XRP may be gearing up for a major move, as long-term holders begin stockpiling the token again after weeks of profit-taking and selloffs.

This shift in investor behavior arrives just as XRP posts a 10% weekend rebound from a monthly low of $2.05, flipping bearish sentiment and reigniting bullish XRP price prediction debates.

While macro conditions—ranging from U.S. trade tensions to labor market weakness—still weigh on the market, XRP’s renewed accumulation trend could hint at a breakout brewing beneath the surface.

Long-Term Holders Show Signs Of Accumulation

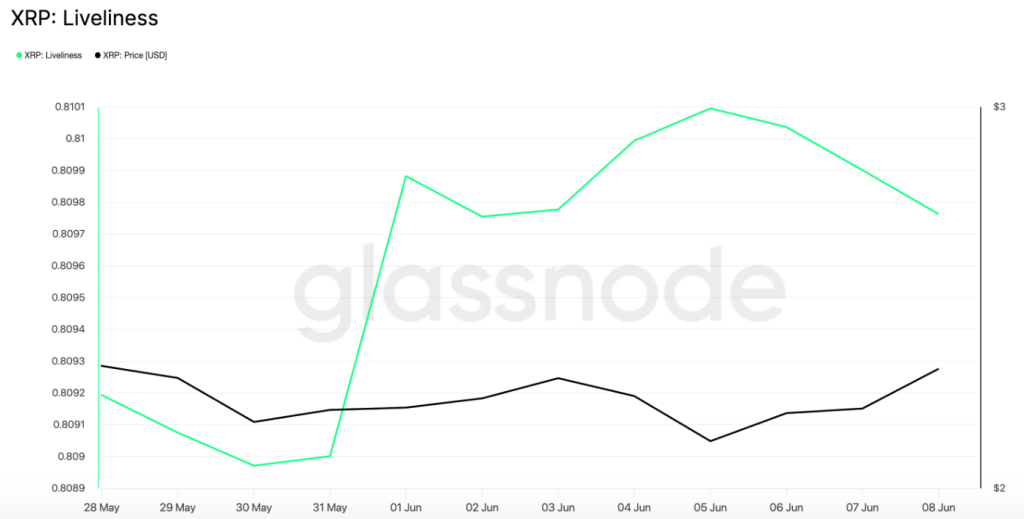

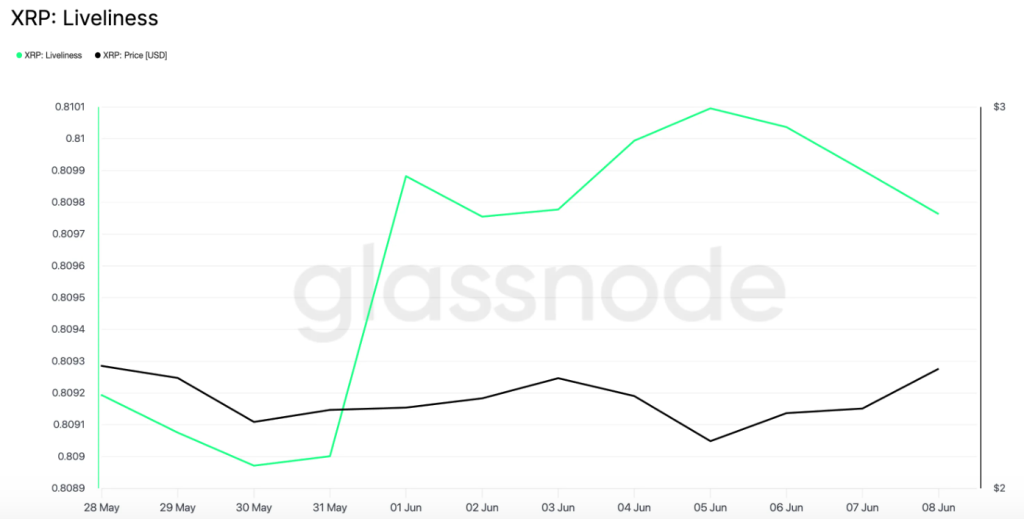

According to Glassnode data, XRP liveliness—the ratio of coin days destroyed to the total coin days accumulated—slipped from 1% on June 5 to 0.809 by the end of the weekend on June 8.

This decline points to a growing trend of HODLing and potential accumulation, as long-term holders opt not to move or spend their XRP.

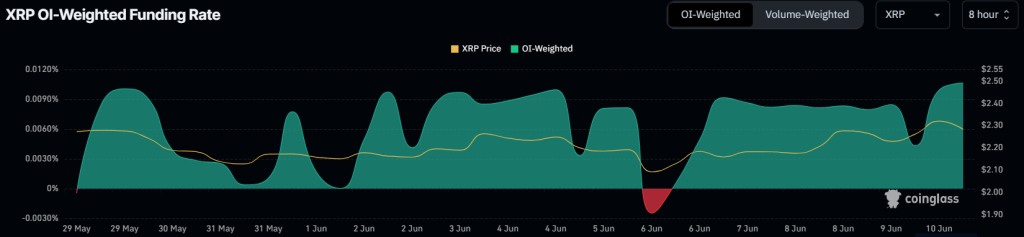

That conviction is echoed in the derivatives market. Coinglass reports that XRP has maintained a consistent positive funding rate since June 6, currently sitting at 0.0106%.

A positive funding rate reflects long dominance in the market, where short sellers are paying to hold their positions—another strong indicator of bullish sentiment building behind XRP.

XRP Price Analysis: What do Long-Term Holders Know?

The late week rally affirms the breakout path of a bullish 6-month pennant pattern, narrowly avoiding invalidation with a bounce from its upper boundary as support.

While post-breakout momentum had waned, slipping into a falling wedge over the past month, the recent bounce has cleanly broken that consolidation range.

This comes as the RSI breaks back above the neutral line at 51 after a stint in bearish territory, a sign that sellside pressure has cooled.

The 3-day MACD line tells a similar story, on track to surpass the signal line in a golden cross. This formation suggests that buyers are starting to overwhelm sellers.

Notably, this crossover has already played out on the 1-day chart. The fact that it’s now appearing on higher timeframes lends credibility to a more sustained uptrend.

XRP also currently sits at the 0.5 Fibonacci retracement level—a zone typically viewed as a prime accumulation range, especially in an uptrend.

If momentum holds, the pennant breakout sets up a potential move toward $4.38 before year-end, representing a potential 90% surge from current prices.

HODLers are Opting For This New Self-Custody Solution – Here’s Why

With shifts towards accumulation, HODLers are taking their bags off exchanges to self-custody solutions like MetaMask, Exodus, and increasingly Best Wallet ($BEST).

This non-custodial crypto wallet introduces tools like “Upcoming Tokens”—a crypto screener that allows users to identify and invest new tokens while they are still flying under the radar.

The upcoming Best Card—taking the place of the traditional debit card—allows seamless real-world transactions using stablecoins anywhere that Mastercard is accepted.

This Web3 storage solution supports assets in more than 50 blockchains and offers low fees for swaps.

With SEC Chair Paul Atkins advocating for crypto self-custody as a “foundational American value,” the over $13 million raised in the $BEST utility token presale could just be the start.

To learn more about Best Wallet, follow its official X, Telegram, or visit the Best Wallet website.

The post XRP Price Prediction: Golden Cross and Long-Term Holder Data Hint at Explosive Pump appeared first on Cryptonews.

https://cryptonews.com/news/golden-cross-and-long-term-holder-data-hint-at-xrp-price-pump/