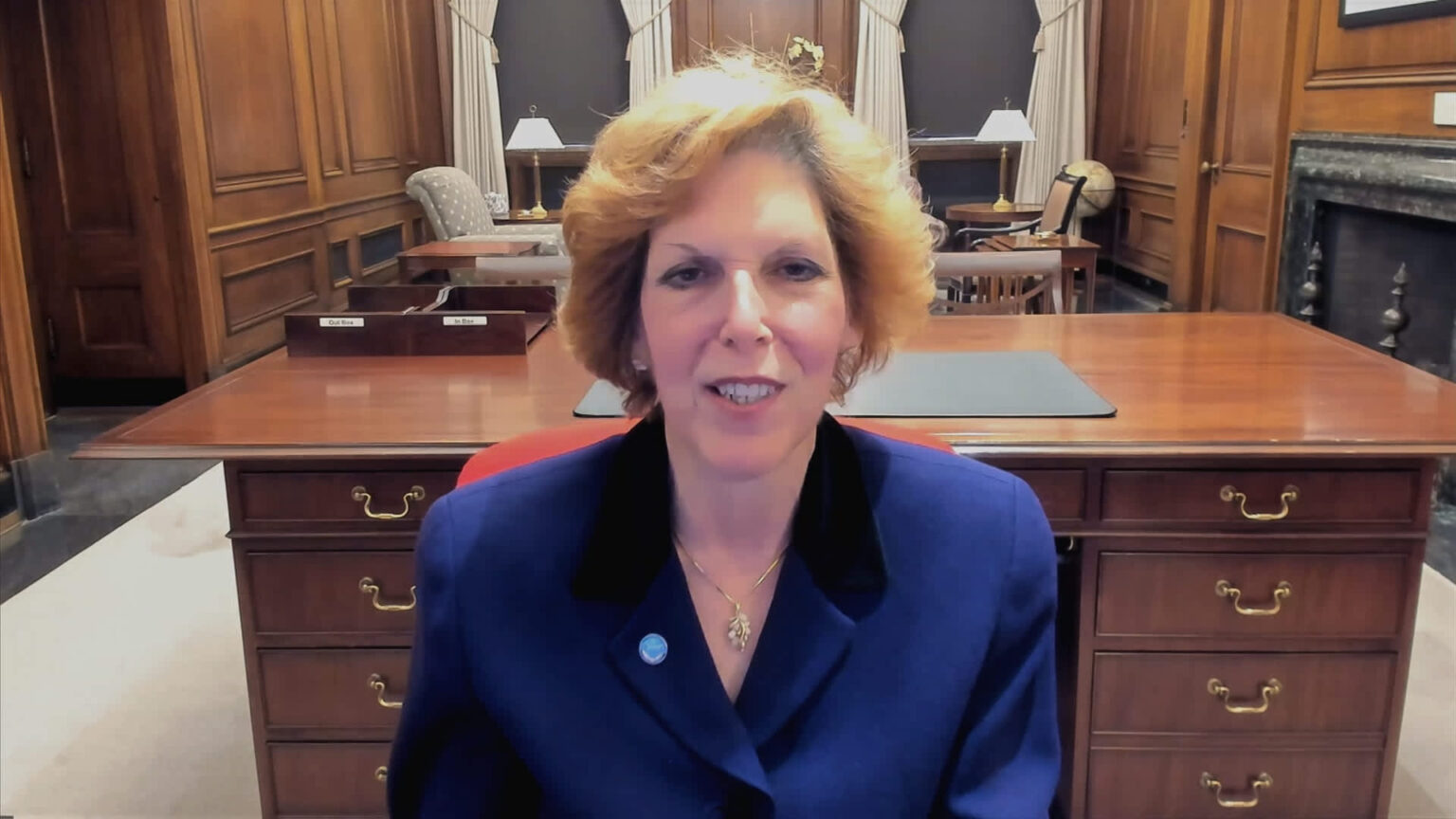

President and CEO of the Federal Reserve Bank of Cleveland, Loretta Mester makes an look on “The Exchange” on March 7, 2024.

CNBC

Cleveland Federal Reserve President Loretta Mester stated Tuesday she nonetheless expects rate of interest cuts this yr, however dominated out the subsequent coverage assembly in May.

Mester additionally indicated that the long-run path is larger than policymakers had beforehand thought.

The central financial institution official famous progress made on inflation whereas the financial system has continued to develop. Should that proceed, fee cuts are possible, although she did not provide any steering on timing or extent.

“I continue to think that the most likely scenario is that inflation will continue on its downward trajectory to 2 percent over time. But I need to see more data to raise my confidence,” Mester stated in ready remarks for a speech in Cleveland.

Additional inflation readings will present clues as as to whether some higher-than-expected knowledge factors this yr both have been non permanent blips or an indication that the progress on inflation “is stalling out,” she added.

“I do not expect I will have enough information by the time of the FOMC’s next meeting to make that determination,” Mester stated.

Those remarks come almost two weeks after the rate-setting Federal Open Market Committee once more voted to carry its key in a single day borrowing fee in a variety between 5.25%-5.5%, the place it has been since July 2023. The post-meeting assertion echoed Mester’s remarks that the committee must see extra proof that inflation is progressing towards the two% goal earlier than it can begin decreasing charges.

Mester’s feedback would appear to rule out a minimize on the April 30-May 1 FOMC assembly, a sentiment additionally mirrored in market pricing. Mester is a voting member of the FOMC however will depart in June after having served the 10-year restrict.

Futures merchants count on the Fed to begin easing in June and to chop by three-quarters of a proportion level by the tip of the yr.

While on the lookout for fee cuts, Mester stated she thinks the long-run federal funds fee can be larger than the long-standing expectation of two.5%. Instead, she sees the so-called impartial or “r*” fee at 3%. The fee is taken into account the extent the place coverage is neither restrictive nor stimulative. After the March assembly, the long-rate fee projection moved as much as 2.6%, indicating there are different members leaning larger.

Mester famous the speed was very low when the Covid pandemic hit and gave the Fed little wiggle room to spice up the financial system.

“At this point, we are seeking to calibrate our policy well to economic developments so we can avoid having to act in an aggressive fashion,” she stated.

https://www.cnbc.com/2024/04/02/feds-mester-still-expects-rate-cuts-this-year-but-rules-out-may.html