A Federal Reserve official mentioned Monday that the market might have misunderstood the central financial institution’s meant message final week after shares and bonds rallied sharply.

The Fed voted final week to carry charges regular as soon as once more, and its up to date projections confirmed an expectation of three fee cuts in 2024. That prompted a rally in shares and bonds, with the Dow Jones Industrial Average leaping to a document excessive.

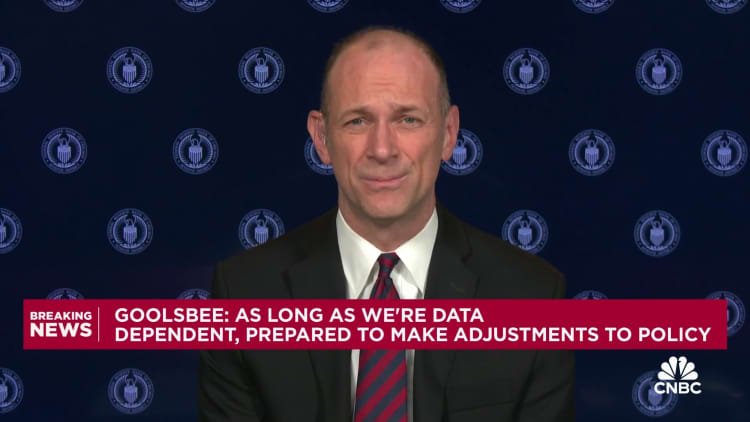

“It’s not what you say, or what the chair says. It’s what did they hear, and what did they want to hear,” mentioned Chicago Fed President Austan Goolsbee mentioned on CNBC’s “Squawk Box.” “I was confused a bit — was the market just imputing, here’s what we want them to be saying?”

The Dow hit a document excessive final week.

The Fed president additionally pushed again in opposition to the concept the Fed is actively planning on a sequence of fee cuts.

“We don’t debate specific policies, speculatively, about the future. We vote on that meeting,” he mentioned.

Trading within the choices market implies that merchants see 3.75% to 4.00% because the almost certainly vary for the Fed’s benchmark fee on the finish of 2024, in accordance with the CME FedWatch Tool. That could be six quarter-point cuts beneath the present Fed funds fee, or double what was forecast within the central financial institution’s abstract of financial projections.

Goolsbee didn’t explicitly say that the market pricing was incorrect, however did spotlight this distinction.

“The market expectation of the number of rate cuts is greater than what the SEP projection is,” Goolsbee mentioned.

Goolsbee shouldn’t be the one Fed official who has downplayed the assembly within the wake of the market rally. New York Fed President John Williams mentioned on CNBC’s “Squawk Box” on Friday that “we aren’t really talking about rate cuts right now.”

https://www.cnbc.com/2023/12/18/feds-goolsbee-says-he-was-confused-by-last-weeks-market-reaction-.html