FTX is seeking court approval to dispute claims from 49 restricted jurisdictions, with Chinese users accounting for 82% of the total value, despite constituting only 5% of the allowed claims in these territories.

The move creates a new hurdle for creditors in countries where crypto trading is subject to legal restrictions or where FTX lacked proper distribution licenses.

According to Sunil, a FTX Creditor Activist, the FTX Recovery Trust plans to treat claims from potentially restricted foreign jurisdictions as disputed until legal opinions determine the feasibility of distribution.

Countries on the restricted list include China, Russia, Iran, North Korea, and 45 other nations where local laws either prohibit crypto trading or where FTX operated without proper licensing.

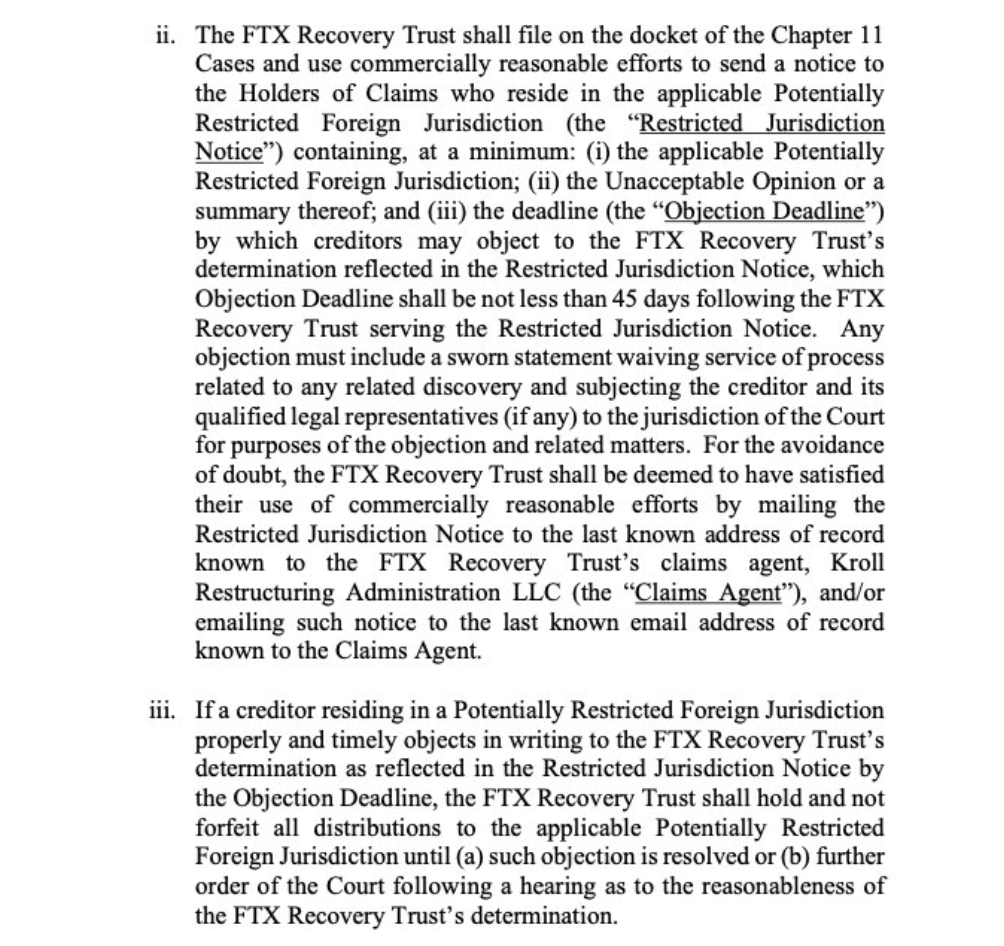

Under the proposed framework, affected creditors will receive 45-day notice periods to object to their jurisdiction’s restricted status. Those who fail to respond within the deadline will forfeit their distribution rights entirely.

The Trust must file sworn statements waiving service of process and submitting to court jurisdiction for any objections.

The development threatens to delay or eliminate payouts for thousands of creditors who have already waited over two years since FTX’s collapse in November 2022.

The exchange has distributed $6.2 billion across two major payment rounds, with the latest $5 billion distribution reaching eligible creditors in May 2025.

Chinese Creditors Face Legal Hurdles Despite Regulatory Clarity

Chinese creditors are mobilizing legal challenges against the restricted jurisdiction designation, arguing that mainland China recognizes the commodity attributes of cryptocurrency and permits its residents to hold digital assets.

One creditor contacted a New York lawyer to raise objections at every procedural stage.

“While mainland China does not support cryptocurrency trading, residents of mainland China are allowed to hold cryptocurrencies,” the creditor stated. “The law recognizes the commodity attributes of virtual currencies.“

The claims process uses USD for settlement, and Chinese residents can legally hold USD overseas despite foreign exchange controls limiting annual USD receipts.

The FTX user further questions why wire transfer settlements aren’t supported given these legal frameworks.

FTX’s restricted jurisdiction list encompasses Afghanistan, Algeria, Belarus, Cambodia, Egypt, Libya, Myanmar, Pakistan, Syria, and Zimbabwe, among others.

The Trust argues local laws create compliance risks that justify the disputed claim treatment.

With this new development, creditors in these jurisdictions must demonstrate legal standing through sworn affidavits and subject themselves to the jurisdiction of U.S. courts.

The process requires significant legal resources that many individual creditors cannot afford.

Ongoing Distribution Challenges Complicate Recovery Process

FTX has distributed funds through two major rounds since beginning payouts in February 2025.

The first distribution totaled $1.2 billion for convenience class creditors with claims under $50,000, while the second distribution reached $5 billion for larger claimants.

Dotcom Customer Entitlement Claims received 72% distributions, while US Customer Entitlement Claims received 54% payouts.

General Unsecured Claims and Digital Asset Loan Claims both received 61% distributions. Convenience Claims received full 120% reimbursement, including 9% annual interest.

Moreover, the exchange added Payoneer as a third official distributor alongside BitGo and Kraken to expand payment accessibility across 93 jurisdictions.

However, creditors in restricted territories remain excluded from these distribution channels.

In a development surrounding the collapse of the crypto exchange, FTX lawyers successfully defended against Three Arrows Capital’s $1.5 billion claim, arguing the hedge fund’s losses resulted from failed trading strategies rather than improper liquidations.

The court filing dismissed 3AC’s claim as “baseless and rooted in the firm’s own trading missteps.”

Sam Bankman-Fried, the former CEO of FTX, remains imprisoned until December 2044 after receiving a 25-year sentence for fraud charges.

He was recently moved to an Oklahoma transfer facility following solitary confinement for an unauthorized interview.

However, for accomplices like Basketball legend Shaquille O’Neal, who settled his FTX promotional lawsuit for $1.8 million, becoming the first celebrity to finalize litigation tied to the exchange’s collapse.

Other celebrity endorsers, including Tom Brady and Kevin O’Leary, face ongoing legal challenges.

The post FTX Seeks Court Approval for Restricted Jurisdiction Claims as 82% of Value Comes from Chinese Users appeared first on Cryptonews.

https://cryptonews.com/news/ftx-seeks-court-approval-for-restricted-jurisdiction-claims-as-82-of-value-comes-from-chinese-users/