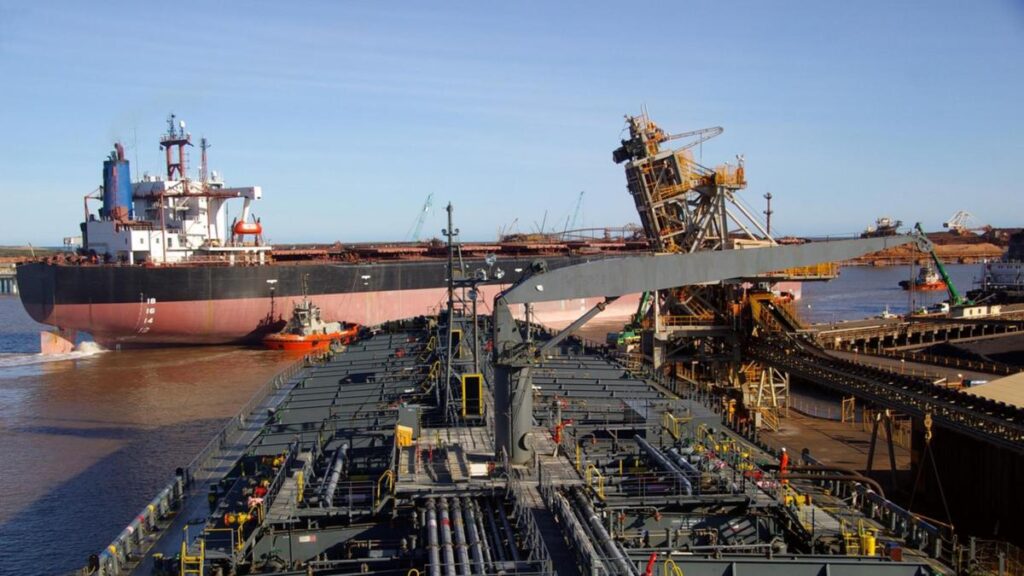

Collapsing iron ore and coal prices are tipped to hammer the national budget in coming years.

The latest budget forecasts show Australia is not immune to global trade tensions, with Australia’s largest trade export, iron ore, likely to be impacted by a slowing Chinese economy.

Treasury estimates iron ore will fall by more than 40 per cent from today’s price of $US102 to $US60 by March 2026, budget papers show.

Iron ore currently makes up 21 per cent of Australia’s total value of goods and service exports in 2023-2024.

Treasury also estimates metallurgical coal will decline to $US140 a tonne and thermal coal will fall to $US70.

“Global developments also cast a shadow over the Australian economic outlook,” the budget papers said.

“Ongoing weaker economic conditions in China could lead to lower service and commodity exports.

“Policy uncertainty related to trade tensions could weigh on domestic investment and employment.

“The use of tariffs by major trading partners could lead to higher import prices and temporarily higher inflation and lower growth.”

The US is embarking on a tariffs plan under President Donald Trump, who has already

added a 25 per cent tariff on all steel and aluminium imports, including from Australia, although this is tipped to have a modest impact on the national economy.

He has also added a 25 per cent tariff on Canadian and Mexican goods as well as a 20 per cent tariff on China, with the latter predicted to have a bigger impact on the Australian economy.

In its budget monitor report, released before Tuesday, Deloitte Access Economics said governments needed to stop relying on unforeseen upticks in revenue through high commodity prices.

“But that recipe may fail this time. Treasury’s commodity price assumptions look less conservative than they have for some time,” report co-author Stephen Smith said.

“And there are some genuine economic surprises on the downside that mean revenues are simply not going to measure up this time around.”

The falling commodity prices will help lead the Australian budget back into the red over at least the next four years.

The budget forecasts show the government will run a deficit of $29.31bn in the 2024-2025 financial year.

This figure will balloon to $42.60bn in 2025-2026 before falling to negative $26.514 in 2026-2027 and minus $22.02bn in 2027-2028.

The budget deficit for the next four years follows back-to-back surpluses recorded at the past two budgets, the first time the budget had been in surplus in 15 years.

Treasurer Jim Chalmers put a positive spin on these figures, saying the budget is $207bn better off than what Labor Party came to government and is still an improvement from forward estimates three years ago.

“In our first two years, we posted the first back-to-back surpluses in nearly two decades.

Our deficit this year has almost halved since we came to office,” Mr Chalmers said.

“Next year’s deficit is $42bn, lower than what was forecast at the last election and lower than at the mid-year update.”

Offsetting some of the falls in revenue from mining is an increase in household taxes, as more Australians are currently in work.

“Excluding GST and policy decisions, tax receipts have been revised up by $6.7bn in 2025-26 and $9.4bn over the five years to 2028–29,” the budget papers say.

“Higher employment and continuing strength in the labour market is the main driver of the upgrade since MYEFO.”

The rise in tax receipts from workers comes despite Mr Chalmers announcing a modest tax cut from July 1, 2026.

From July 1, Australians earning on average $79,000 a year will pocket $268 (or $5.15 a week) in 2026-2027, before going up to $536 a year (or $10.30) in 2027-2028.

“Every Australian taxpayer will get a tax cut next year and the year after, to top up the tax cuts which began last July,” Mr Chalmers said.

“This will take the first tax rate down to its lowest level in more than half a century.

“These additional tax cuts are modest but will make a difference.

“This is on top of the $2190 delivered for the average Australian through the stage three tax cuts last year.

“In total, the average Australian will get a total tax cut of $2548, or about $50 a week.”

The budget papers reveal the average Australian taxpayer will now pay $30,000 less in tax by 2035-2036.

The tax-to-GDP ratio is expected to be 23.5 per cent of GDP in 2025–26 and then fall to 23.4 per cent of GDP by the end of the forward estimates.

https://thewest.com.au/business/falling-commodity-prices-push-budget-back-in-the-red-c-18156868