Bitcoin’s rebound has pushed BlackRock’s iShares Bitcoin Trust ETF (IBIT) back into profitability, marking a key psychological turning point for both retail and institutional holders. IBIT investors collectively sit on $3.2 billion in cumulative profits, according to Arkham Intelligence, reversing weeks of pressure caused by Bitcoin’s earlier slide into the mid-$80,000s.

Arkham’s data show the ETF’s average buy price is now approaching the break-even level, restoring confidence among those who accumulated during the market’s late-summer volatility. This shift is already visible in ETF flows.

Bitcoin funds recorded two straight days of inflows, the first such streak in two weeks, with Wednesday adding a modest but meaningful $21 million. K33 Research reports that BlackRock remains the only ETF issuer to post net positive inflows for 2025, underscoring its influence in shaping broader market flows.

Market Drivers Behind Bitcoin’s Recovery

Several catalysts are reinforcing the current momentum. Geoff Kendrick, Standard Chartered’s head of digital assets research, ties much of Bitcoin’s strength this year to persistent spot ETF demand. At the same time, expectations of a Federal Reserve policy shift continue to support risk assets.

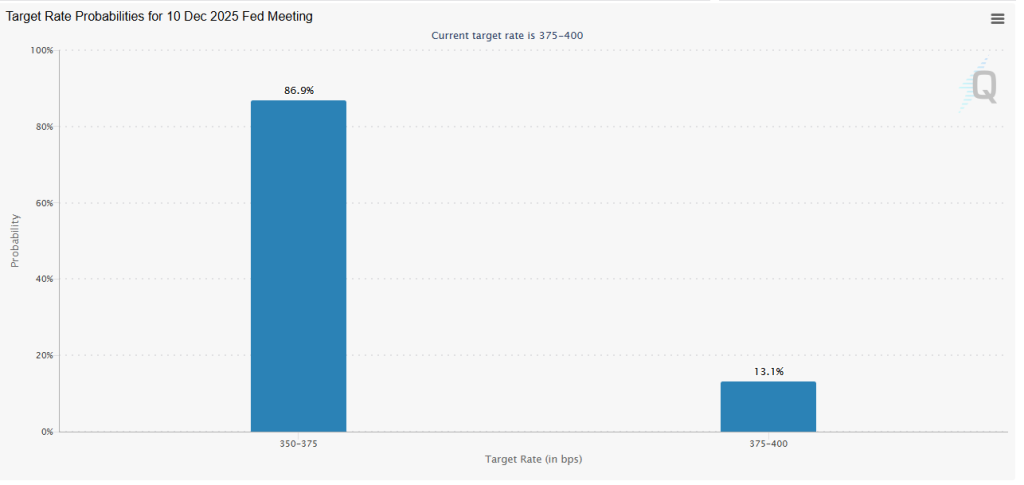

Markets now price in around 87% probability of a 25-basis-point rate cut at the December 10 meeting as per Fedwatch tool, easing fears of prolonged tightening.

Investor behavior also appears more grounded. Even during Bitcoin’s sharp two-week correction, when ETF holders briefly fell below their flow-weighted cost basis near $89,600, most investors held steady. Many are long-term allocators rather than short-term traders, reducing the likelihood of panic-driven selling.

Bitcoin (BTC/USD) Technical Outlook: Key Levels to Watch

Bitcoin’s technical structure now strengthens the bullish case. On the 4-hour chart, BTC is pressing against a descending trendline that has capped every rebound since early November.

After establishing a clean higher low at $86,878, the price reclaimed the 20-EMA, forming a cluster of steady candles, ranging from spinning tops to small bullish bodies, that reflect controlled accumulation.

Momentum Signals Support for Breakout

Bitcoin price prediction has turned slightly bullish as BTC is currently trading around the 0.382 Fibonacci retracement at $90,798. While the 50-EMA flattens overhead, a setup that often precedes an EMA crossover. The RSI near 68 signals strong momentum with no bearish divergence, leaving room for a push higher.

If BTC can maintain support above $90,000, a breakout above $93,982 would confirm the wedge-pattern expansion illustrated by the TradingView path. That move opens targets at $93,966, $97,135, and the heavier resistance at $102,255. Should momentum extend into December, Bitcoin could even revisit $107,000, a level that aligns with prior supply.

For traders, the structure favors a long setup on a confirmed break of $93,982, using $90,000 as the invalidation zone.

Maxi Doge: The Meme Coin Built for Maximum Hype

Maxi Doge is exploding in popularity as traders rush toward its high-energy meme identity and fast-growing presale. With over $4.22 million raised, it’s quickly becoming one of the standout meme tokens of the year.

The project mixes bold branding with real engagement features, from ROI contests to nonstop community events, giving it more personality and momentum than typical dog coins. Its shredded, leverage-obsessed mascot has already turned Maxi Doge into a recognizable culture coin.

Holders can also stake $MAXI for daily smart-contract rewards and unlock access to exclusive competitions and partner events. The staking utility adds a passive-earning layer that keeps users active and invested in the ecosystem.

With $MAXI priced at $0.0002705 and the next increase approaching, the presale continues to gain speed. If you’re looking for a meme coin built on hype, personality, and real community energy, Maxi Doge is shaping up to be one worth watching.

Click Here to Participate in the Presale

https://cryptonews.com/news/bitcoin-price-prediction-blackrocks-bitcoin-bet-turns-green-again-is-the-selling-finally-over/