Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

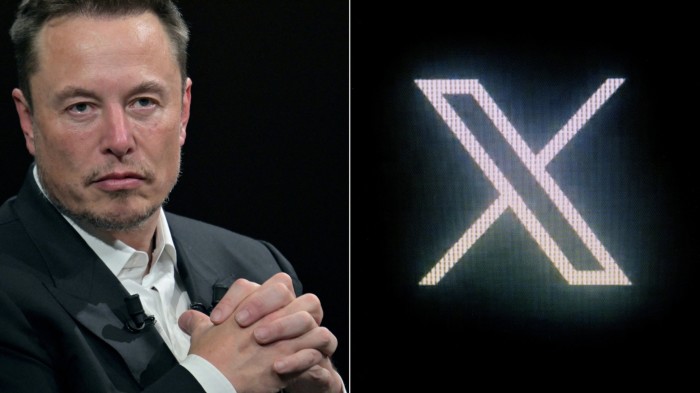

Social media site X’s valuation has soared back to $44bn, underscoring the sharp turnaround in the company’s fortunes since its owner Elon Musk assumed the role of staunch ally to President Donald Trump.

Investors valued the platform at $44bn in a so-called secondary deal earlier this month, in which they exchange existing stakes in the company, according to two people with knowledge of the matter.

X was also working on raising fresh capital in a primary round, which would aim to raise about $2bn through selling new equity and be used to pay off more than $1bn of junior debt that Musk agreed to take on to finance his buyout of the company, then known as Twitter, in 2022, several people briefed on the situation said.

Since taking over the group, Musk has loosened the platform’s moderation policies, something that prompted many advertisers to leave. Disclosures from Fidelity Investments in late September implied a valuation for the company that was below $10bn. Musk purchased Twitter for $44bn.

The new $44bn valuation represents a rebound for Musk and the group’s investors, including Andreessen Horowitz, Sequoia Capital, 8VC, Goanna Capital and Fidelity Investments. The deal would help set a price for the upcoming primary round.

X’s revenues have dropped since Musk’s takeover, but it posted about $1.2bn in adjusted earnings before interest, taxes, depreciation and amortisation in 2024, according to two people familiar with the matter — roughly flat with the period before Musk’s takeover.

Another two people with knowledge of X’s finances said there were signs Musk’s cost-cutting plan for the company was working, and that revenues had been improving. A further person noted, however, that the ebitda figure was “wildly adjusted”.

X declined to comment.

A group of seven Wall Street banks including Morgan Stanley, Bank of America, Barclays and MUFG have sold almost all the $12.5bn of loans Musk used to finance his takeover of Twitter in 2022. The lenders had been saddled with the debt while Musk sought to turn around X’s operations as equity investors repriced their stakes in the platform at dramatic discounts.

Investor interest in the loans improved in the weeks following Trump’s election victory in November, given the billionaire’s proximity to the new administration as a confidant to the president and the head of the so-called Department of Government Efficiency (Doge) intent on cutting government red tape.

It also improved after Musk gave a 25 per cent stake in his artificial intelligence start-up xAI to investors in the social media company early last year. xAI has obtained a valuation of $45bn, and the novel arrangement has provided new security to X’s lenders and boosted the platform’s valuation.

One banker close to the fundraising said the upcoming primary round would help X “clean up the last bit of debt”.

The banks agreed to give the company time to raise fresh equity or equity-like funding to pay down the remaining junior debt, instead of offloading it when they sold more than $11bn of the loans in January and February, two people said.

In a further boost for X, groups such as Amazon have boosted marketing spending recently as Musk’s relationship with Trump has deepened. X recently added a number of brands, including Nestlé, Lego, Pinterest and Shell, to a lawsuit alleging the companies had previously illegally boycotted the platform.

Beyond advertising, X is expanding its efforts to diversify into new revenue streams and become what Musk has dubbed “the everything app”. Chief executive Linda Yaccarino announced in January that the company would later this year launch X Money, a digital wallet and peer-to-peer payment service, with Visa as its first partner.

It is also working closely with xAI to integrate its AI technology into the platform, on Monday launching the latest version of its AI chatbot Grok 3 for premium subscribers. X plans to wield the AI technology developed by xAI to boost its ads offering and products, according to one person familiar with the matter.

https://www.ft.com/content/d4616dec-c4c7-417f-8549-134710bbc5b1