Ethereum (ETH) continues to dominate crypto headlines, but not for the reasons many were hoping. The U.S. Securities and Exchange Commission (SEC) has once again delayed decisions on Ethereum exchange-traded funds (ETFs) tied to staking, including BlackRock’s iShares Ethereum Trust and Franklin Templeton’s proposal. With deadlines now pushed back to late October, institutional investors will need to wait longer before gaining regulated access to ETH.

At the same time, traders are looking toward other parts of the market for momentum. One project drawing increasing attention is Mutuum Finance (MUTM), a decentralized finance (DeFi) protocol currently in presale, where the token is priced under $0.05 and has shown notable fundraising progress.

Ethereum’s Regulatory Roadblocks

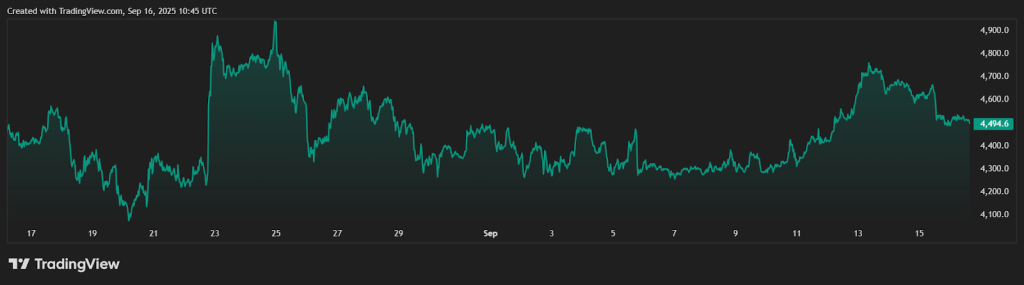

Ethereum remains the second-largest cryptocurrency by market capitalization, currently valued at more than $545 billion, with ETH trading in the $4,510–$4,520 range. Its role as the backbone of decentralized applications and smart contracts is unchanged, but the delay in ETF approvals highlights ongoing regulatory scrutiny.

For institutions, regulated ETH products would represent a major milestone, but with the SEC’s decision postponed until October 30, 2025, the short-term outlook has become less certain. While ETH could still move toward the $5,000 level, the timeline for such moves may now depend on developments outside of Ethereum’s technology and ecosystem.

Mutuum Finance (MUTM)

Mutuum Finance is developing a non-custodial lending and borrowing protocol designed to bring lenders, borrowers, and liquidators into one system. The project’s presale has raised more than $15.9 million to date, with over 16,350 holders. It is currently in Phase 6 at $0.035, with the launch price set at $0.06, representing a near 2x increase from the current stage and around 250% growth compared to the opening phase at $0.01.

According to the roadmap, Mutuum plans to release a beta version of its platform at the same time as the token lists, meaning core lending and borrowing features could be available from day one. This approach may also improve the token’s prospects for exchange listings once trading begins.

Security has been another focus, with the protocol undergoing a CertiK audit where its smart contracts received a Token Scan score of 90/100. In addition, a $50,000 bug bounty program and a $100,000 community giveaway are in place, signaling efforts to strengthen trust and broaden participation.

Why Traders Are Paying Attention

The protocol is designed around two complementary lending models: Peer-to-Contract (P2C) liquidity pools for mainstream assets such as ETH or stablecoins, and a Peer-to-Peer (P2P) marketplace for niche or high-risk tokens like SHIB or DOGE. Borrowers can choose between variable rates that adjust with liquidity levels or stable-rate options that offer predictability, while lenders receive mtTokens, yield-bearing assets that accrue interest in real time.

A portion of the protocol’s fees will be used to buy MUTM from the open market and redistribute it to participants, a design that could add buying demand over time as usage expands. Compared to projects with limited use cases, this structure has drawn attention for embedding utility and demand into the token’s design.

Ethereum continues to anchor the broader DeFi ecosystem, but regulatory hurdles have slowed near-term developments for institutional investors. In contrast, Mutuum Finance is progressing through its presale with a platform scheduled to go live alongside its token listing.

Whether it becomes a major player in DeFi will depend on the successful delivery of its roadmap and user adoption. Still, its combination of presale momentum, dual lending model, and tokenomics has positioned it as a project many traders are now monitoring as Q4 2025 approaches.

For more information about Mutuum Finance (MUTM), visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

The post Ethereum ETF Delayed Again, Yet This Cheap DeFi Crypto Token Gains Traction Among Traders appeared first on Cryptonews.

https://cryptonews.com/press-releases/ethereum-etf-delayed-again-yet-this-cheap-defi-crypto-token-gains-traction-among-traders/