The crypto market rose 3.29% over the last 24 hours, following huge institutional moves, policy shifts and massive inflows in ETFs, showing bullish momentum. The global cryptocurrency market cap on Friday is $3.86 trillion, per CoinMarketCap data.

Renewed positive sentiment surrounds the crypto market, fueled by factors like institutional adoption and the recent Trump executive order regarding crypto in 401(k) plans.

Crypto ETFs Inflows Are Big Market Drivers – Here’s Why

Besides, the US Bitcoin and Ether exchange-traded funds (ETFs) have rebounded, marking another big day for crypto inflows.

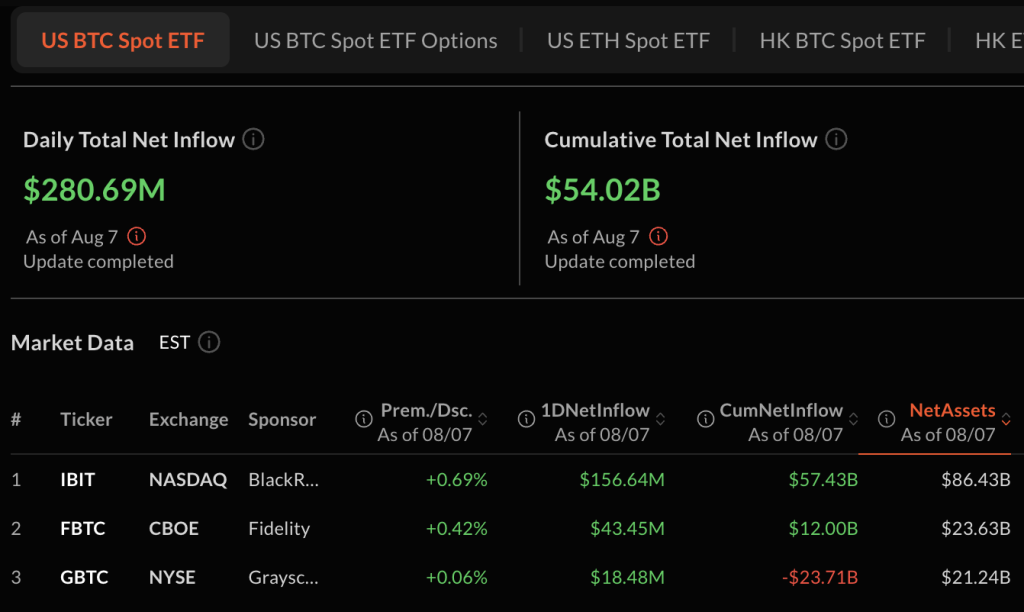

Spot Bitcoin ETFs, led by BlackRock’s IBIT, saw over $280.69 million in net inflows on August 7, according to Sosovalue data. BlackRock’s IBIT alone saw $156.64 million in net inflows, followed by Fidelity’s FBTC, which recorded $43.45 million inflows as of Thursday.

Additionally, Ether ETFs witnessed $222.34 million in net inflow on Thursday, led by BlackRock’s ETHA, recording $103.52 million.

In total, more than $503 million was poured into BTC & ETH ETFs in a single day.

“Inflows are back, regulators are moving, and altcoins are positioning for breakout. Keep faith in institutional flows and token-level triggers,” one user wrote on X.

Regulatory Progress, Institutional Adoption Led to Bullish Impact

Further, XRP climbed more than 13% on Friday, after the US SEC and Ripple agreed to dismiss appeals, ending their four-year legal battle. This means a reduced legal risk for XRP holders, boosting sentiments.

XRP is trading around $3.34 at press time, with bulls anticipating that a break above the resistance level $3.40, could lead $3.70 mark.

Additionally, Ethereum is up more than $3,900 on Friday, following a fresh institutional interest in ETH treasury. Analysts have predicted that a test of the $4,000 mark could be imminent.

The price increase comes as SharpLink Gaming announced Thursday that it has secured $200 million in a direct offering led by four global institutional investors, which will be used to expand its Ethereum treasury.

On the technical front, the total BTC futures open interest (OI) stands at 691,550 BTC, equivalent to $80 billion, according to Coinglass.

CryptoQuant analyst Axel Adler Jr reported that the SMA-120 line has reversed upward, thus indicating a shift from a prolonged bearish trend since late July.

“A similar attempt a week ago failed,” he wrote on X. Currently, the market has transitioned from aggressive short pressure phase to neutral-bullish.”

The post Crypto Market Turns Green with Over $500M Inflows to BTC and ETH ETFs appeared first on Cryptonews.

https://cryptonews.com/news/crypto-market-turns-green-with-over-500m-inflows-to-btc-and-eth-etfs/