Inflation’s affect could even transcend the quick strain on Americans’ pocketbooks, to a bigger sense that it’s stifling alternative in America and the deeper sense that the nation’s financial troubles of latest years have been, as a complete, more durable than others it has confronted in generations.

So, even amid stronger jobs reviews and economists’ discuss of “soft landings,” folks say they nonetheless pay extra consideration to their very own experiences than to macroeconomic measures — and an awesome quantity say their incomes aren’t protecting tempo.

More folks immediately say their lifestyle is worse, not higher, than their mother and father’ was, and it is age teams encompassing lots of millennials and Gen-Xers, at present of their prime working years, who’re particularly apt to suppose so — a sentiment that runs counter to the standard notion of the American Dream.

It’s been 4 many years since Americans have seen inflation like they’ve lately. When requested to place present troubles in context, Americans say the financial difficulties arising out of the pandemic have been the worst in a few generations, extra so than the crash and Great Recession of 2008-09, different recession intervals within the 90’s and 80’s, and extra so than the inflation and gasoline shortages of the Nineteen Seventies.

Today will certainly be brisker in thoughts and convey some recency results right here, but it surely does underscore the truth that many adults haven’t been by means of this sort of inflation earlier than. (And for these over 65, who have been adults within the Nineteen Seventies, the nation’s newer difficulties stand out for them, too.)

The “disconnect” between micro and macro?

For months, the nation’s conventional “macro” numbers like job development and employment, GDP and even the speed of inflation have usually proven indicators of power or enchancment.

So, we simply requested instantly what they take note of — and other people say they pay extra consideration to private expertise than to those sorts of financial figures.

And the job market could also be robust, however an awesome three-quarters really feel their incomes aren’t maintaining with inflation.

There’s a prevailing feeling that chance is simply rising for the rich, not the center class. In all, Americans have voiced skepticism about unequal alternatives for some time, however immediately the bigger concept that “everyone has a chance to get ahead” is down in comparison with earlier than the pandemic.

So what can we do?

More rate of interest hikes aren’t a broadly well-liked concept for controlling inflation — they’re particularly unpopular with folks within the lowest revenue bracket.

Nor are Americans prepared to see unemployment go up (maybe a consequence of upper charges) if that meant dampening inflation.

Back within the late 1970’s when the nation was dealing with excessive inflation, the CBS News ballot was asking about it, and requested in regards to the concept of presidency value controls. So we requested an identical query now — and located that the majority would help the (very hypothetical) concept.

Price management help consists of massive numbers of Democrats and although the social gathering could be related to a extra free-market strategy within the public thoughts, greater than half of Republicans help it, too.

What does this imply for the White House?

Most Americans do suppose a president can management inflation.

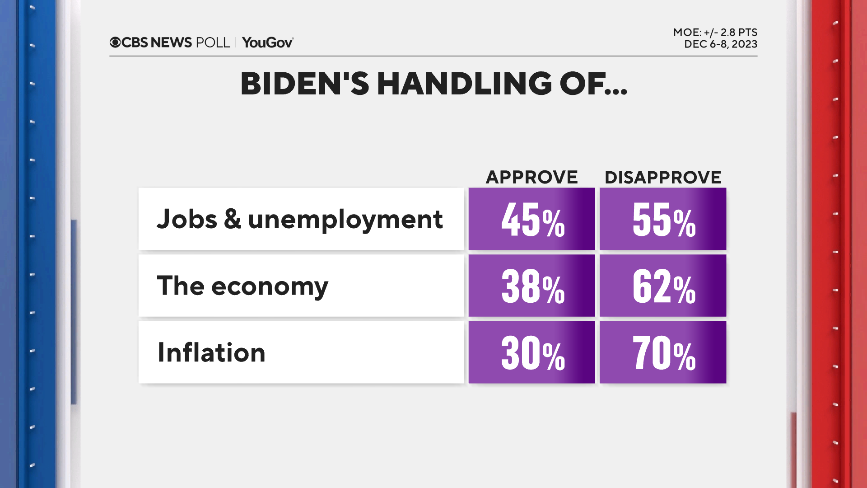

For some context, in considerably comparable questions from the Nineteen Seventies and 80’s, many thought so then, too. Given the complexity of the world’s financial system — and that folks do acknowledge a number of causes for inflation — they could or is probably not making correct reads of the workplace’s energy. But both means, as long as inflation is excessive, that might be one cause President Biden continues to get poor marks on his dealing with of it.

People do not blame themselves for inflation within the type of “higher consumer demand.” Their major causes level additional afield, to worldwide elements, suspicion of corporations overcharging and authorities spending.

Inflation stays the highest cause folks say they really feel the financial system is dangerous, after they do. Views of the financial system, total, are nonetheless broadly destructive (although lots of that’s pushed by partisanship, too) and nearer once more to the place they have been this spring than this fall. The sample this 12 months has been the quantity saying “bad” floating round within the low to mid-60’s; maybe reflective of some ongoing uncertainty about its total outlook.

Mr. Biden nonetheless will get giant disapproval for dealing with inflation and Americans are nonetheless extra apt to suppose his administration’s actions have led to it rising, not slowing.

The Biden administration usually touts its legislative document on the financial system, however Americans’ evaluations of issues just like the Build Back Better Act and the Inflation Reduction Act are combined. Many, together with within the president’s personal social gathering, say they haven’t heard sufficient about them, no less than not by identify.

This CBS News/YouGov survey was performed with a nationally consultant pattern of two,144 U.S. grownup residents interviewed between December 6-8, 2023. The pattern was weighted based on gender, age, race, and training based mostly on the U.S. Census American Community Survey and Current Population Survey, in addition to previous vote. The margin of error is ±2.8 factors.

In the CBS News polling referenced from 1979 and 2017 the interviews have been performed with respondents by phone utilizing RDD samples. The most essential downside merchandise from 1979 was coded on the time from open-ended responses.

Toplines:

https://www.cbsnews.com/news/cbs-news-poll-inflation-impact-living-standards-opportunity-2023-12-10/