Chipmaking stocks rallied to kick off 2026 as investors piled into the winning artificial intelligence-fueled sector following another big year of gains.

Micron Technology and dutch chip equipment maker ASML jumped 10% and 9%, respectively, to start the new trading year. Lam Research and Intel rallied more than 6% each, while Marvell Technology rose 5%.

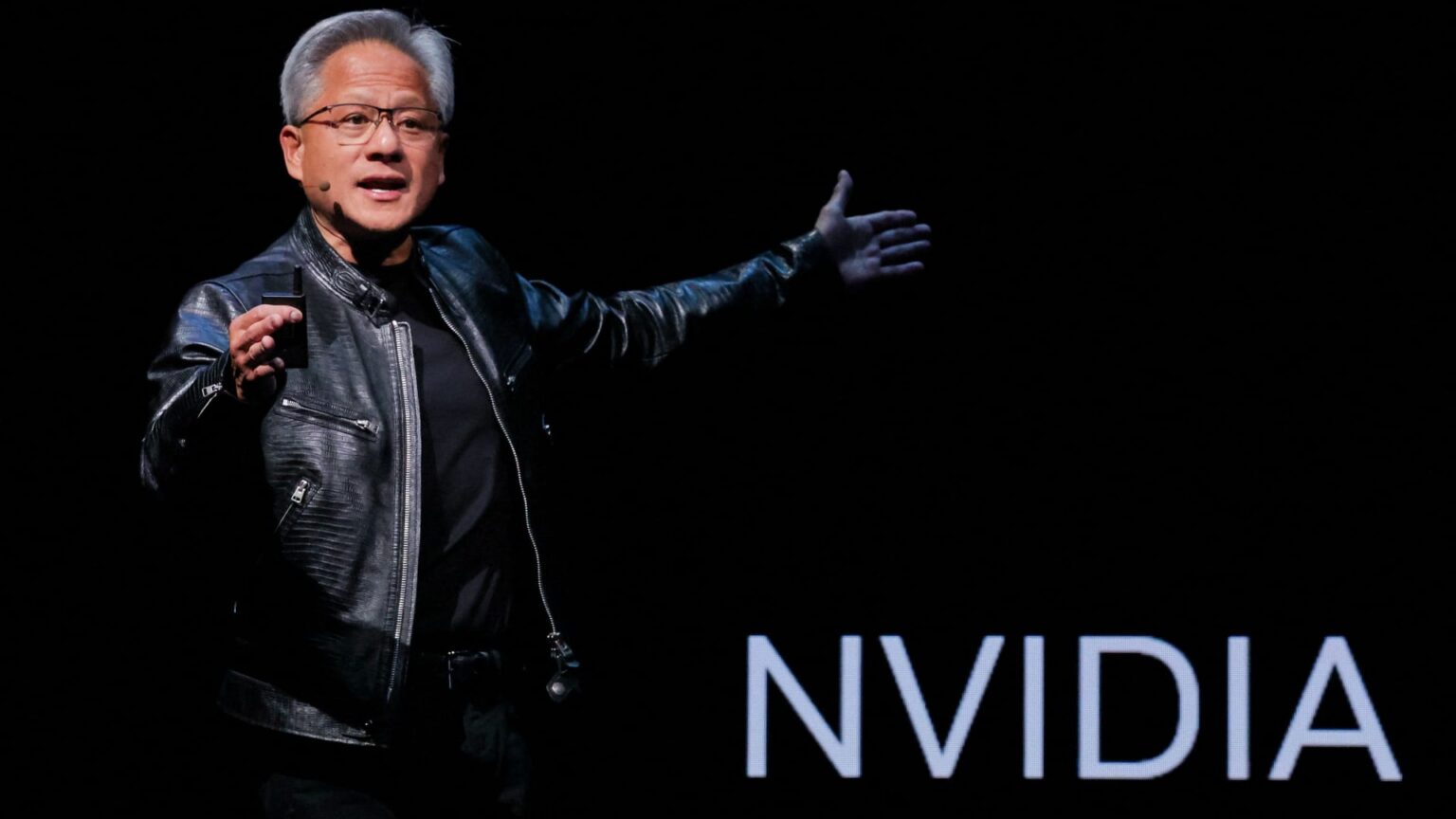

Advanced Micro Devices and Nvidia gained about 4% and 1%, respectively. In 2025, AMD gained 77% while Nvidia added 39%.

Chipmaking stocks got a boost in 2025 from the ongoing AI buildout. Hyperscalers such as Amazon and Google have spent big to power unwavering datacenter demand.

Last year marked a third consecutive year of gains for the sector, despite growing AI valuation concerns and worries over the sustainability of the trade.

Investors have raised concerns over the prospect of an AI bubble in recent months as the sector continues its massive ascent. In November, Michael Burry of “Big Short” fame revealed a short position in Nvidia and AI winner Palantir.

He later blasted hyperscalers for artificially boosting earnings.

The rally in chipmaking stocks lifted the VanEck Semiconductor ETF about 4% to build on a nearly 49% rally in 2025.

The ETF has rallied for three straight years and posted its best year ever in 2023, when it gained more than 72%.

WATCH: Chips trade still has legs in 2026, says Bernstein’s Rasgon

https://www.cnbc.com/2026/01/02/chipmakers-2026-ai-trade.html