Ethereum is trading near $4,471 after a modest 1.14% dip over the past 24 hours, leaving its market cap at $539.7 billion. Despite short-term volatility, onchain signals, ETF inflows, and corporate treasury moves suggest ETH may be preparing for a breakout that could carry prices toward the $5,000 milestone.

Network Signals and Onchain Strength

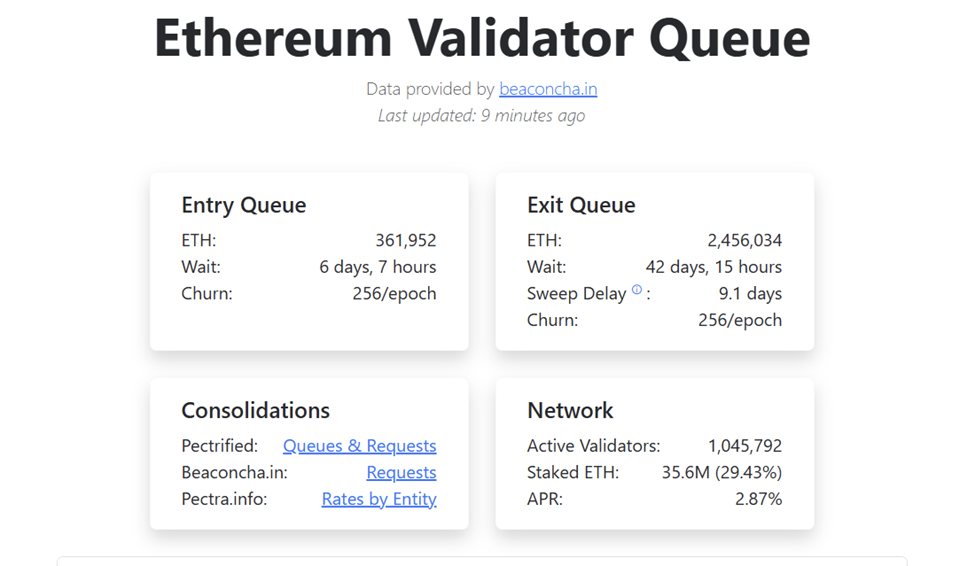

Ethereum’s recent price action has been mixed. On one side, validator exits have surged, with more than 2.45 million ETH—worth $11 billion—waiting to be unstaked. This has extended the withdrawal queue to an estimated 42 days, raising concerns about near-term supply pressure.

Still, unstaking doesn’t always translate into immediate selling. For many institutions, it’s part of a rebalancing strategy.

At the same time, network fundamentals are improving. Transaction fees climbed 35% from last week, and active addresses rose 10%, reflecting growing use of Ethereum’s ecosystem.

Higher network activity boosts validator yields and strengthens security, while fee burns reduce overall supply. Corporate treasuries are also expanding exposure.

In the past month alone, companies added 877,800 ETH, about $4 billion at current prices, into reserves. This steady inflow has come from firms like Bitming Immersion Tech, SharpLink Gaming, and The Ether Machine, all underscoring ETH’s rising profile as a reserve asset.

ETFs and Treasury Support Fuel $5K Ethereum Outlook

Ethereum has outpaced the broader crypto market by 21% over the past two months, maintaining dominance in decentralized applications. According to DeFiLlama, Ethereum, including its layer-2 networks, controls 64.5% of total value locked, far ahead of Solana’s 9%.

Spot Ether ETFs are also providing powerful institutional tailwinds. Assets under management in these funds now stand at $24.7 billion, with $213 million in net inflows last Thursday alone. These products offer a regulated channel for institutions to gain ETH exposure, further cementing Ethereum’s role in traditional finance.

Exchange balances continue to shrink, with 2.69 million ETH withdrawn in the last two months—driving available supply to a five-year low. That reduction in liquid ETH not only eases selling pressure but also signals sustained accumulation.

Together, shrinking supply, institutional inflows, and corporate reserves are building a foundation for Ethereum’s next move higher.

Ethereum (ETH/USD) Technical Roadmap Toward $5,000

From a technical perspective, Ethereum price prediction is neutral as ETH is consolidating inside a symmetrical triangle, with resistance around $4,566 and support at $4,440.

Momentum indicators are mixed: the RSI sits near 41, pointing to oversold conditions, while candlestick patterns hint at bearish pressure.

A bullish engulfing candle above $4,566 could reverse sentiment quickly, opening the way toward $4,670, $4,775, and eventually $5,000.

The key range for traders is $4,440 to $4,566. A sustained defense of this zone favors upside continuation, with projections suggesting a breakout path toward $5,000–$5,200 in the coming weeks. A breakdown below $4,350, however, could drag ETH back toward $4,238 or even $4,108 before new demand appears.

Despite short-term caution, the bigger picture remains constructive. Ethereum’s combination of growing institutional flows, shrinking supply, and resilient network activity suggests that once current pressures ease, the path to $5,000 looks increasingly attainable.

Presale Bitcoin Hyper ($HYPER) Combines BTC Security With Solana Speed

Bitcoin Hyper ($HYPER) is positioning itself as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM). Its goal is to expand the BTC ecosystem by enabling lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation.

By combining BTC’s unmatched security with Solana’s high-performance framework, the project opens the door to entirely new use cases, including seamless BTC bridging and scalable dApp development.

The team has put strong emphasis on trust and scalability, with the project audited by Consult to give investors confidence in its foundations.

Momentum is building quickly. The presale has already crossed $17.2 million, leaving only a limited allocation still available. At today’s stage, HYPER tokens are priced at just $0.012945—but that figure will increase as the presale progresses.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Ethereum Price Prediction: This Critical Onchain Level Could Unlock a Push to $5,000 appeared first on Cryptonews.

https://cryptonews.com/news/ethereum-price-prediction-this-critical-onchain-level-could-unlock-a-push-to-5000/