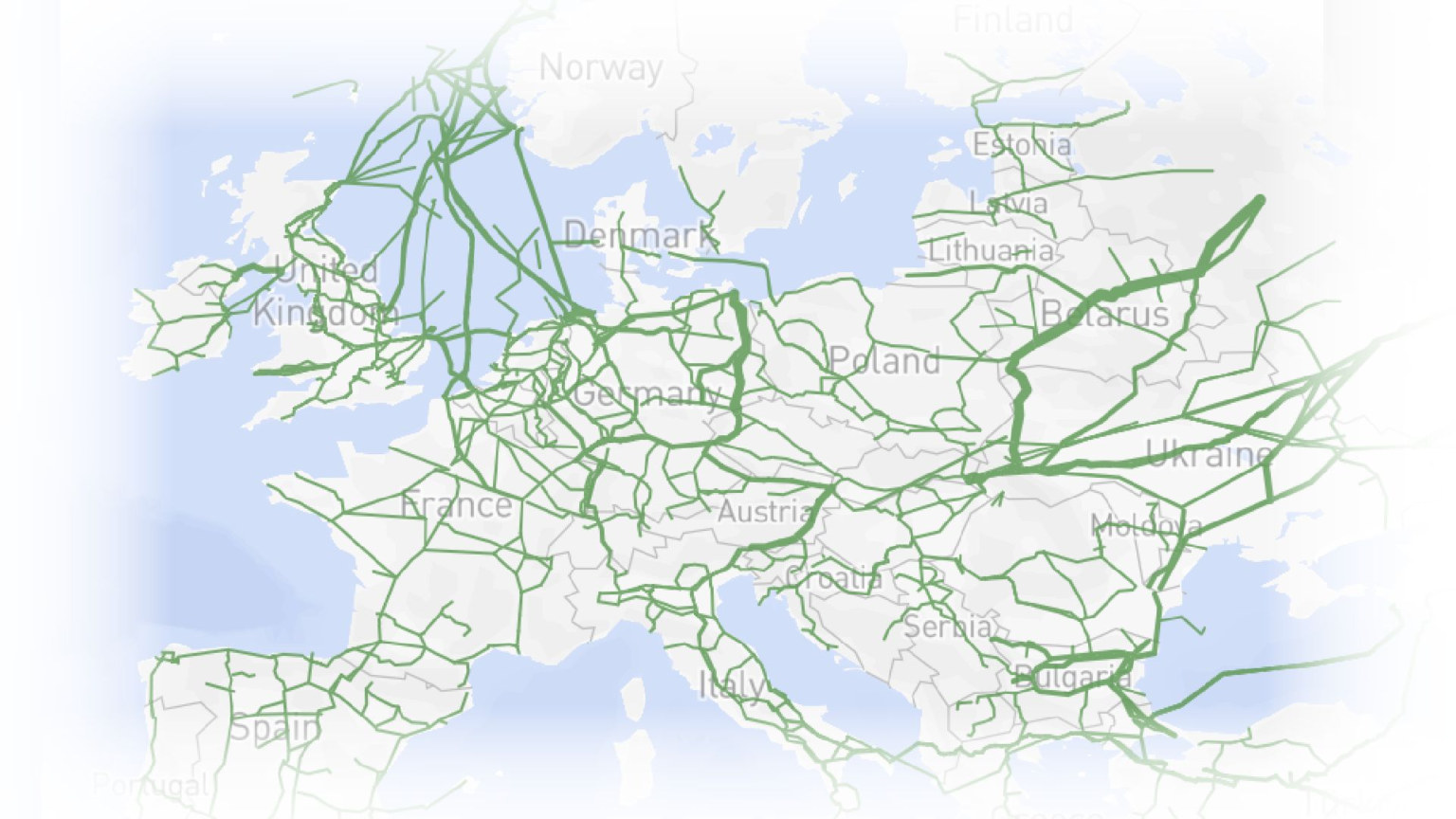

To transport these large volumes of oil and gas, Europe relies on an extensive network of 202,685 km of active pipelines as of 2023, according to GlobalData.

A key part of this network is the 4,000 km (2,500 miles) Druzhba pipeline, one of the world’s longest oil pipelines, with a capacity of 1.2 to 1.4 million barrels per day, carrying oil from eastern Russia through Belarus and Ukraine to Hungary and Slovakia.

Hungary and Slovakia continue to receive oil through the pipeline under a temporary EU exemption, granted to prevent severe energy shortages, as these landlocked countries rely heavily on the Druzhba pipeline and have few alternative import routes or ports.

How has Europe’s reliance on Russian gas changed?

Before Russia’s invasion of Ukraine in February 2022, the EU sourced more than 45 percent of its total gas imports and 27 percent of its oil from Russia. By 2024, these shares had fallen to 19 percent for gas and three percent for oil.

Many European leaders have faced pressure to impose heavier sanctions on Russia as the EU seeks to reduce its dependence on Russian energy. However, this remains challenging for countries heavily reliant on a single energy source, for example, in Hungary, more than 60 percent of energy comes from oil and gas.

Imports of Russian gas fell from over 150 billion cubic meters (bcm) in 2021 to less than 52 bcm in 2024. This shortfall was largely offset by increased imports from other partners: US imports rose from 18.9 bcm in 2021 to 45.1 bcm in 2024, Norway from 79.5 bcm to 91.1 bcm, and other partners from 41.6 bcm to 45 bcm.

What other commodities is Europe buying from Russia?

In addition to lower energy imports, the EU is now importing less nickel, iron and steel from Russia.

However, fertiliser essential for farming, for which Russia is a major producer and exporter, has increased by almost 20 percent from 2021 to 2025.

Earlier this year, the European Commission’s proposal to introduce a 6.5 percent tariff on fertiliser imports from Russia and Belarus was endorsed by the European Commission with the aim to phase out reliance on inorganic fertiliser from Moscow.

Outside the EU, who is buying Russian energy?

In August, China was the largest buyer of Russian fossil fuels, accounting for 5.7 bn euros ($6.7 bn) worth of Russian energy export revenues, with 58 percent (3.1 bn euros) of these imports being crude oil.

India was the second-largest buyer, with 3.6 bn euros ($4.2bn) in imports, of which 78 percent (2.9 bn euros) was crude oil.

Turkiye ranked third, importing 3 bn euros ($3.5bn) worth of energy, including a mix of pipeline gas, oil products, crude oil and coal.

The EU was the fourth-largest purchaser, accounting for 1.2 bn euros ($1.4bn) in imports. Two-thirds of these were Russian LNG and pipeline gas, valued at 773 million euros ($907m).

South Korea was the fifth-largest buyer at 564 million euros ($662m), with three-quarters of its imports consisting of coal.

https://www.aljazeera.com/news/2025/10/3/how-much-of-europes-oil-and-gas-still-comes-from-russia?traffic_source=rss