Wednesday was a consequential day for Donald Trump’s presidency, and the repercussions could have an impact on Bitcoin.

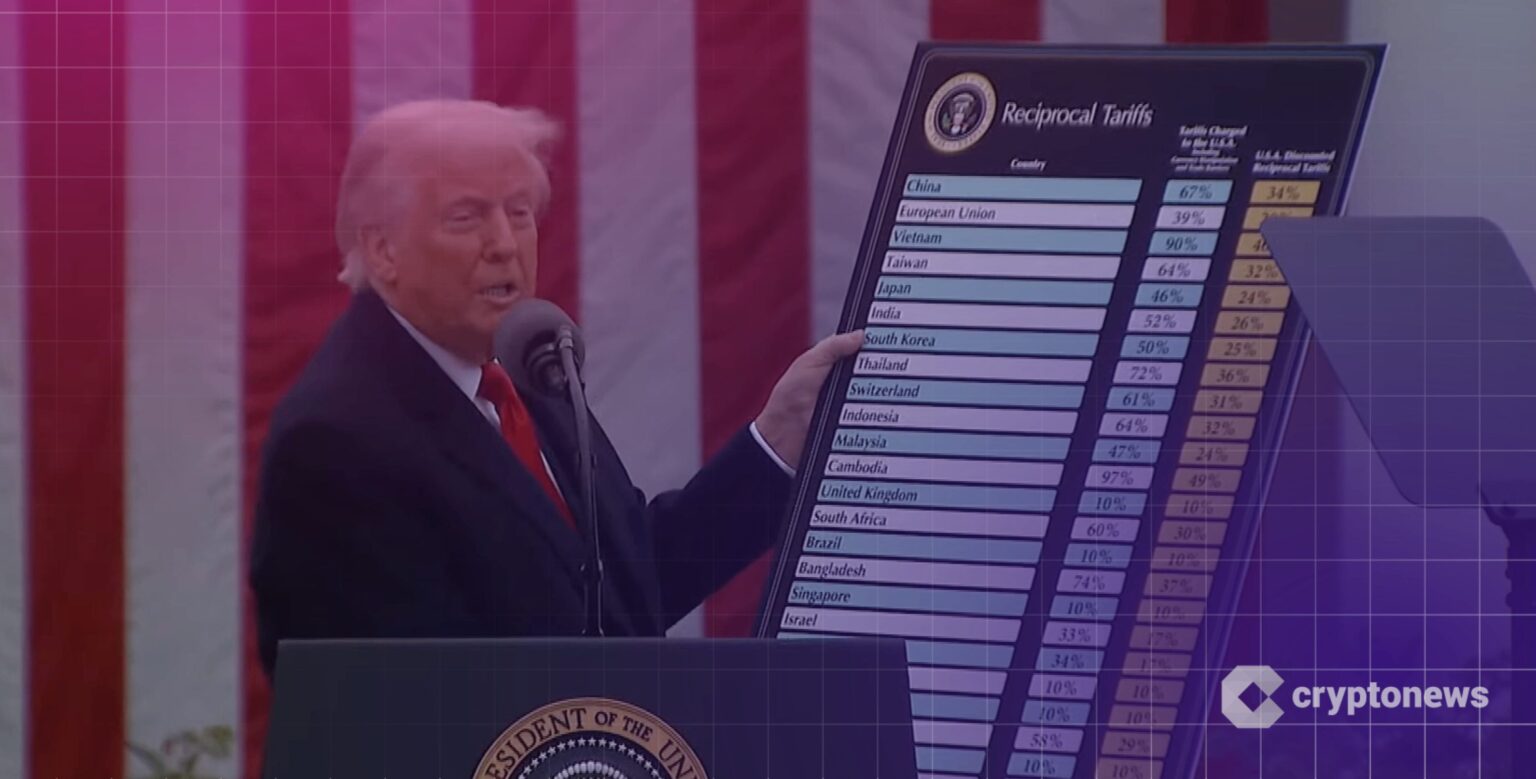

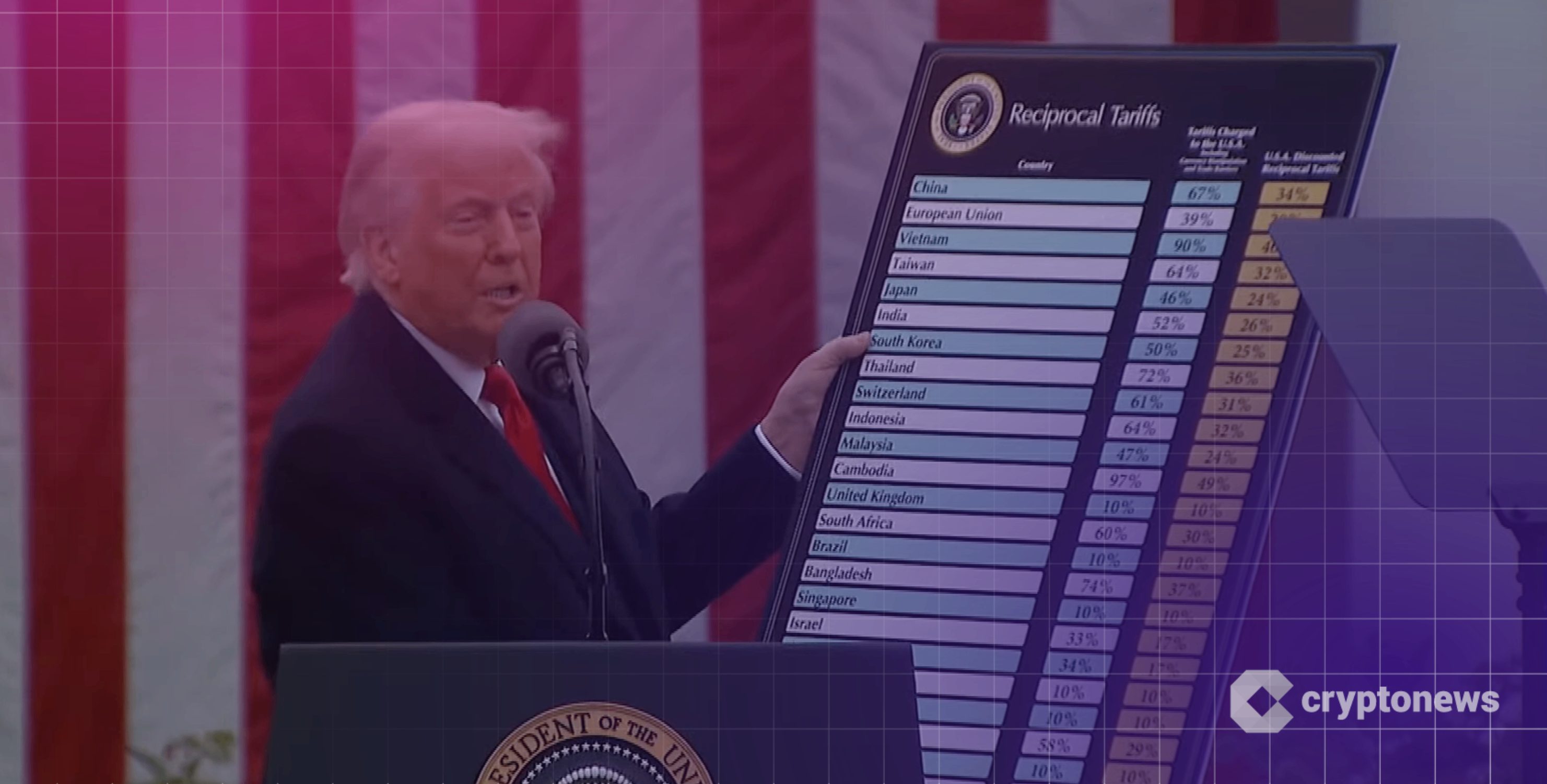

In a surprise ruling, a little-known trade court blocked the president from rolling out his controversial “Liberation Day tariffs” — taxes on imports that caused stock and crypto markets to tank when they were unveiled in April.

And a little later in the evening, it was confirmed that Elon Musk’s time as a “special employee” in the Trump administration is over, meaning the Department of Government Efficiency’s efforts to slash federal spending will fall to someone else.

Reaction to the three-judge panel’s ruling on tariffs was pretty swift. As investors digested the impact, Asian equities were on the rise, while S&P 500 futures witnessed an uptick.

But despite that correlation we’ve seen with BTC and equities in the past, the verdict didn’t serve as rocket fuel for this cryptocurrency’s price. At the time of writing it’s flat over the past 24 hours and trading at about $108,700 — lodging itself just below the previous all-time high that was set in January.

Make no mistake: the Court of International Trade’s intervention is a big deal. It dealt a hammer blow to the president’s economic agenda, and found that the president exceeded his authority without seeking Congressional approval for these tariffs first. Trump argues he needed to act quickly because it was a “national emergency,” but critics say the U.S. has had trade deficits with many other countries for the best part of 50 years.

So: if Bitcoin tanked when the full scale of these tariffs became clear — falling from $109,000 to $75,000 in three months — why isn’t it ripping higher now the Oval Office’s erratic trade policies have been nixed?

As you might expect, it’s not all that simple. First off, the U.S. dollar strengthened against several major fiat currencies when the ruling emerged. This tends to be bad news for riskier assets like Bitcoin.

Second, it’s highly likely that further uncertainty for the markets lies ahead, with the Trump administration already vowing to appeal the ruling. Senior White House officials did little to conceal their rage, with the president’s deputy chief of staff lambasting a “judicial coup that is out of control,” and a spokesperson decrying “unelected judges” meddling with the Oval Office’s agenda.

Businesses across the country — not to mention some of America’s biggest trading partners — are now scratching their heads and wondering what this ruling means for them… and how fast it will be implemented. But if the verdict stands, the government will need to lift the flat 10% tariffs imposed worldwide, as well as the additional levies imposed on China, Mexico, and Canada since Trump’s second term began.

In the long term, this has the potential to be good news for Bitcoin. The Federal Reserve and experienced economists have long argued that these tariffs had the potential to be inflationary — with some U.S. banks fearing they could even increase the likelihood of a recession. Lower inflation would give the Fed a freer hand to slash interest rates, which helps make assets like BTC more attractive.

But Thursday’s price action for BTC also shows that traders are keeping a close eye on the minutes from the Federal Open Markets Committee’s latest meeting, which were released a day earlier. It shows officials raised fears that “inflation could prove to be more persistent than expected” — and there were also fears for the dollar’s status as a safe haven asset.

Musk’s (expected) departure from DOGE is also worth a mention when it comes to the long-term outlook for BTC. Following criticism that he hasn’t been spending enough time overseeing his businesses, including Tesla, the billionaire has now confirmed that he is “back to spending 24/7 at work and sleeping in conference/server/factory rooms.”

This could be good news for Tesla’s share price, and Bitcoin could benefit in turn, given how its moves have been closely correlated to tech stocks.

Four months into Trump’s second term, and the president is facing stumbling blocks as he pursues his agenda. A huge question mark now lingers over tariffs, and the Department of Government Efficiency has failed to achieve the drastic cuts first hoped for. If the president doubles down, further volatility will lie ahead.

The post Court Blocks Trump’s Tariffs: What Shock Ruling Means for Bitcoin appeared first on Cryptonews.

https://cryptonews.com/exclusives/what-shock-trump-tariffs-ruling-means-for-bitcoin/