XRP price is trading at $2.22 with a neutral bias, despite a minor 0.58% dip in the past 24 hours. The XRP/USD continues to trade over the critical $2.20 support level, bolstered by Ripple’s aggressive push into traditional finance. The company recently filed for a U.S. national banking charter with the Office of the Comptroller of the Currency (OCC) and is also seeking a Federal Reserve master account.

If successful, these moves could integrate Ripple directly into the U.S. payments infrastructure — an unprecedented development for a crypto-native entity. The news has revived optimism among traders, who are eyeing a possible long-term surge to $10.

Meanwhile, institutional sentiment is improving, driven by:

- Ongoing speculation of an XRP ETF filing

- Ripple’s central bank digital currency (CBDC) partnerships across 50+ countries

- Broader adoption in cross-border payments infrastructure

These indicators are reinforcing a solid fundamental backdrop in XRP, even as cryptocurrency markets stays in a state of cautious consolidation.

Institutional Flows and ETF Rumours Fuel Speculative Targets

XRP’s demand among institutions is growing despite macro uncertainty. Ripple’s continued engagement with regulators, including its pro-CBDC positioning, has made the asset a top contender for ETF consideration.

Traders and analysts point to a scenario where ETF approval, combined with regulatory clarity and Ripple’s potential U.S. banking license, could propel XRP toward the $10 mark — a level once thought speculative but increasingly discussed.

- Banking License: May grant Ripple direct access to U.S. payment rails

- ETF Hopes: Could drive retail and institutional inflows

- CBDC Activity: Reinforces global relevance

While the immediate path to $10 isn’t guaranteed, many in the market view Ripple’s alignment with traditional finance as a catalyst that may gradually close the gap.

XRP Technical Outlook – Watching the $2.23 Barrier

From a technical perspective, XRP remains well-supported. The 2-hour chart shows the price respecting a rising trendline from the June 23 low, with the 50-SMA ($2.2281) and 100-SMA ($2.2079) forming a critical support zone.

XRP price prediction and its price action have been tightening into a wedge near $2.23, a resistance level that has been tested multiple times but not yet breached. Candlestick formations are neutral to indecisive, including spinning tops, signalling a volatility squeeze.

If bulls manage a breakout above $2.2340 on substantial volume, XRP could quickly target $2.2822 and $2.3400. Conversely, a break below $2.20 may invite a pullback toward $2.147 or even $2.084.

XRP Trade Setup – Breakout in the Making:

- Entry: Above $2.23 on bullish confirmation

- Targets: $2.2822 → $2.3400

- Stop-Loss: Below $2.20 trendline

- Bias: Bullish while above 100-SMA

With Ripple’s institutional alignment deepening and price holding above support, XRP remains one of the most closely watched altcoins in 2025.

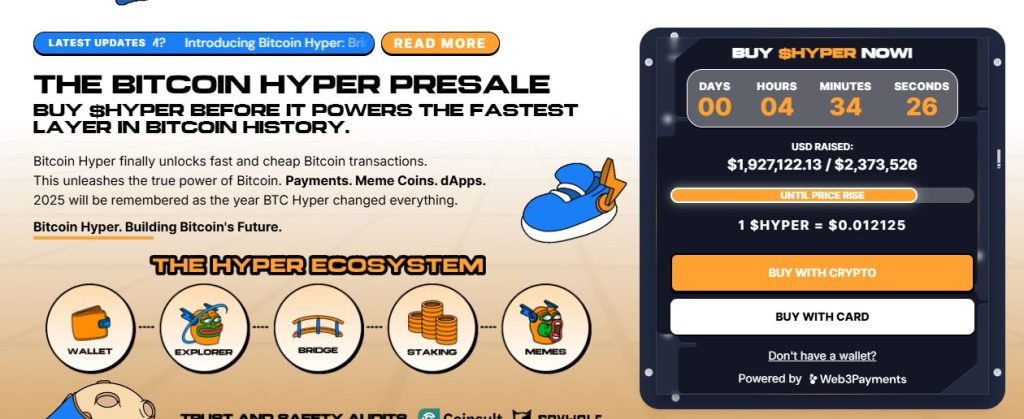

Bitcoin Hyper Presale Surges Past $1.92M as Price Rise Nears

Bitcoin Hyper ($HYPER), the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), has surpassed $1.90 million in its public presale, with $1,927,122 raised out of a $2,373,526 target. The token is priced at $0.012125, with the next price tier expected within hours.

Designed to merge Bitcoin’s security with Solana’s speed, Bitcoin Hyper enables fast, low-cost smart contracts, dApps, and meme coin creation, all with seamless BTC bridging. The project is audited by Consult and engineered for scalability, trust, and simplicity.

The golden cross of meme appeal and real utility has made Bitcoin Hyper a Layer 2 contender to watch in 2025. With staking, a streamlined presale, and a full rollout expected by Q1, $HYPER is gaining serious traction.

The post XRP Price Prediction: Despite Recent Slip, Ripple’s Institutional Push Targets $10 – What to Watch appeared first on Cryptonews.

https://cryptonews.com/news/xrp-price-prediction-despite-recent-slip-ripples-institutional-push-targets-10-what-to-watch/

XRP EYES $10: Ripple Moves to Become a U.S. Bank

XRP EYES $10: Ripple Moves to Become a U.S. Bank