Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

China has banned shipments to the US of several “dual-use” minerals and metals used in semiconductor manufacturing and military applications, in a rapid retaliation by Beijing against export curbs from Washington that pushed the shares of a leading Chinese tech company down 10 per cent.

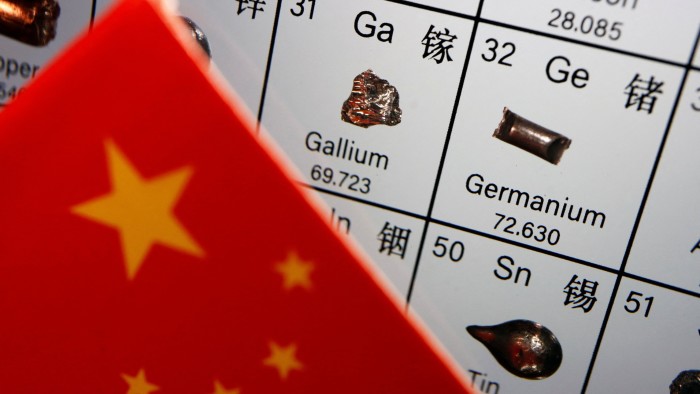

China’s commerce ministry on Tuesday said it would not permit the export of dual-use items related to gallium, germanium, antimony and superhard materials to the US, and that it would implement stricter controls for graphite-related items.

“The US has broadened the concept of national security, politicising and weaponising trade and technology issues, and abused export control measures,” it said in a statement.

“To safeguard national security . . . China has decided to strengthen export controls on dual-use items to the US,” it added, noting that the measures would be effective immediately.

Four major Chinese industry associations, representing the internet, auto, semiconductor and communications industries, reacted to the US moves by calling on their members to reduce purchases of US semiconductors.

“US chip products are no longer safe or reliable, and relevant Chinese industries should be cautious in procuring US chips,” said the China Semiconductor Industry Association.

The embargoed minerals and metals are used in the production of semiconductors and batteries, as well as communications equipment components and military hardware such as armour-piercing ammunition.

Beijing had already been strengthening controls on their export in response to tightening western chip sanctions, with its curbs on shipments of germanium and gallium leading to an almost twofold increase in the minerals’ prices in Europe.

China’s latest shipment ban to the US makes clear President Xi Jinping’s government is willing to target western economic interests to hit back against Washington’s chip restrictions.

It also highlights Beijing’s dominance of the global supply of dozens of crucial resources. China produces 98 per cent of the world’s supply of gallium and 60 per cent of germanium, according to the US Geological Survey.

Washington on Monday imposed a range of new sanctions designed to slow the development of China’s semiconductor industry.

They include tougher restrictions on the export of critical semiconductor manufacturing tools and a ban on the export to China of advanced high bandwidth memory (HBM) chips, a crucial component in artificial intelligence products.

But Bernstein analysts said the US restrictions were generally less severe than expected. Japanese chip equipment suppliers were seen as benefiting from the tighter restrictions, with chip stocks leading the Nikkei share average to a three-week high on Tuesday. Tokyo Electron rose 4.3 per cent, and Disco Corp and Lasertec were up 6.1 per cent and 4.3 per cent respectively.

Washington also added 136 Chinese companies to a US trade blacklist, including major Apple and Samsung supplier Wingtech, which had been working to buy up foreign semiconductor technology.

Since 2018, Wingtech has spent more than $4bn acquiring Dutch semiconductor group Nexperia. It also tried to buy Newport Wafer Fab, Britain’s largest chipmaker, in a deal ultimately blocked by the UK government.

The US blacklisting sent Wingtech’s Shenzhen-listed shares sliding more than 10 per cent over two days and highlighted the delicate balancing act for Chinese companies between growing their international business and supporting Beijing’s policy priorities at home.

Wingtech had previously bought an Apple-related camera module business from another Chinese group after it was hit with sanctions in 2020.

“Western companies no longer buy from us,” said a manager at one blacklisted Chinese firm. “For two years, we basically stopped growing as we replaced foreign components.”

Charlie Chai, of 86Research, said Wingtech could be split up if necessary to retain foreign business. He noted that the latest US controls closed loopholes making it harder for Chinese chip companies to buy foreign equipment.

“It has turned into a classic game of cat and mouse, but the room for manoeuvring is fast shrinking for Chinese firms,” he said.

Wingtech did not immediately respond to a request for comment. Nexperia said the US controls did not apply to it or its subsidiaries.

Reporting by Ryan McMorrow and Eleanor Olcott in Beijing, Christian Davies and Song Jung-a in Seoul, Harry Dempsey in Tokyo and Andy Bounds in Belgium

https://www.ft.com/content/eca9a562-ffc7-4989-bbf6-734997409265