Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

A month ago, the Italian Treasury announced the successful sale of a 15 per cent stake in Monte dei Paschi di Siena — a big step in the reprivatisation of the world’s oldest bank, after a dice with death involving alleged fraud, serial mismanagement and a 2017 government bailout.

The transaction, hailed by the government as a big success, cuts the state’s stake to 12 per cent, allowing it to comply with an EU state aid deadline. So far, so straightforward.

But in a narrative worthy of Niccolò Machiavelli, the full story is rather more complex: a battle for influence over Italy’s banking and finance realm pits two of the country’s most powerful — and most contrasting — business figures against each other.

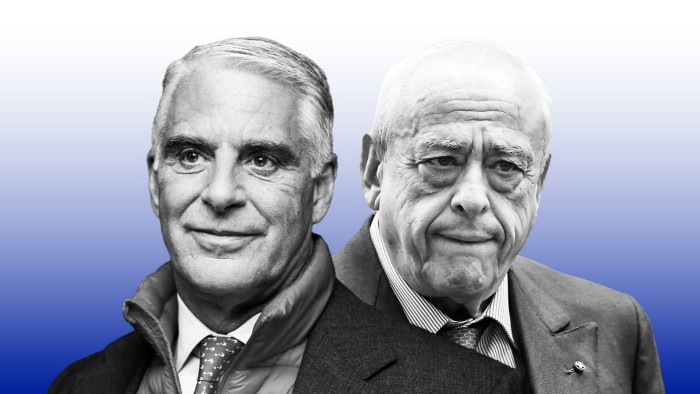

In one camp is Andrea Orcel, the suave global financier turned UniCredit chief executive. Facing him is Francesco Gaetano Caltagirone, the octogenarian industrialist-cum-media baron-cum-financial investor, who also counts Prime Minister Giorgia Meloni as a close ally.

Which brings us back to MPS. Meloni’s government has had to cut its direct ownership of the Sienese lender. But there is a clear political desire both to create a third big bank to challenge the dominance of the big two, UniCredit and Intesa, while also maintaining strong indirect influence over the financing of the economy.

And so it was that Banca Popolare di Milano, Italy’s third-biggest bank by assets, acquired a 5 per cent shareholding in MPS, putting it in a good position to decide its future, possibly via a full-blown merger. The other 10 per cent sold by the government was split between three allies of BPM and the government — Anima, an asset manager that BPM is in the process of buying; Delfin, the investment arm of the Del Vecchio/EssilorLuxottica dynasty; and Caltagirone.

People close to the MPS transaction say the Treasury’s main advisers, UBS and Jefferies, were sidelined. Instead BPM’s own investment banking arm, Banca Akros, was brought in and duly oversaw the sale to BPM, Caltagirone and their allies. (UniCredit had tried to buy a 10 per cent stake in MPS, the people said, but the bank’s call to Akros was not returned.)

Caltagirone’s motives are twofold, according to those who know him: to cement his close relationship with Meloni and to further his influence over Italian business. His particular perennial obsession is to gain effective control of insurance group Generali, in which he and his allies already own more than a 17 per cent stake. — a power base amplified though a near-30 per cent stake in Mediobanca, combined with the new influence over MPS and BPM, and their multiple cross-shareholdings.

Orcel, for his part, is never one to give up on a fight. His response to being sidelined from the MPS transaction was to revive a bid — aborted in 2022 — for BPM. Thwarted at least for now in his ambition to acquire Germany’s Commerzbank, Orcel is keen to grow Unicredit’s domestic footprint.

In contrast to Caltagirone’s ingratiating ways with the government, however, Orcel has riled the political elite by maintaining a hard line on deal economics. In 2021, he spurned then prime minister Mario Draghi’s invitation to buy MPS, concluding that the risk was too great. His new BPM bid looks like another clear rebuke to the government: under Italy’s “passivity” law, Unicredit’s bid bars BPM from pursuing any transaction of its own, including a further purchase of MPS shares from the government.

Government ministers have responded by threatening to invoke a “golden power” to block Unicredit’s bid or modify it. Deputy prime minister Matteo Salvini has suggested UniCredit is un-Italian, decrying foreigners on its shareholder base.

Where does that all leave the two protagonists? Orcel’s bid for BPM may be helped politically by the emergence of Crédit Agricole as a significant shareholder — UniCredit is likely to have to increase its nil-premium offer, but it can at least claim to be more Italian than the French bank.

Meanwhile, over the next few months Caltagirone is set to train his focus on Generali as it approaches an all-important May annual shareholder meeting. A new law could give him the right to appoint as many as six out of 13 board directors, according to one person close to the process.

With two different endgames, both men may yet triumph. Behind the scenes, bankers say Caltagirone is even in “very constructive” contact with Orcel over BPM. One old associate recalls: “He once said to me: ‘Life is made up of friendship and enmity. One has only to decide which to choose.’”

patrick.jenkins@ft.com

https://www.ft.com/content/bf8e456f-47a2-40f4-b4ad-b838b10519ae