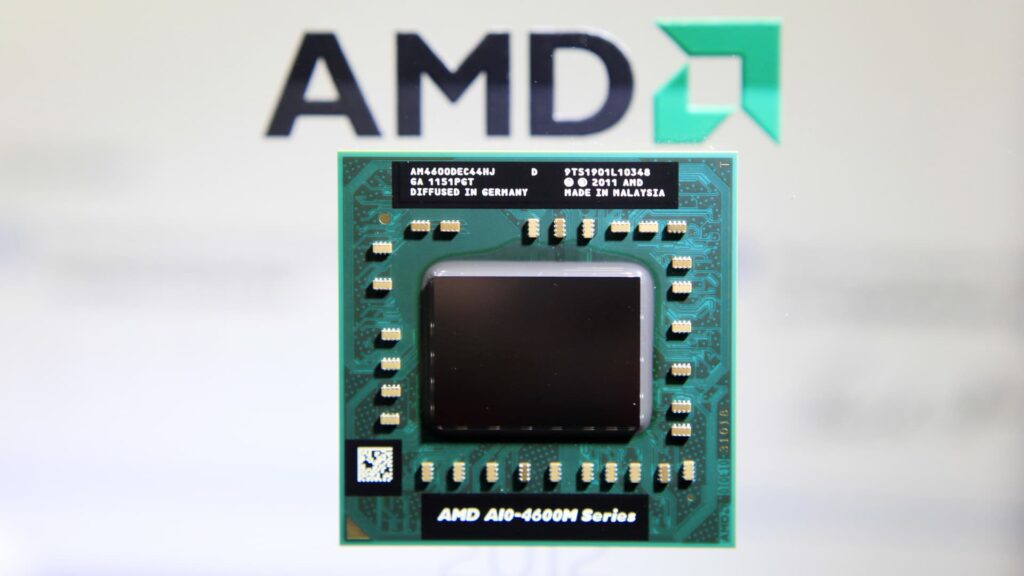

Check out the businesses making headlines in noon buying and selling. Advanced Micro Devices — The chipmaker’s inventory popped 7%, a day after the corporate unveiled its new synthetic intelligence chips poised to problem Nvidia’s dominance. Nvidia shares added about 1%. Meta Platforms and Microsoft have already stated they’d purchase AMD’s chip instead. Alphabet — The Google mum or dad’s inventory rallied greater than 5%, a day after the corporate unveiled in newest and strongest AI Model referred to as Gemini. The product will probably be used to energy Google’s merchandise similar to its Bard chatbot. Sprinklr — Shares plunged about 30% on the again of the corporate’s quarterly earnings announcement. Despite posting better-than-expected outcomes for the 2024 fiscal third quarter on Wednesday, administration forecasted a deceleration in gross sales progress within the 2025 fiscal 12 months. BTIG downgraded shares to impartial from purchase following the discharge. AbbVie — AbbVie shares added 1% a day after the pharmaceutical firm stated it might a cquire neuroscience drugmaker Cerevel Therapeutics for $8.7 billion, or $45 a share. The firm expects the acquisition to undergo in the course of subsequent 12 months. Cerevel’s inventory popped greater than 12%. Chewy — The pet merchandise e-commerce inventory slumped greater than 3% a day after Chewy reported disappointing quarterly outcomes and steering. Revenue fell barely in need of expectations, and Chewy posted a wider-than-expected loss by 2 cents. Net gross sales steering for the fourth quarter additionally got here up in need of the $2.93 billion anticipated, per LSEG. GameStop — GameStop shares have been final up practically 2% a day after the online game retailer reported third-quarter outcomes. The firm posted a 1-cent loss per share on income of $1.08 billion. It was unclear if that was akin to LSEG estimates. JetBlue — JetBlue shares soared greater than 13% after the airline boosted its steering as a consequence of sturdy journey demand. The firm expects income to fall between 7% and 4% from a 12 months in the past within the fourth quarter. Prior steering known as for a decline between 6.5% and 10.5%. JetBlue additionally forecasts a smaller-than-expected loss within the fourth quarter between 25 cents and 35 cents. ChargePoint — ChargePoint shares popped greater than 11%. On Wednesday, the electrical automobile charging inventory reported $110 million in income, which fell in need of the $122 million anticipated by analysts polled by LSEG. C3.ai — The synthetic intelligence software program inventory dropped greater than 10% after C3.ai issued blended quarterly outcomes and shared mild steering. On Wednesday, C3.ai posted smaller-than-expected adjusted lack of 13 cents per share. For its fiscal third quarter, the corporate expects income to vary between $74 million and $78 million. Take-Two Interactive — Shares slipped practically 2% after Bank of America downgraded the online game writer to impartial from a purchase score, noting the corporate’s monitor report of delaying launches. Duckhorn Portfolio — The wine inventory shed greater than 9% a day after Duckhorn issued quarterly outcomes that fell in need of Wall Street’s expectations. Bank of America downgraded the corporate to a impartial score, citing “little reason to be bullish” within the close to to medium time period. — CNBC’s Sarah Min, Alex Harring, Hakyung Kim and Michelle Fox contributed reporting

https://www.cnbc.com/2023/12/07/stocks-making-the-biggest-moves-midday-amd-googl-cxm-chwy-and-more.html