Criminal charges to start: Well-known bond investor Ken Leech was charged with fraud on Monday for allegedly orchestrating a $600mn “cherry-picking” scheme that improperly allocated trades to particular portfolios at Western Asset Management.

And a pair of asset management scoops: France’s Natixis Investment Managers and Italian insurer Generali are in early-stage talks about a potential tie-up, while Canadian financial services group Canaccord Genuity is working with bankers to run a strategic review of its UK wealth management business.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Premium subscribers can sign up here to get the newsletter delivered every Tuesday to Friday. Standard subscribers can upgrade to Premium here, or explore all FT newsletters. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter:

-

Andrea Orcel’s bank takeover redux

-

Big writedowns from Northvolt’s collapse

-

Blackstone’s latest financing deal

‘Cristiano Ronaldo’ of bankers wants a deal

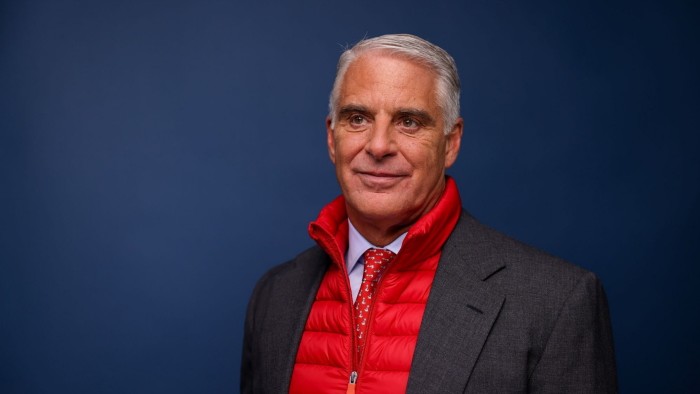

Andrea Orcel is back on the offensive.

The one-time M&A banker, now chief executive of UniCredit, first attempted to bolster the Milanese lender’s ambitions with an acquisition of Banco BPM two years ago, but was stymied after a media leak sent the fellow Italian lender’s share price soaring.

His following attempt to accumulate a stake in Germany’s Commerzbank was then tangled up by regulators, politicians and unions.

But Orcel continues to use the element of surprise to push forward his planned consolidation of the European banking system.

Late on Sunday, Orcel phoned Massimo Tononi, the chair of BPM, and revealed his unsolicited €10.1bn takeover bid would land in the morning.

An acquisition of BPM, the largest lender in Italy’s wealthy northern region, would make UniCredit the largest bank in Italy by market capitalisation, edging out Intesa Sanpaolo, and reward Orcel’s ambitions to consolidate the Italian banking sector.

Underperforming loans and fragmentation once made consolidation a hard task. But the country’s lenders have shaped up in recent years, laying the groundwork for mergers.

BPM two weeks ago snapped up a 2 per cent stake in Monte dei Pashi di Siena from the Italian state, sparking anticipation of a boom in tie-ups across the sector.

Orcel says UniCredit will be an aggressor. “We cannot remain absent from that move [to consolidate],” he told analysts after launching the bid publicly.

That sparked a long list of dismissals from the Italian establishment.

Matteo Salvini, deputy prime minister, said: “I wouldn’t want to think that someone is trying to stop [the BMP and MPS tie-up]. And Giancarlo Giorgetti suggested the government may use so-called “golden power rules” that would allow it to scuttle the deal.

Still, if history is any indication, Orcel may have his way. He has sent UniCredit shares soaring 400 per cent higher since joining in 2021.

The US re-election of Donald Trump and ensuing rabid animal spirits on Wall Street has also potentially played into Orcel’s hands, offering new political cover for his dream of creating a European banking titan.

Goldman’s $900mn loss in rural Sweden

Northvolt, the battery maker that has long been seen as the North Star for Europe’s industrial foothold in electric vehicle production, collapsed into bankruptcy protection last week.

Already, the writedowns have started to trickle in. And no surprise: they’re big.

The FT’s Richard Milne and Harriet Agnew reported Goldman Sachs’ private equity funds have at least $896mn in exposure to Northvolt, making the US bank its second-largest shareholder. They’ll write that down to zero at the end of the year.

That’s a serious contrast to a rosy prediction by one of the Goldman funds just seven months ago. It had told investors its investment in Northvolt was worth 4.29 times what it paid for it — and it would increase to six times by next year.

Goldman said: “While we are one of many investors disappointed by this outcome, this was a minority investment through highly diversified funds. Our portfolios have concentration limits to mitigate risks.”

Goldman’s certainly not alone. On Monday the FT reported German carmaker Volkswagen has written down the majority of its 21 per cent stake in Northvolt over the past year ahead of the Swedish battery maker’s bankruptcy filing. Baillie Gifford was also a big shareholder.

VW’s writedowns have been done in phases over the past 11 months, and aren’t expected to have any material impact on the carmaker’s financial performance.

But it’s still a major headache. VW’s dealing with its fair share of corporate pain, with plans to close several factories in Germany and cut tens of thousands of employees.

Goldman and VW invested in Northvolt in 2019 in a $1bn series B funding round that allowed the battery maker to build its first factory in northern Sweden. Northvolt was Europe’s best-funded private start-up after raising $15bn from investors and governments.

Although problems at the battery maker have been reported for months by the FT’s Milne, the scale of its collapse was startling. By last Thursday, it had just $30mn in cash — enough for a week’s operations — and $5.8bn in debt.

In bankruptcy, Northvolt has access to $145mn in cash and $100mn from Swedish truckmaker Scania. But the company needs more.

It’s looking to raise about $1bn in additional financing to exit the court process in the first quarter of next year, and is in talks with various investors and companies about partnerships.

Blackstone’s new pipeline of deals

The giants of the private investment world have been calling on blue-chip companies as they look for the next elephant to bag.

On Monday, Blackstone snared its latest one — US energy giant EQT.

But the deal is not a straight buyout; increasingly behemoths such as Apollo, Blackstone and KKR are looking to feed insurers (including ones they own or are invested in) rather than their private equity funds.

Blackstone will pay $3.5bn for a large minority stake in a joint venture, which will hold EQT pipeline assets. About 60 per cent of the cash that it generates will go to pay the Blackstone funds that have invested in the venture. EQT will keep the remainder once Blackstone hits an agreed 8 per cent return target, people familiar with the matter tell DD.

An 8 per cent internal rate of return may not seem like much (certainly by buyout standards), but for a credit investment shop looking for low-risk yields, it’s more than enough. EQT’s 10-year bonds, by contrast, traded on Friday with a yield of 5.6 per cent. The spread between 8 per cent and 5.6 per cent is the new game on Wall Street.

And critically, because EQT and Blackstone will each hold equity stakes in the joint venture, the financing will not be treated like debt by credit rating agencies.

Companies such as EQT, AB InBev and Intel have been increasingly turning to these complex and creative manoeuvres to obtain fresh financing that preserves their investment-grade ratings. Private investment firms have been more than willing to step in.

And for some further reading: Blackstone, Elliott Management and Vista Equity Partners are making the most of the market rally.

Job moves

-

Lazard’s chief executive officer Peter Orszag will become chair of the board beginning in January. Kenneth Jacobs is giving up his board seat at the end of December, and will work as senior chair and senior adviser to the board.

-

Kirkland & Ellis has hired Scott Rolnik as a partner with the firm’s debt finance group. He previously worked for Ropes & Gray.

-

ICR has appointed JD Moriarty as chief executive of the company’s broker-dealer affiliate. He previously worked at LendingTree and as a managing director at Bank of America.

Smart reads

Trump Justice The US Department of Justice’s recent bribery charges against Gautam Adani and parts of his mining, ports and renewable energy empire carries huge geopolitical implications that will test the incoming Trump administration, the FT reports.

Musk vs regulators Billionaire Elon Musk has vowed to cut trillions of dollars in government spending and red tape. In the meantime, his electric car group Tesla has thumbed its nose at safety regulations, reports The Wall Street Journal.

Maga Market 2.0 Wall Street is betting that the election of Trump will provide fuel to an epic stock market rally. The FT examines how long the good vibes will last.

News round-up

Mubadala Capital agrees C$12.1bn deal for Canadian asset manager CI Financial (FT)

Anglo American sells remaining coal assets for $3.8bn in first stage of restructuring (FT)

French oil major TotalEnergies suspends fresh investment in Adani joint ventures (FT)

Thyssenkrupp to slash 40% of steel jobs in latest blow to German industry (FT)

Macy’s says employee hid more than $132mn in delivery expenses (FT)

BDO bucks gloom with first pay rise for UK partners in three years (FT)

US expansion helps Klarna to report third-quarter profit (FT)

Due Diligence is written by Arash Massoudi, Ivan Levingston, Ortenca Aliaj, and Robert Smith in London, James Fontanella-Khan, Sujeet Indap, Eric Platt, Antoine Gara, Amelia Pollard and Maria Heeter in New York, Kaye Wiggins in Hong Kong, George Hammond and Tabby Kinder in San Francisco, and Javier Espinoza in Brussels. Please send feedback to due.diligence@ft.com

Recommended newsletters for you

Full Disclosure — Keeping you up to date with the biggest international legal news, from the courts to law enforcement and the business of law. Sign up here

Scoreboard — Key news and analysis behind the business decisions in sport. Sign up here

https://www.ft.com/content/1f61765f-6d26-456b-9cb5-8790f665e2d4