Stay informed with free updates

Simply sign up to the Oil myFT Digest — delivered directly to your inbox.

Investors have been nervous about oil prices since Israel launched a surprise attack on Iran 12 days ago, a move that raised fears of potential disruption to crude supplies and a resulting surge in prices.

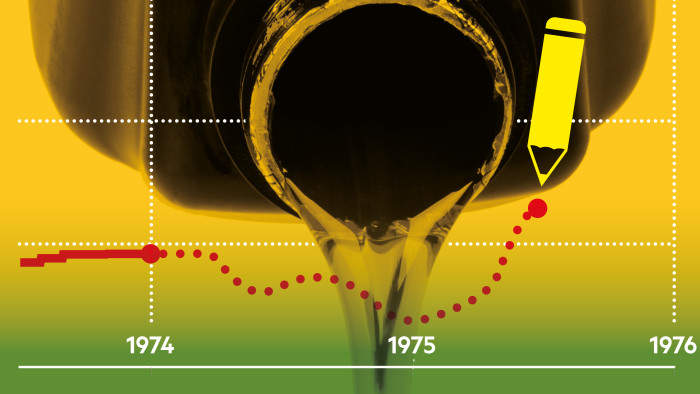

How have the oil price undulations of the past two weeks compared with what happened during and after previous geopolitical crises affecting the region? The lesson from history is that oil prices are rarely entirely predicable — see how well you can draw in the missing data in the charts below.

1973: Yom Kippur war

Egypt and Syria launched a surprise offensive against Israel on October 6 1973, on Yom Kippur, the holiest day in the Jewish calendar. Israel counter-attacked before a ceasefire officially ended the conflict about 20 days later. The war was short yet politically significant — what was its impact on oil prices?

The full impact of the war on the price of oil became apparent only after the Organization of Arab Petroleum Exporting Countries (OAPEC), the oil cartel, imposed a crude embargo on the US in retaliation for its support of the Israeli military during the conflict. Along with a cut in oil production, the embargo kept oil prices elevated for years.

1979: Deposing of the Shah of Iran

In February 1979, the Shah of oil-rich Iran, Mohammad Reza Pahlavi, was swept from power during the Iranian Revolution. In his place came Ayatollah Ruhollah Khomeini, who took over as supreme leader of the newly formed Islamic republic.

Oil production collapsed amid the upheaval, triggering panic across global markets. Oil buyers were concerned that this “crisis would only get worse, that the combination of religious fundamentalism and nationalism would spread to other oil-producing countries in the region”, wrote Samantha Gross, a fellow at the Brookings Institution.

The price of oil more than doubled and remained elevated during much of the early to mid-1980s.

1990: Invasion of Kuwait

Iraq’s army, under President Saddam Hussein, invaded Kuwait in August 1990, targeting its neighbour’s vast oil reserves.

The attack “resulted in a gross disruption of 4.3mn barrels of oil per day”, the International Energy Agency noted months later. Markets feared the conflict could spread across the region, threatening broader disruption to global oil supplies.

But Saudi Arabia, alongside other oil producers, increased production, offsetting the loss of supplies from Iraq and Kuwait. This resulted in the global oil price largely returning to pre-invasion levels by early 1991.

2001: 9/11 attacks

On September 11 2001, 19 al-Qaeda operatives hijacked four US passenger jets in co-ordinated attacks. Two planes were flown into New York skyscrapers, a third struck the Pentagon and a fourth crashed in Pennsylvania. It was one of the deadliest terrorist attacks in US history.

The “attacks on the US caused a sharp reduction in air travel and further lowered expectations of global economic growth for this year and next”, the IEA said at the time. The intergovernmental group subsequently cut its forecast for global oil demand growth, with jet fuel accounting for most of the downward revision.

But by mid-2002, when it was clear that there would be no substantial disruptions to oil production, crude prices were trading around the same level as a year earlier.

2025: Israel and US strike Iran

The focus has again turned to oil markets amid the tension created by Israeli and US strikes on Iran, but the landscape for global oil production has shifted since the previous crises. How has the US itself fared as a producer of oil since the start of the 20th century?

One reason often cited for oil investors’ more muted reactions to recent bouts of geopolitical turmoil is the rise in US oil output, driven by the shale boom. This has made global supply less dependent on the Opec-producing nations.

https://www.ft.com/content/c618a4c0-740e-4dbf-bbde-192b8b754223