21 straight days of ETF inflows could not stop Solana from sliding toward a new yearly low, hitting 127 dollars on December 2. So the real question becomes: if inflows could not save it, what happens on the outflow days?

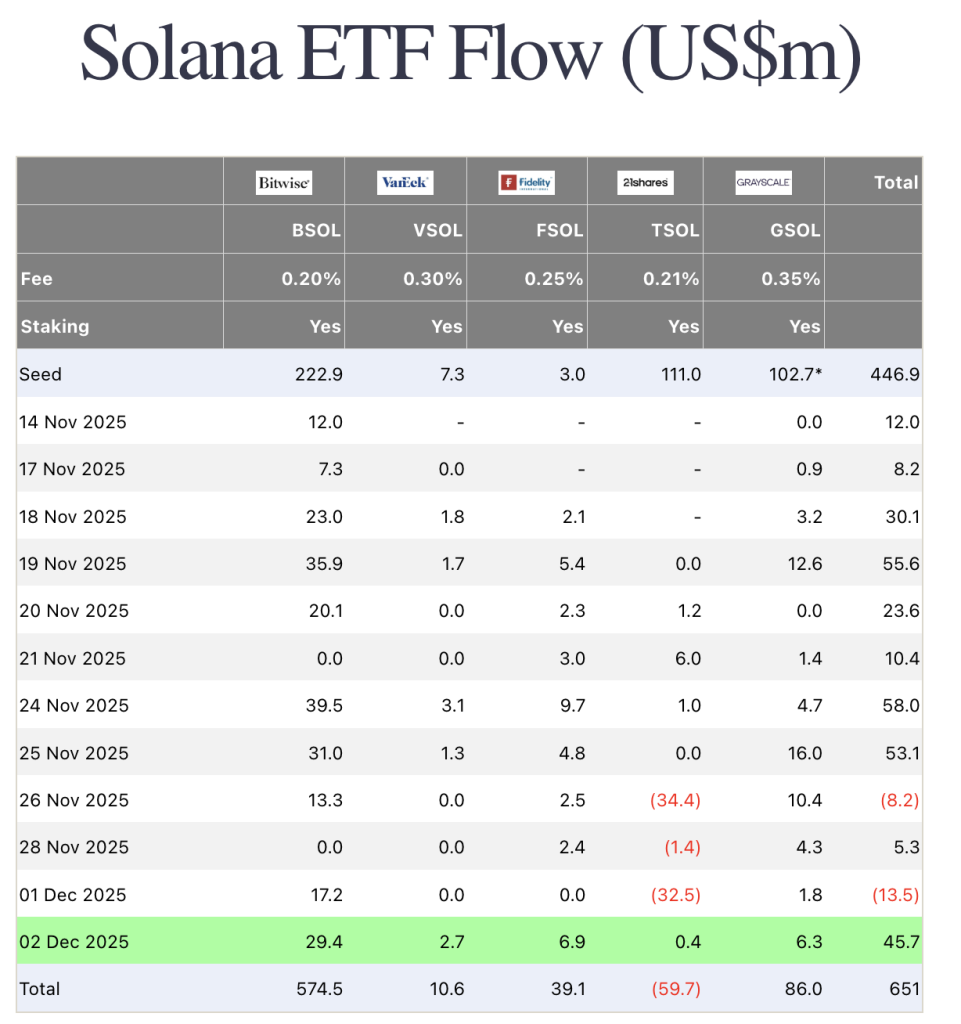

Solana ETFs saw a notable outflow of $8.10 million on November 26, the first since they launched on October 28. Then it happened again on the first day of December, this time totaling more than $13.5 million in outflows.

The following day, Solana bounced back with one of its biggest inflow days yet, pulling in more than $45 million. This basically means that the outflows are tiny compared to the inflows, and this growing institutional interest in Solana shouldn’t be ignored.

Since launching, SOL ETFs have brought in more than $650 million in net inflows. During that same period, investors pulled more than 3 billion from Bitcoin ETFs and over 1 billion from Ethereum ETFs. That kind of contrast makes Solana look like one of the strongest bets in crypto for the coming months.

Solana Price Prediction: Why $127 Dip Could Have Been A Gift

Solana is currently sitting around $141 and is once again trying to retest the $144 level, which turned into one of November’s toughest resistance zones. SOL hit this level multiple times already and has not managed to break through even once.

If the price can finally close above $144 with strength, the SOL/USDT pair could push toward $160, and from there, a revisit of the $170 area becomes possible.

If it fails again, though, we could see it drop back toward the $120 zone before going even lower, and that is the last scenario SOL bulls want to watch play out.

Could Bitcoin Hyper Compete With Solana?

While Solana wrestles with heavy volatility, failed breakouts, and a market that cannot decide whether to punish or reward its ETF flows, one project is managing to push forward with momentum that is actually holding up even in the chop.

That project is Bitcoin Hyper, and it is quietly becoming one of the strongest early-cycle plays of 2025.

Bitcoin Hyper is building a high-speed Bitcoin Layer 2 powered by the Solana Virtual Machine, giving it Solana-level performance while still settling back to Bitcoin for actual security. It is the mix traders are rotating into right now: fast, scalable, and backed by Bitcoin’s base layer instead of relying on unstable L1s.

And the numbers explain why confidence is rising. The presale has already raised more than $28.9 million, which is massive considering how shaky the market has been. Early buyers have not slowed down at all, and staking rewards still sit at a heavy 40% APY, making it one of the strongest yield opportunities tied to the Bitcoin ecosystem.

If the market rotates back into high efficiency ecosystems, Bitcoin Hyper does not just have momentum… it has timing.

Visit the Official Website Here

https://cryptonews.com/news/price-prediction-21-days-of-straight-etf-inflows-is-sol-the-strongest-bet-in-crypto-right-now/