Cryptocurrency markets faced a brutal correction on what’s being dubbed “Black Monday,” with total liquidations exceeding $1.36 billion in the past 24 hours.

The crypto market is falling along with global stock markets following Trump’s ‘Liberation Day’ tariffs.

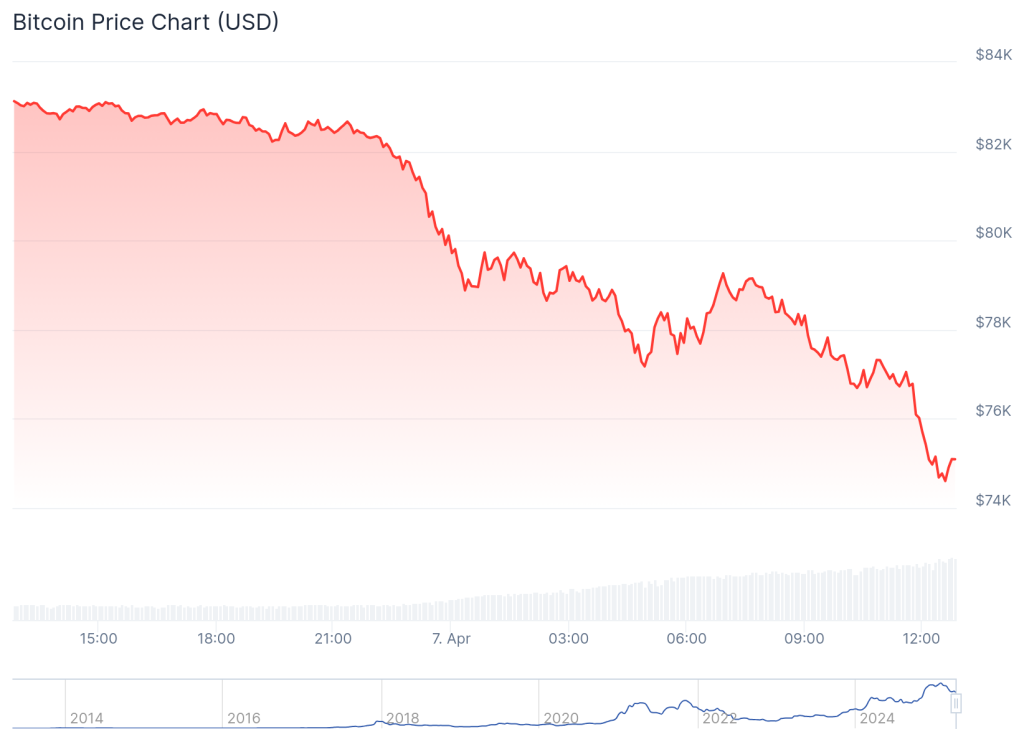

The crash was led by Bitcoin (BTC), which fell to nearly $75,000, triggering a cascade of forced liquidations across the board. The entire crypto market is down nearly 13% in the last 24 hours.

According to data from CoinGlass, long-positioned futures traders bore the brunt of the market turmoil. Over $1.2 billion of long bets were wiped out, with Bitcoin longs accounting for more than $392 million in losses.

ETH, SOL, and XRP Traders Suffer Nearly $730M in Liquidations Amid Market Crash

Ether (ETH) traders lost close to $328 million, while altcoins—including Solana (SOL) and XRP—contributed nearly $400 million to the total, with each seeing about $60 million in liquidations.

ETH plunged 20% to $1,449 while major altcoins like SOL, XRP, and Dogecoin (DOGE) dropped by as much as 20% in the last 24 hours.

BNB also dropped nearly 10%. Mid-cap and low-cap tokens were also swept up in the selloff, falling between 10% and 20%, per CoinGecko data.

Nearly 86% of all futures traders had bet on a price rally, anticipating short-term relief in the market.

However, the violent downturn forced exchanges to liquidate leveraged positions en masse, as traders failed to meet margin calls.

Liquidations of this scale are often signs of extreme market stress. Forced selling during a downturn can accelerate price declines, while potentially setting the stage for a sharp rebound once the excess leverage is flushed out.

Crypto Crash Mirrors U.S. Stock Futures Slump

Crypto wasn’t alone in the selloff. U.S. stock futures also plunged Sunday night, heightening fears of a broader market crash.

S&P 500 futures fell 5.98%, Nasdaq 100 futures slid 6.2%, and Dow futures dropped 5.5%, all pointing to a chaotic start to the trading week.

The sharp selloff follows growing macroeconomic uncertainty, intensifying trade tensions, and investor jitters over President Donald Trump’s sweeping tariff order.

CNBC’s Jim Cramer referenced the 1987 crash in a post on Saturday, warning that a “Black Monday” could weigh heavily on the administration’s legacy.

Markets in Asia mirrored the panic. Japan’s Nikkei 225 tumbled 8.9% early Monday, while Taiwan’s Taiex index plunged nearly 10%, triggering circuit breakers on heavyweights like TSMC and Foxconn.

Authorities responded by temporarily banning short-selling to curb further volatility.

Meanwhile, retail investors pulled a record $1.5 billion from equities in just 2.5 hours on Friday, underscoring the depth of fear in the market.

Institutional capital continued its exodus, making March 2025 one of the sharpest withdrawal periods in recent history.

As reported, U.S. stock markets have experienced a staggering $11 trillion wipeout since February 19, with losses accelerating on April 4 following heightened concerns over President Donald Trump’s sweeping tariff measures.

The single-day market loss amounted to $3.25 trillion—exceeding the total valuation of the global cryptocurrency market, which stood at $2.68 trillion at the time.

Among major tech players, dubbed the “Magnificent 7,” Tesla led the plunge, falling 10.42%. Nvidia and Apple also saw steep losses, dropping 7.36% and 7.29% respectively.

The post Crypto Liquidations Surpass $1.3B as Markets Continue to Crash on ‘Black Monday’ appeared first on Cryptonews.

https://cryptonews.com/news/crypto-liquidations-hit-1-3b-as-markets-crash-on-black-monday/